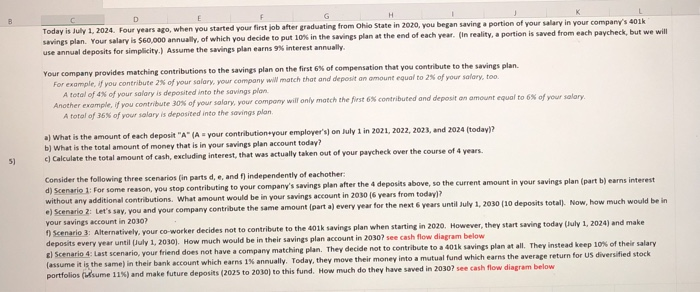

Today is July 1, 2024. Four years ago, when you started your first job after gradusting from ohio state in 2020, you began saving s portion of your salary in your company's 401 savings plan. Your salary is $60,000 annually, of which you decide to put 10% in the use annual deposits for simplicity.) Assume the savings plan earns 9% interest annually savings plan at the end of each year. (in reality, a portion is saved from each paycheck, but we will r company provides matching contributions to the savings plan on the first 6% of compensation that you contribute to the savings plan. ny will match that and deposit an amount equal to 2% of your salary, too. pan exomple" rou contribute 2% of your salary, your compa A total of 4% of your salary is deposited into the savings Another example, if you contribute 30% of your salary, your company will only match the first 6% contributed and deposit an amount equal to 6% of your salary A total of 36% of your salary is deposited into the savings plan r contribution your employer's) on July 1 in 2021, 2022, 2023, and 2024 (today)? a) What is the amount of each deposit "A (A b) What is the total amount of money that is in your savings plan account today? c) Calculate the total amount of cash, excluding interest, that was actually taken out of your 5) Consider the following three scenarios (in parts d, e, and f) independently of eachother: d) Scenario 1: For some reason, you stop contr ibuting to your company's savings plan after the 4 deposits above, so the current amount in your savings plan (part b) earns interest be in your savings account in 2030 (6 years from today)? without any additional contributions. What amount would e) Scenario 2: Let's say, you and your company your savings account in 20307 f) Scenario 3: Alternatively, you contribute the same amount (part a) every year for the next & years until July 1, 2030 (10 deposits total). Now, how much would be in ur co-worker decides not to contribute to the 401k savings plan when starting in 2020. However, they start saving today (luly 1, 2024) and make deposits every year until (July 1, 2030]. How much would be in their savings plan account in 2030? see cash flow diagram below Scenario 4: Last scenario, your friend does not have a company matching plan. They decide not to contribute to a 401k savings plan at all. They instead keep 10% of their salary el [assume it is the same) in their bank account which earns 1% annually portfolios (diume Today, they move their money into a mutual fund which earns the average return for US diversified stock 11%) and make future deposits (2025 to 2030) to this fund. How' much do they have saved in 2030? see cash flow diagram below