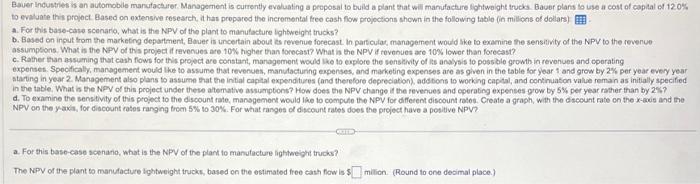

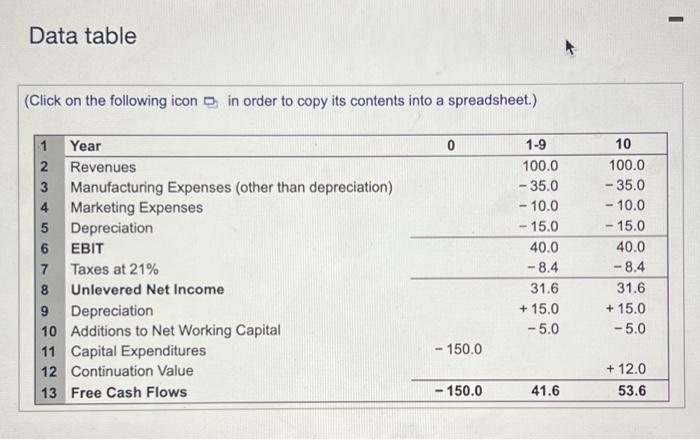

to evaluate this provect. Based on oxtensive research, thas propared the incrementar fee cosh fiow projoctions shown in the followng tabio (in millons of dolars) a. For this base-case scenario, what is the NPY of the plant to manufacture lightweight trucks? b. Based on input trom the markefing department, Baver is uncertain about is revenue forecast. in parf culat management would the to examine the sensitily of the NPV to the revenue assumpsions. What is the NPV of this project if revenues are toW higher than forecast? What in the NPV if revonues are 100 lowor than forecast? c. Rather than assuming that cash fows for this project are constant, management would lie to explore the sonsteivity of iss anolysis to possble growth in revonues and cperating expenses. Spooficaly, marngement would the to assume that revenues, manutacturng expenses, and marketing expenses are as given in the table for year 1 and grow by 2% per yoar every year starting in year 2. Management also plans to assume that the intial caplal expenditures (and therefore depreciation) addions to working captal, and continuaton value reman as initially specified in the table. What is the NPV of thin pooject under these atemative assumptons? How does the NPV change it the revenues and cperabing expenses -grow by 5% per year mather than by 2 th? d. To examine the senstivity of this propect to the discount rate, mansgemont would live to compute the Npy for diflerent discount ratos. Create a graph, with the dscount rate on the x-awis and the NPV on the y axia, for diocount rates ranging tren 5% to 30%. For what ranges of discount rates does the project have a positive NPV? a. For this base-case scenano, what is the NPV of the plant to manutacture lightweight trucks? The NPV of the plant to manulacture lightweight trucks, based on the estimated free cath fow is $ milion. (Round to one desimal place.) b. Based on input trom the marketing departnont, Bauer is uncertain about is revenue forecatt. In paricular, management would ike to examine the senstivi of the NPV to the revenue assumptions What is the NPV of this project if revenues ave 10% higher than forecast? What is the NPV if revenues are 10% lower than forecass? The NPVof this project it tevenues are 10\% higher than forecast is: milion. (Round to one decimal place) The NPV of this project it revenues are 10% lower than forecast is 1 millon, (Round to one decimal place) c. Rather than assuming that cash flows for this project are conitant, management would tho to explore the sensitivity of ts analysis to possble growth in revenues and coperating expenses. Specificaly, management would the to assume that revenues, manulacturing expenses, and marketing expenses are as glven in the table for year 1 and grow by 2% per yoar every year staring in year 2. Managemert also plans to aswume that the initial capital expendcures (and thenefore depreciaton), addions to working captal, and conthuason value remain as inibally specifed in the table. What is the NPV of this project inder those allematve assumptons? How does the NPV change if the rerenues and operating expenses grow by 5% per year rather than by 2% ? if revenues, manufacturing exponses, and tharketing expenses grow by 2% per year every year starting in year 2 , the NPV of the essimatod free cash flow is decimal plase.) If revenues, manufacturing expenses, and macketing expenses grow by 5% per year every year staring in year 2, the NPV of the estimsted free cash fow is 4 millon. (Round to one secinal place] d. To examine the senstiviy of this project to the discount rate, management would like to compule the NPV for dilerent discount rates using the base-case scenario Creatn a graph. with the discount rate on the x-ais and the NPV on the y-axis, for discount raies ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV7 The NPV is poetvo for discount rates betiow the IRR of IW. (Round to two decimal places) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) to evaluate this provect. Based on oxtensive research, thas propared the incrementar fee cosh fiow projoctions shown in the followng tabio (in millons of dolars) a. For this base-case scenario, what is the NPY of the plant to manufacture lightweight trucks? b. Based on input trom the markefing department, Baver is uncertain about is revenue forecast. in parf culat management would the to examine the sensitily of the NPV to the revenue assumpsions. What is the NPV of this project if revenues are toW higher than forecast? What in the NPV if revonues are 100 lowor than forecast? c. Rather than assuming that cash fows for this project are constant, management would lie to explore the sonsteivity of iss anolysis to possble growth in revonues and cperating expenses. Spooficaly, marngement would the to assume that revenues, manutacturng expenses, and marketing expenses are as given in the table for year 1 and grow by 2% per yoar every year starting in year 2. Management also plans to assume that the intial caplal expenditures (and therefore depreciation) addions to working captal, and continuaton value reman as initially specified in the table. What is the NPV of thin pooject under these atemative assumptons? How does the NPV change it the revenues and cperabing expenses -grow by 5% per year mather than by 2 th? d. To examine the senstivity of this propect to the discount rate, mansgemont would live to compute the Npy for diflerent discount ratos. Create a graph, with the dscount rate on the x-awis and the NPV on the y axia, for diocount rates ranging tren 5% to 30%. For what ranges of discount rates does the project have a positive NPV? a. For this base-case scenano, what is the NPV of the plant to manutacture lightweight trucks? The NPV of the plant to manulacture lightweight trucks, based on the estimated free cath fow is $ milion. (Round to one desimal place.) b. Based on input trom the marketing departnont, Bauer is uncertain about is revenue forecatt. In paricular, management would ike to examine the senstivi of the NPV to the revenue assumptions What is the NPV of this project if revenues ave 10% higher than forecast? What is the NPV if revenues are 10% lower than forecass? The NPVof this project it tevenues are 10\% higher than forecast is: milion. (Round to one decimal place) The NPV of this project it revenues are 10% lower than forecast is 1 millon, (Round to one decimal place) c. Rather than assuming that cash flows for this project are conitant, management would tho to explore the sensitivity of ts analysis to possble growth in revenues and coperating expenses. Specificaly, management would the to assume that revenues, manulacturing expenses, and marketing expenses are as glven in the table for year 1 and grow by 2% per yoar every year staring in year 2. Managemert also plans to aswume that the initial capital expendcures (and thenefore depreciaton), addions to working captal, and conthuason value remain as inibally specifed in the table. What is the NPV of this project inder those allematve assumptons? How does the NPV change if the rerenues and operating expenses grow by 5% per year rather than by 2% ? if revenues, manufacturing exponses, and tharketing expenses grow by 2% per year every year starting in year 2 , the NPV of the essimatod free cash flow is decimal plase.) If revenues, manufacturing expenses, and macketing expenses grow by 5% per year every year staring in year 2, the NPV of the estimsted free cash fow is 4 millon. (Round to one secinal place] d. To examine the senstiviy of this project to the discount rate, management would like to compule the NPV for dilerent discount rates using the base-case scenario Creatn a graph. with the discount rate on the x-ais and the NPV on the y-axis, for discount raies ranging from 5% to 30%. For what ranges of discount rates does the project have a positive NPV7 The NPV is poetvo for discount rates betiow the IRR of IW. (Round to two decimal places) Data table (Click on the following icon in order to copy its contents into a spreadsheet.)