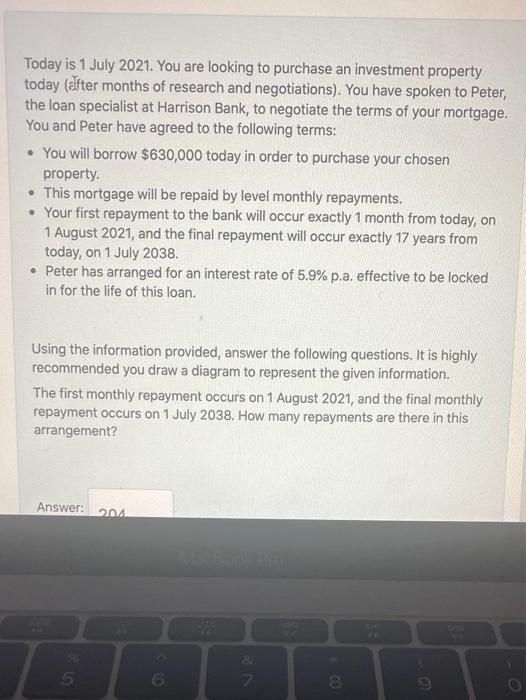

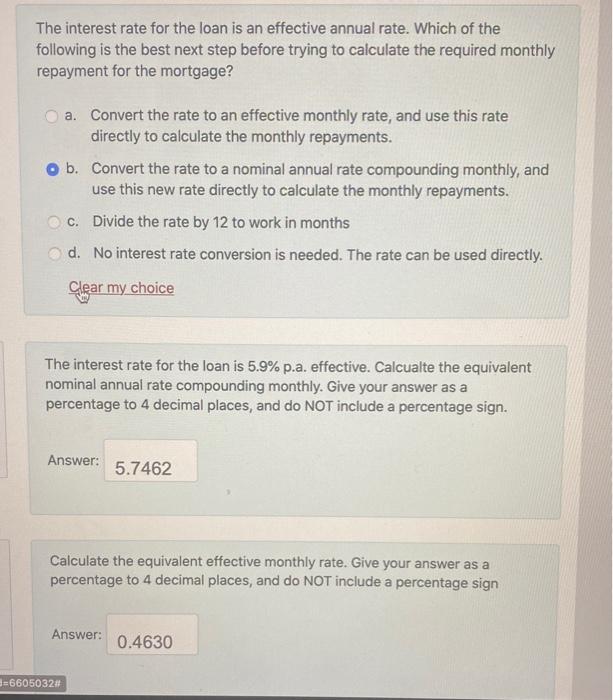

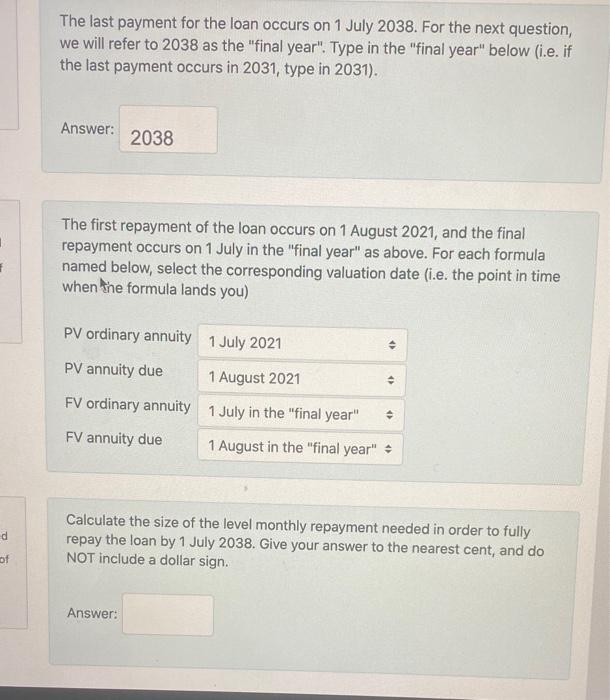

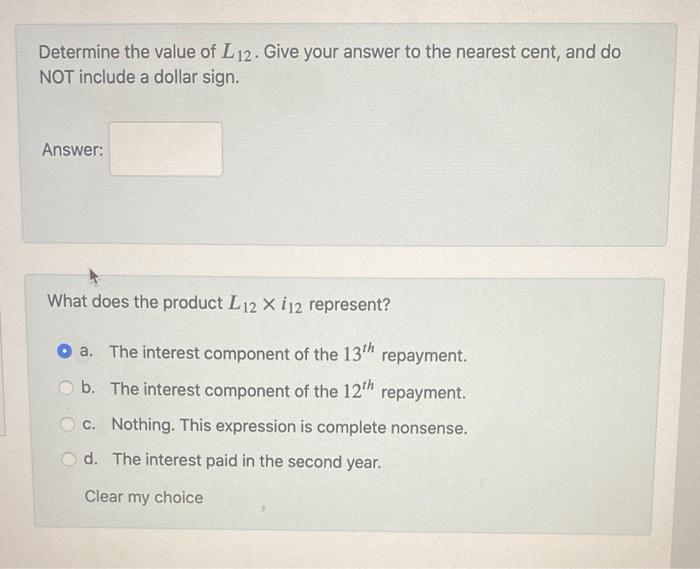

Today is 1 July 2021. You are looking to purchase an investment property today after months of research and negotiations). You have spoken to Peter, the loan specialist at Harrison Bank, to negotiate the terms of your mortgage. You and Peter have agreed to the following terms: You will borrow $630,000 today in order to purchase your chosen property. This mortgage will be repaid by level monthly repayments. Your first repayment to the bank will occur exactly 1 month from today, on 1 August 2021, and the final repayment will occur exactly 17 years from today, on 1 July 2038. Peter has arranged for an interest rate of 5.9% p.a. effective to be locked in for the life of this loan. Using the information provided, answer the following questions. It is highly recommended you draw a diagram to represent the given information. The first monthly repayment occurs on 1 August 2021, and the final monthly repayment occurs on 1 July 2038. How many repayments are there in this arrangement? Answer: 2014 5 6 The interest rate for the loan is an effective annual rate. Which of the following is the best next step before trying to calculate the required monthly repayment for the mortgage? a. Convert the rate to an effective monthly rate, and use this rate directly to calculate the monthly repayments. b. Convert the rate to a nominal annual rate compounding monthly, and use this new rate directly to calculate the monthly repayments. c. Divide the rate by 12 to work in months d. No interest rate conversion is needed. The rate can be used directly. Clear my choice The interest rate for the loan is 5.9% p.a. effective. Calcualte the equivalent nominal annual rate compounding monthly. Give your answer as a percentage to 4 decimal places, and do NOT include a percentage sign. Answer: 5.7462 Calculate the equivalent effective monthly rate. Give your answer as a percentage to 4 decimal places, and do NOT include a percentage sign Answer: 0.4630 =6605032 The last payment for the loan occurs on 1 July 2038. For the next question, we will refer to 2038 as the "final year". Type in the "final year" below (i.e. if the last payment occurs in 2031, type in 2031). Answer: 2038 The first repayment of the loan occurs on 1 August 2021, and the final repayment occurs on 1 July in the "final year" as above. For each formula named below, select the corresponding valuation date (i.e. the point in time when the formula lands you) . PV ordinary annuity 1 July 2021 PV annuity due 1 August 2021 FV ordinary annuity 1 July in the "final year" FV annuity due 1 August in the "final year" > d Calculate the size of the level monthly repayment needed in order to fully repay the loan by 1 July 2038. Give your answer to the nearest cent, and do NOT include a dollar sign. of Answer: Determine the value of L 12. Give your answer to the nearest cent, and do NOT include a dollar sign. Answer: What does the product L 12 X 112 represent? O a. The interest component of the 13th repayment. b. The interest component of the 12th repayment c. Nothing. This expression is complete nonsense. d. The interest paid in the second year. Clear my choice