Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Together with the working on excel pls. QUESTION 1 (TOTAL: 40 MARKS) In order to tap the growing gaming market, Penang Technologies Sdn Bhd, an

Together with the working on excel pls.

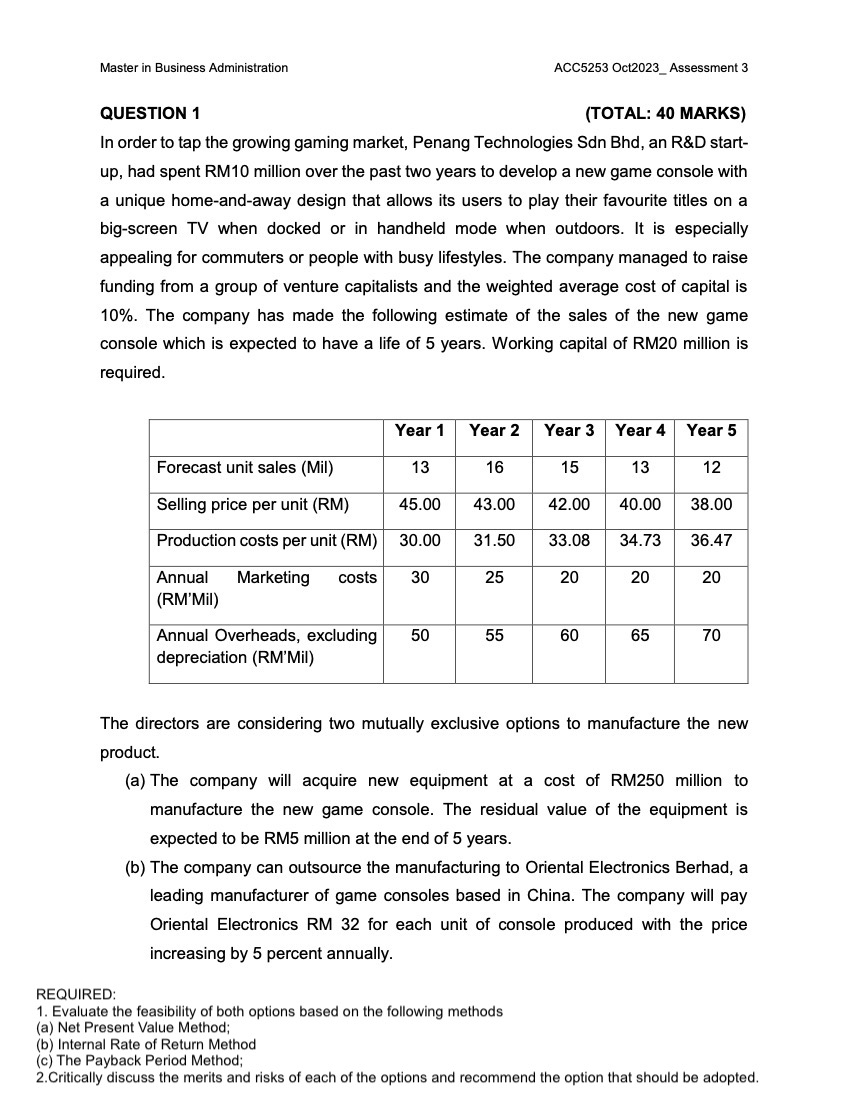

QUESTION 1 (TOTAL: 40 MARKS) In order to tap the growing gaming market, Penang Technologies Sdn Bhd, an R\&D startup, had spent RM10 million over the past two years to develop a new game console with a unique home-and-away design that allows its users to play their favourite titles on a big-screen TV when docked or in handheld mode when outdoors. It is especially appealing for commuters or people with busy lifestyles. The company managed to raise funding from a group of venture capitalists and the weighted average cost of capital is 10%. The company has made the following estimate of the sales of the new game console which is expected to have a life of 5 years. Working capital of RM20 million is required. The directors are considering two mutually exclusive options to manufacture the new product. (a) The company will acquire new equipment at a cost of RM250 million to manufacture the new game console. The residual value of the equipment is expected to be RM5 million at the end of 5 years. (b) The company can outsource the manufacturing to Oriental Electronics Berhad, a leading manufacturer of game consoles based in China. The company will pay Oriental Electronics RM 32 for each unit of console produced with the price increasing by 5 percent annually. REQUIRED: 1. Evaluate the feasibility of both options based on the following methods (a) Net Present Value Method; (b) Internal Rate of Return Method (c) The Payback Period Method; 2.Critically discuss the merits and risks of each of the options and recommend the option that should be adoptedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started