Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To offer scholarships to children of employees, a company invests $14,000 at the end of every three months in an annuity that pays 10.5% compounded

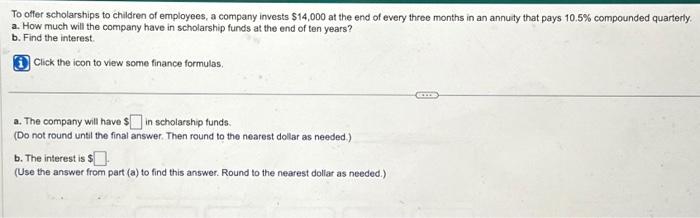

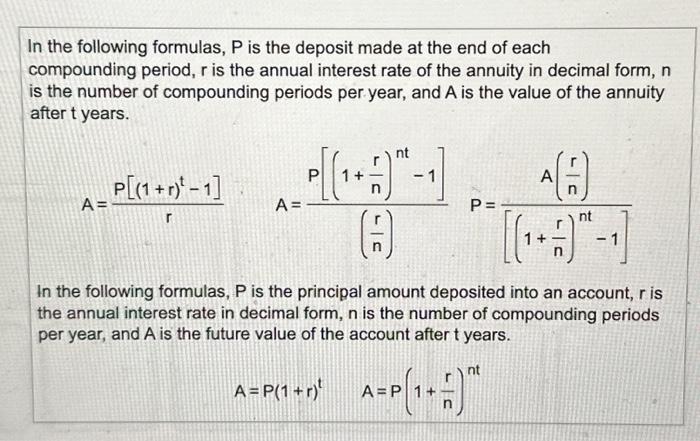

To offer scholarships to children of employees, a company invests $14,000 at the end of every three months in an annuity that pays 10.5% compounded quarterly. a. How much will the company have in scholarship funds at the end of ten years? b. Find the interest. Click the icon to view some finance formulas. a. The company will have $ in scholarship funds. (Do not round until the final answer. Then round to the nearest dollar as needed.) b. The interest is $ (Use the answer from part (a) to find this answer. Round to the nearest dollar as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started