Answered step by step

Verified Expert Solution

Question

1 Approved Answer

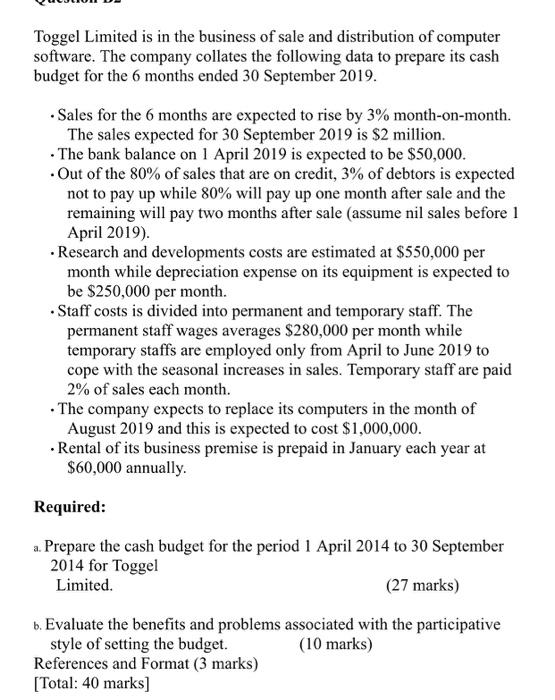

Toggel Limited is in the business of sale and distribution of computer software. The company collates the following data to prepare its cash budget

Toggel Limited is in the business of sale and distribution of computer software. The company collates the following data to prepare its cash budget for the 6 months ended 30 September 2019. Sales for the 6 months are expected to rise by 3% month-on-month. The sales expected for 30 September 2019 is $2 million. The bank balance on 1 April 2019 is expected to be $50,000. Out of the 80% of sales that are on credit, 3% of debtors is expected not to pay up while 80% will pay up one month after sale and the remaining will pay two months after sale (assume nil sales before 1 April 2019). Research and developments costs are estimated at $550,000 per month while depreciation expense on its equipment is expected to be $250,000 per month. Staff costs is divided into permanent and temporary staff. The permanent staff wages averages $280,000 per month while temporary staffs are employed only from April to June 2019 to cope with the seasonal increases in sales. Temporary staff are paid 2% of sales each month. The company expects to replace its computers in the month of August 2019 and this is expected to cost $1,000,000. Rental of its business premise is prepaid in January each year at $60,000 annually. Required: a. Prepare the cash budget for the period 1 April 2014 to 30 September 2014 for Toggel Limited. (27 marks) b. Evaluate the benefits and problems associated with the participative style of setting the budget. References and Format (3 marks) [Total: 40 marks] (10 marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Working note Particular April May June July August September Sales 1725218 1776974 1830283 1885192 1941748 2000000 Cash Sales 20 345044 355395 366057 377038 388350 400000 Credit Sales 1380174 1421579 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started