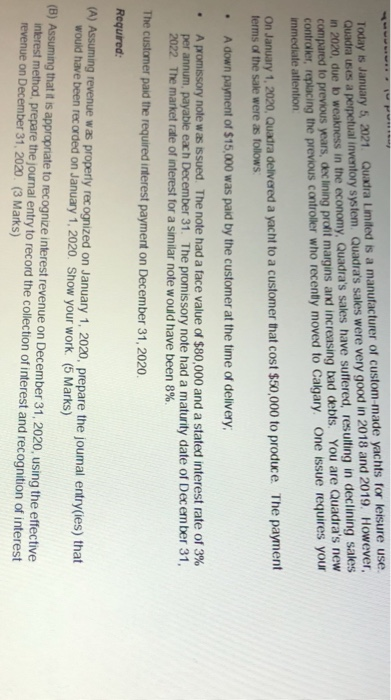

Today is January 5, 2021 Quadra Limited is a manufacturer of custom-made yachts for leisure use. Quadra uses a perpetual inventory system. Quadra's sales were very good in 2018 and 2019. However, in 2020, due to weakness in the economy, Quadra's sales have suffered, resulting in declining sales compared to previous years, declining profit margins and increasing bad debts. You are Quadra's new controller, replacing the previous controller who recently moved to Calgary. One issue requires your immediate attention On January 1, 2020, Quadra delivered a yacht to a customer that cost $50,000 to produce. The payment terms of the sale were as follows: A down payment of $15,000 was paid by the customer at the time of delivery A promissory note was issued. The note had a face value of $80,000 and a stated interest rate of 3% per annum, payable each December 31. The promissory note had a maturity date of December 31, 2022 The market rate of interest for a similar note would have been 8%. The customer paid the required interest payment on December 31, 2020. Required: (A) Assuming revenue was properly recognized on January 1, 2020, prepare the joumal entry(ies) that would have been recorded on January 1, 2020. Show your work (5 Marks) (B) Assuming that it is appropriate to recognize interest revenue on December 31, 2020, using the effective interest method, prepare the journal entry to record the collection of interest and recognition of interest revenue on December 31, 2020. (3 Marks) Today is January 5, 2021 Quadra Limited is a manufacturer of custom-made yachts for leisure use. Quadra uses a perpetual inventory system. Quadra's sales were very good in 2018 and 2019. However, in 2020, due to weakness in the economy, Quadra's sales have suffered, resulting in declining sales compared to previous years, declining profit margins and increasing bad debts. You are Quadra's new controller, replacing the previous controller who recently moved to Calgary. One issue requires your immediate attention On January 1, 2020, Quadra delivered a yacht to a customer that cost $50,000 to produce. The payment terms of the sale were as follows: A down payment of $15,000 was paid by the customer at the time of delivery A promissory note was issued. The note had a face value of $80,000 and a stated interest rate of 3% per annum, payable each December 31. The promissory note had a maturity date of December 31, 2022 The market rate of interest for a similar note would have been 8%. The customer paid the required interest payment on December 31, 2020. Required: (A) Assuming revenue was properly recognized on January 1, 2020, prepare the joumal entry(ies) that would have been recorded on January 1, 2020. Show your work (5 Marks) (B) Assuming that it is appropriate to recognize interest revenue on December 31, 2020, using the effective interest method, prepare the journal entry to record the collection of interest and recognition of interest revenue on December 31, 2020