Question

Tom and Tina are the co-founders of Genesis2 Electronics Ltd, a company that manufactures and installs contemporary models of electronic products for residential and commercial

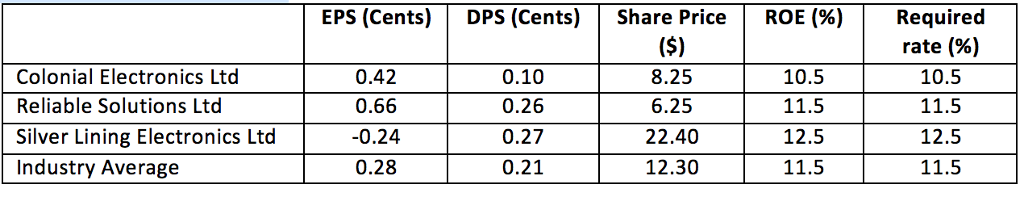

Tom and Tina are the co-founders of Genesis2 Electronics Ltd, a company that manufactures and installs contemporary models of electronic products for residential and commercial purposes. Genesis2 Electronics Ltd has experienced rapid growth recently because of the new technology that enhances the energy efficiency of its systems. The company is owned equally by Tom and Tina, each holding 100,000 shares. If either wishes to sell the shares, the shares have to be offered first to the other shareholder at an agreed price. Recently Tom and Tina have decided to value their holdings in the company for financial planning purposes. To accomplish this, they have gathered the following information about their main competitors in the industry.

Last year, Genesis2 Electronics Ltd had an EPS of $2.725 and paid a dividend to Tom and Tina of $102,500 each. The company also had a return on equity of 14.5%. Tom and Tina believe a required rate of return of 12.5% for the company is appropriate.

Required:

Assuming that the company continues its current growth rate (growth rate should be inferred from the data given) into the infinite period, calculate the share price of the company?

William, an equity analyst, has a good understanding of the electronics industry and so Tom and Tina hired William to verify the company calculations. William has examined the companys financial statements as well as those of its competitors. Although Genesis2 Electronics Ltd currently has a technological advantage, Williams research indicates that Genesis2s competitors are implementing other methods to improve their efficiency. Given this, William believes that Genesis2s technological advantage will last for only the next five years. After that period, the companys growth is likely to slow down to the industry average. Also, William believes that currently the companys required rate of return is too high and so the industry average required rate of return is a more appropriate rate for valuation. Under Williams assumptions, what is the estimated share price?

(12 marks)

What is the industry average price-earnings ratio? What is Genesis2s price-earnings ratio based on Williams estimation above in part (2)? Comment on any differences and explain why these differences may exist?

(6 marks)

After discussion with William, Tom and Tina agree that they would like to increase the value of the companys equity. They want to retain control of the company and so do not want to sell shares to outside investors. They also feel that the companys debt is at a manageable level and do not want to borrow more money. What steps can they take to increase the share price? Justify your suggestions.

EPS (Cents) | DPS (Cents) | Share Price | ROE (%) Colonial Electronics Ltd Reliable Solutions Ltd Silver Lining Electronics Ltd Industry Average 0.42 0.66 0.24 0.28 0.10 0.26 0.27 0.21 8.25 6.25 22.40 12.30 10.5 11.5 12.5 11.5 Required rate (%) 10.5 11.5 12.5 11.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started