Answered step by step

Verified Expert Solution

Question

1 Approved Answer

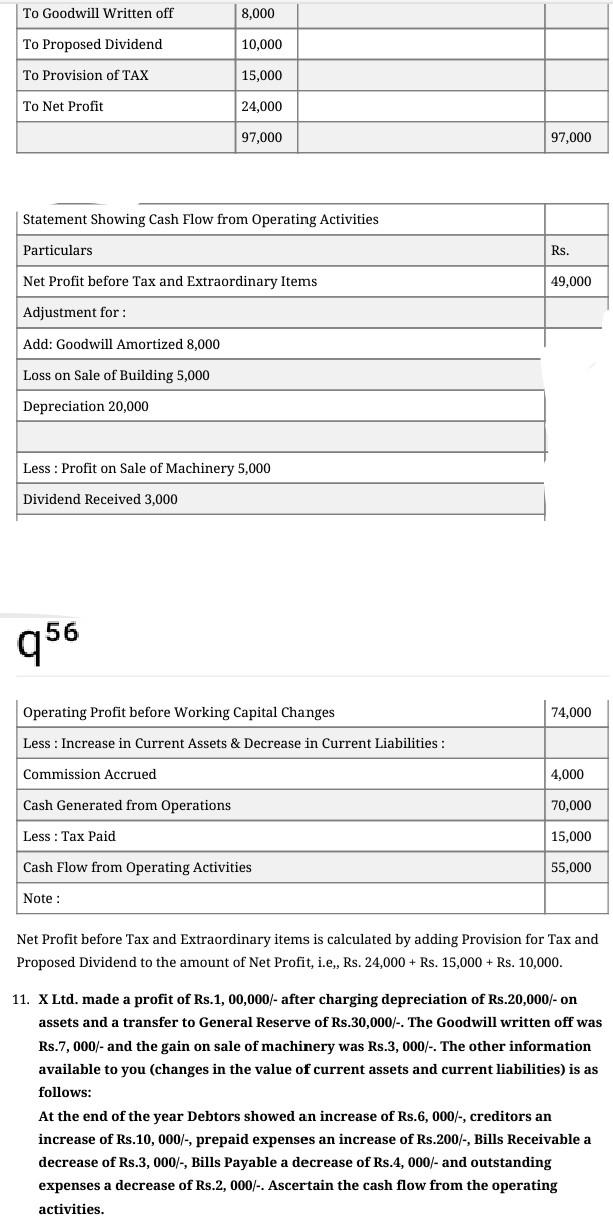

To Goodwill Written off 8.000 To Proposed Dividend 10,000 To Provision of TAX 15,000 To Net Profit 24,000 97,000 97,000 Statement Showing Cash Flow from

To Goodwill Written off 8.000 To Proposed Dividend 10,000 To Provision of TAX 15,000 To Net Profit 24,000 97,000 97,000 Statement Showing Cash Flow from Operating Activities Particulars Rs. Net Profit before Tax and Extraordinary Items 49,000 Adjustment for : Add: Goodwill Amortized 8,000 Loss on Sale of Building 5,000 Depreciation 20,000 Less : Profit on Sale of Machinery 5,000 Dividend Received 3.000 956 Operating Profit before Working Capital Changes 74,000 Less : Increase in Current Assets & Decrease in Current Liabilities: Commission Accrued 4,000 Cash Generated from Operations 70,000 Less : Tax Paid 15,000 Cash Flow from Operating Activities 55,000 Note : Net Profit before Tax and Extraordinary items is calculated by adding Provision for Tax and Proposed Dividend to the amount of Net Profit, i.e., Rs. 24,000 + Rs. 15,000 + Rs. 10,000. 11. X Ltd. made a profit of Rs.1,00,000/- after charging depreciation of Rs.20,000/- on assets and a transfer to General Reserve of Rs.30,000/-. The Goodwill written off was Rs.7, 000/- and the gain on sale of machinery was Rs.3, 000/-. The other information available to you (changes in the value of current assets and current liabilities) is as follows: At the end of the year Debtors showed an increase of Rs.6, 000/-, creditors an increase of Rs.10, 000/-, prepaid expenses an increase of Rs.200/-, Bills Receivable a decrease of Rs.3, 000/-, Bills Payable a decrease of Rs.4, 000/- and outstanding expenses a decrease of Rs.2, 000/-. Ascertain the cash flow from the operating activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started