Answered step by step

Verified Expert Solution

Question

1 Approved Answer

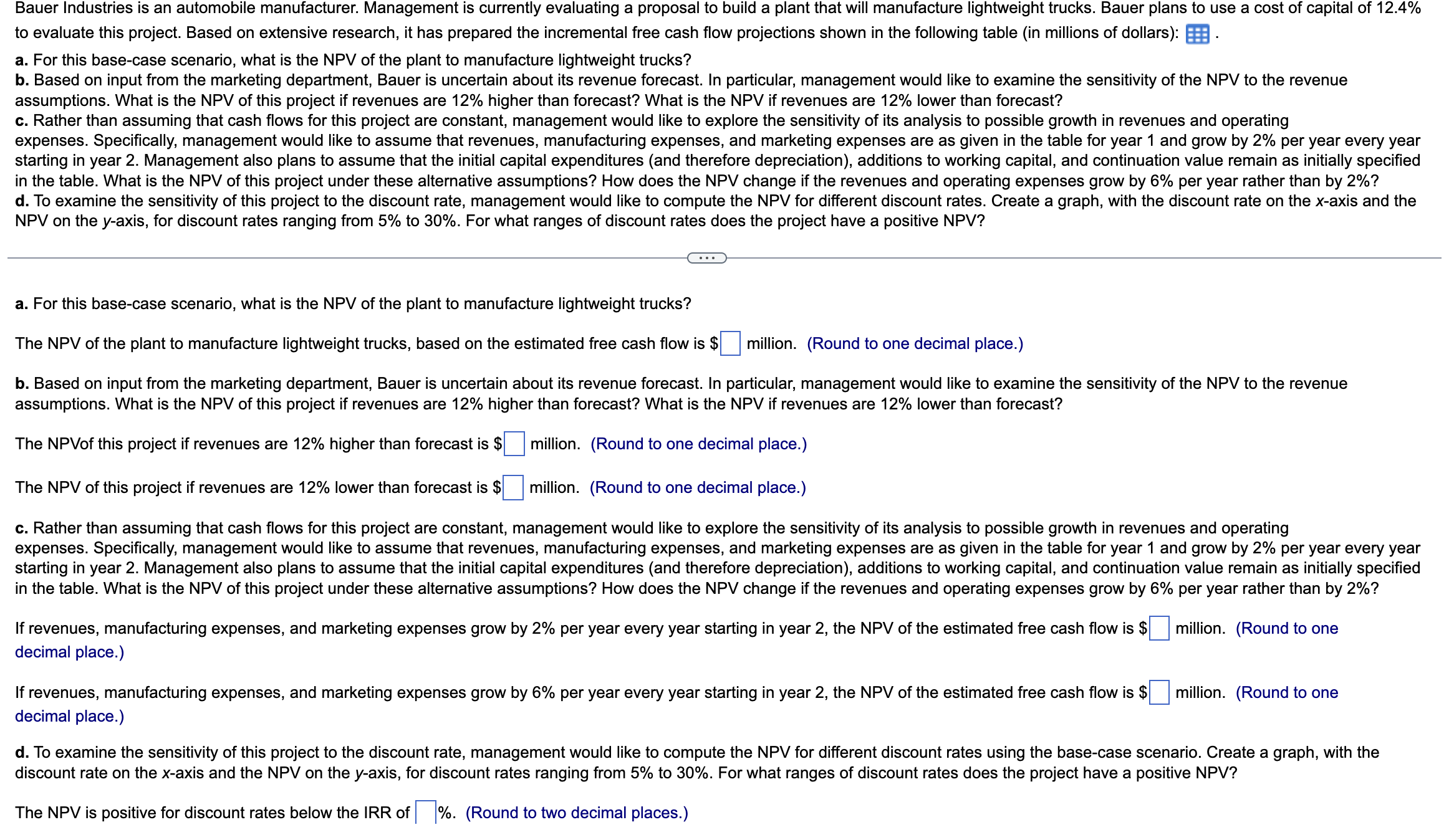

to evaluate this project. Based on extensive research, it has prepared the incremental free cash flow projections shown in the following table ( in millions

to evaluate this project. Based on extensive research, it has prepared the incremental free cash flow projections shown in the following table in millions of dollars:

a For this basecase scenario, what is the NPV of the plant to manufacture lightweight trucks?

assumptions. What is the NPV of this project if revenues are higher than forecast? What is the NPV if revenues are lower than forecast?

NPV on the axis, for discount rates ranging from to For what ranges of discount rates does the project have a positive NPV

a For this basecase scenario, what is the NPV of the plant to manufacture lightweight trucks?

The NPV of the plant to manufacture lightweight trucks, based on the estimated free cash flow is $ million. Round to one decimal place.

assumptions. What is the NPV of this project if revenues are higher than forecast? What is the NPV if revenues are lower than forecast?

The NPVof this project if revenues are higher than forecast is $ million. Round to one decimal place.

The NPV of this project if revenues are lower than forecast is $ million. Round to one decimal place.

decimal place.

decimal place.

The NPV is positive for discount rates below the IRR of

Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started