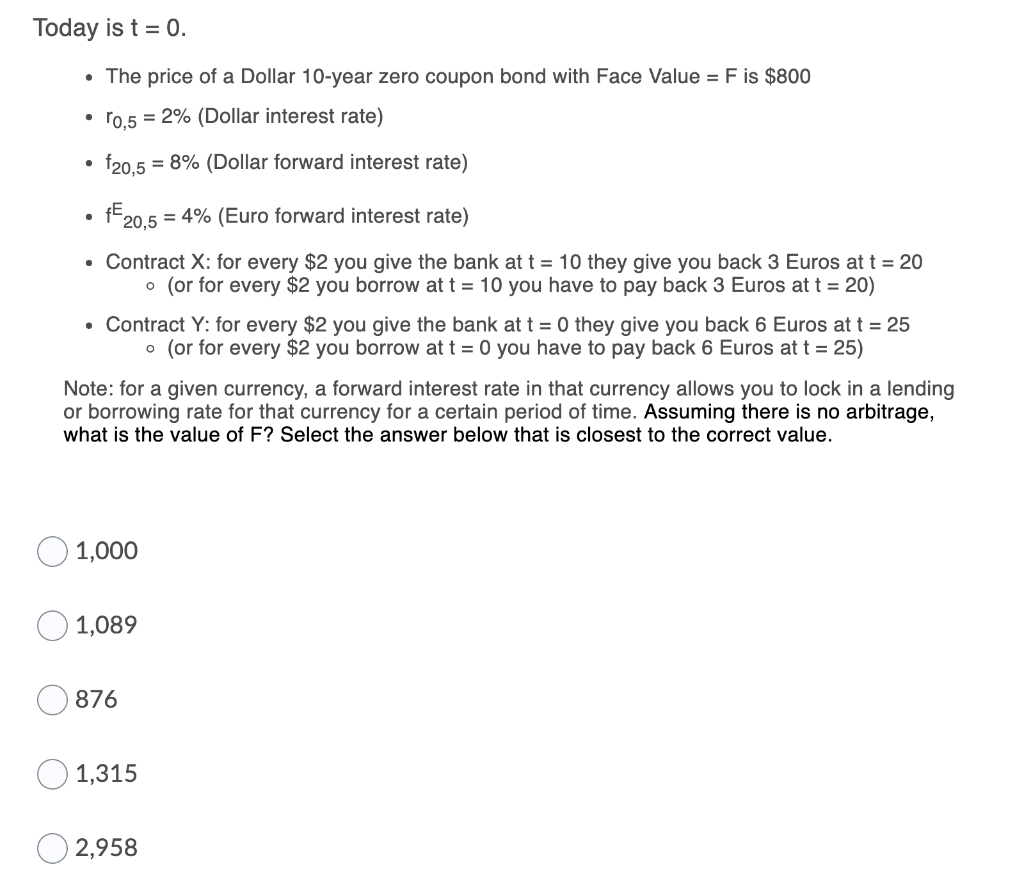

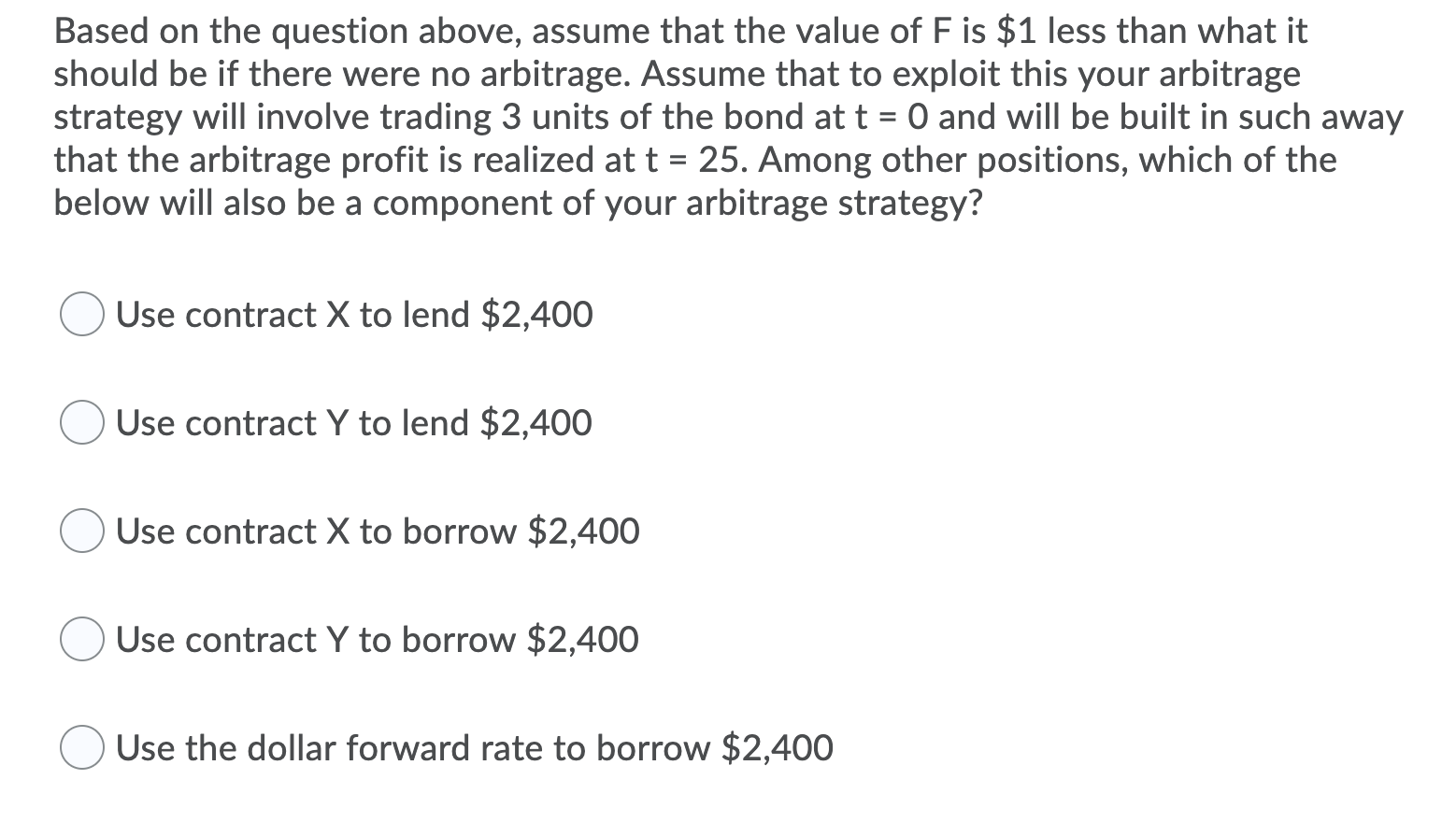

Today is t = 0. The price of a Dollar 10-year zero coupon bond with Face Value = F is $800 10,5 = 2% (Dollar interest rate) $20,5 = 8% (Dollar forward interest rate) f2 20,5 = 4% (Euro forward interest rate) Contract X: for every $2 you give the bank at t = 10 they give you back 3 Euros at t = 20 (or for every $2 you borrow at t = 10 you have to pay back 3 Euros at t = 20) Contract Y: for every $2 you give the bank at t = 0 they give you back 6 Euros at t = 25 o (or for every $2 you borrow at t = 0 you have to pay back 6 Euros at t = 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending or borrowing rate for that currency for a certain period of time. Assuming there is no arbitrage, what is the value of F? Select the answer below that is closest to the correct value. 1,000 1,089 876 1,315 02,958 Based on the question above, assume that the value of Fis $1 less than what it should be if there were no arbitrage. Assume that to exploit this your arbitrage strategy will involve trading 3 units of the bond at t = 0 and will be built in such away that the arbitrage profit is realized at t = 25. Among other positions, which of the below will also be a component of your arbitrage strategy? Use contract X to lend $2,400 Use contract Y to lend $2,400 Use contract X to borrow $2,400 Use contract Y to borrow $2,400 Use the dollar forward rate to borrow $2,400 Today is t = 0. The price of a Dollar 10-year zero coupon bond with Face Value = F is $800 10,5 = 2% (Dollar interest rate) $20,5 = 8% (Dollar forward interest rate) f2 20,5 = 4% (Euro forward interest rate) Contract X: for every $2 you give the bank at t = 10 they give you back 3 Euros at t = 20 (or for every $2 you borrow at t = 10 you have to pay back 3 Euros at t = 20) Contract Y: for every $2 you give the bank at t = 0 they give you back 6 Euros at t = 25 o (or for every $2 you borrow at t = 0 you have to pay back 6 Euros at t = 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending or borrowing rate for that currency for a certain period of time. Assuming there is no arbitrage, what is the value of F? Select the answer below that is closest to the correct value. 1,000 1,089 876 1,315 02,958 Based on the question above, assume that the value of Fis $1 less than what it should be if there were no arbitrage. Assume that to exploit this your arbitrage strategy will involve trading 3 units of the bond at t = 0 and will be built in such away that the arbitrage profit is realized at t = 25. Among other positions, which of the below will also be a component of your arbitrage strategy? Use contract X to lend $2,400 Use contract Y to lend $2,400 Use contract X to borrow $2,400 Use contract Y to borrow $2,400 Use the dollar forward rate to borrow $2,400