Answered step by step

Verified Expert Solution

Question

1 Approved Answer

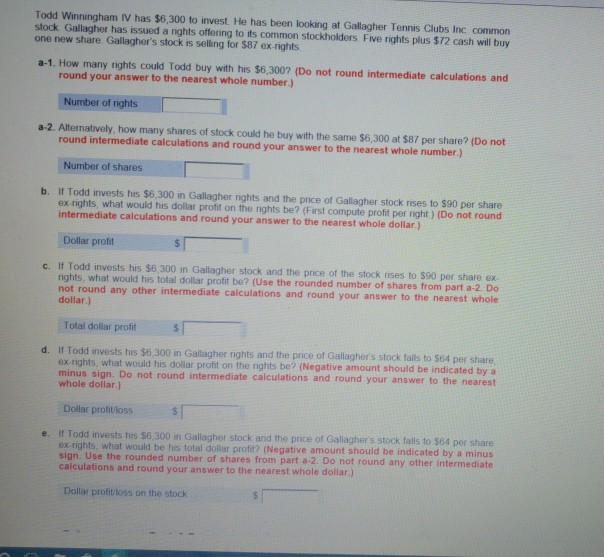

Todd Winningham IV has $6,300 to invest. He has been looking at Gallagher Tennis Clubs Inc common stock. Gallagher has issued a rights offering to

Todd Winningham IV has $6,300 to invest. He has been looking at Gallagher Tennis Clubs Inc common stock. Gallagher has issued a rights offering to its common stockholders Five rights plus $72 cash will buy one new share Gallagher's stock is selling for $87 ex-rights a-1. How many rights could Todd buy with his $6,3007 (Do not round intermediate calculations and round your answer to the nearest whole number.) Number of rights) a-2. Alternatively, how many shares of stock could he buy with the same $6,300 at $87 per share? (Do not round intermediate calculations and round your answer to the nearest whole number.) Number of shares b. If Todd invests his $6,300 in Gallagher nghts and the price of Gallagher stock rises to $90 per share ex-rights, what would his dollar profit on the rights be? (First compute profit per night ) (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Dollar proft c. If Todd invests his $6,300 in Gallagher stock and the price of the stock rises to $90 per share ex rights, what would his total dollar profit be? (Use the rounded number of shares from part a-2 not round any dollar.) other intermediate calculations and round your answer to the nearest whole Total dollar profit s d. If Todd invests his $6,300 in Gallagher rights and the price of Gallaghers stock fails to 564 per share ex rights, what would his dollar profit on the rights be? (Negative amount should be indicated by minus sign. Do not round intermediate calculations and round your answer to the nearest whole dollar.) Dollar profitloss s e. If Todd invests his S6.300 in Gallagher stock and the price of Gallaghers stock falls to $64 per share ex rights, what would be his total dollar profit? (Negative amount should be indicated by a minus sign. Use the rounded number of shares from part a-2. Do not round any calculations and round your answer to the nearest whole dollar.) Dollar profit/loss on the stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started