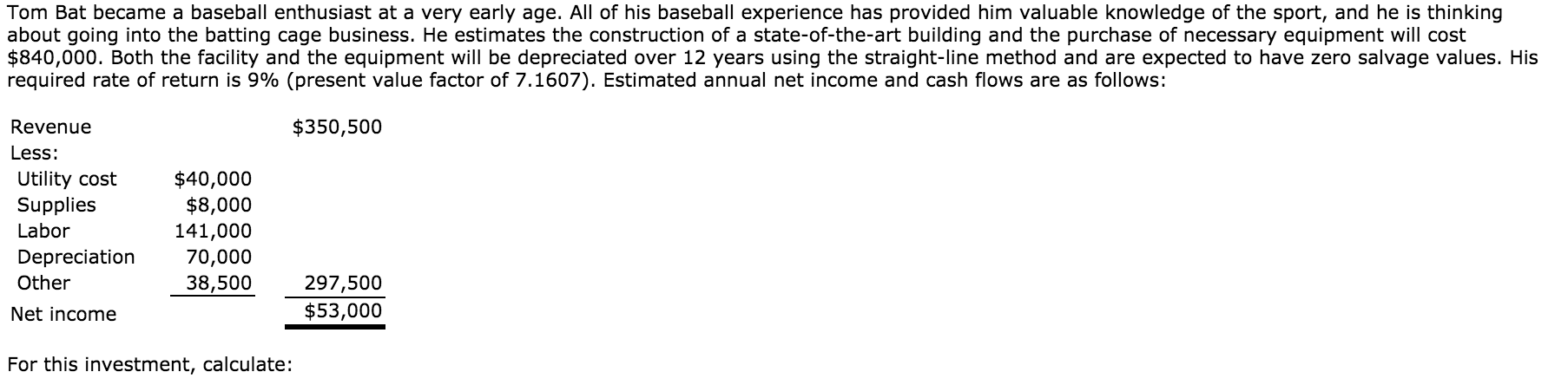

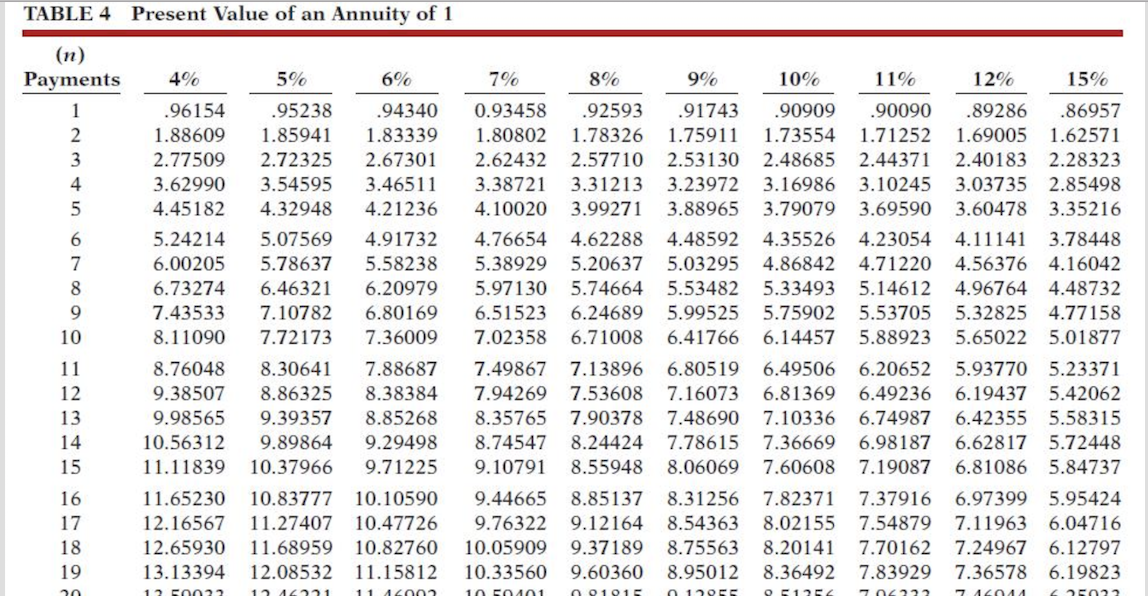

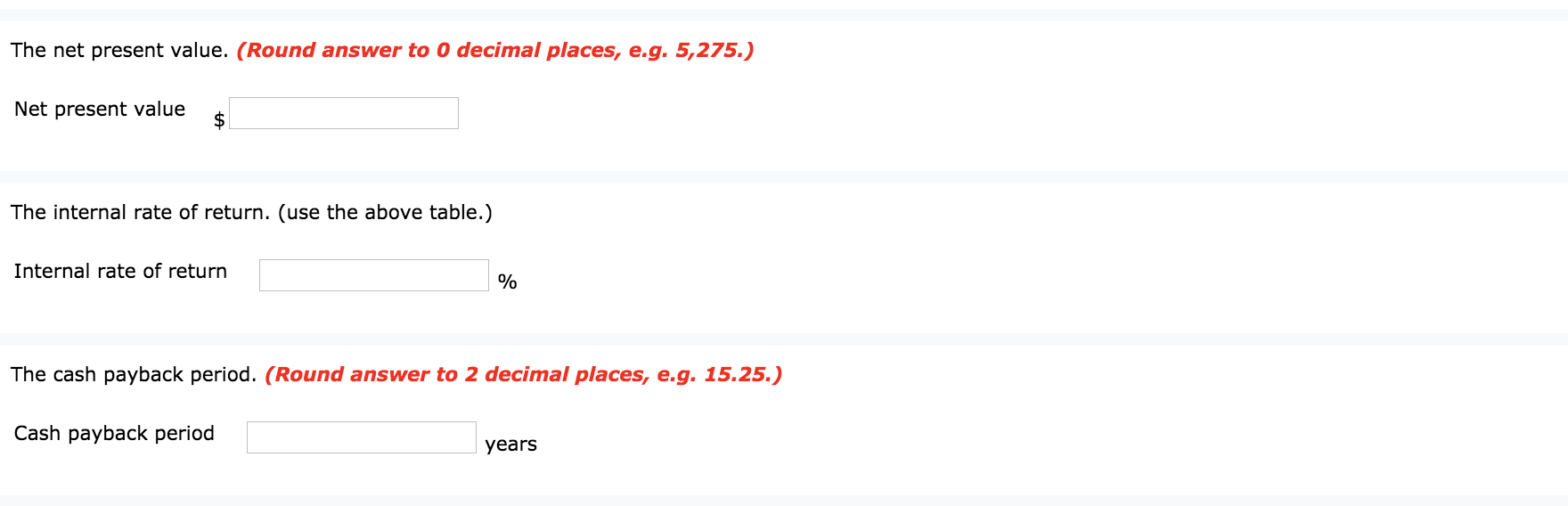

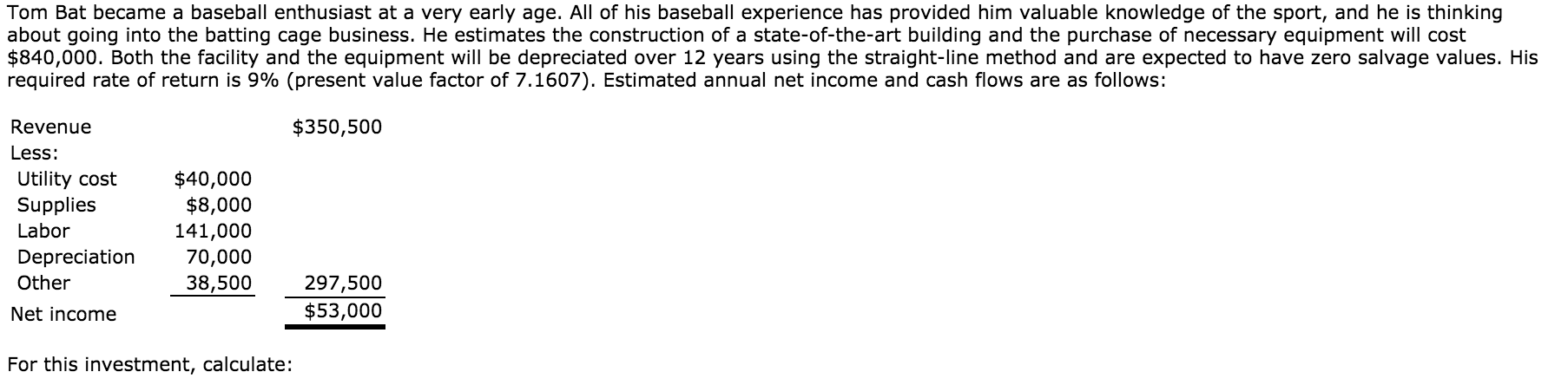

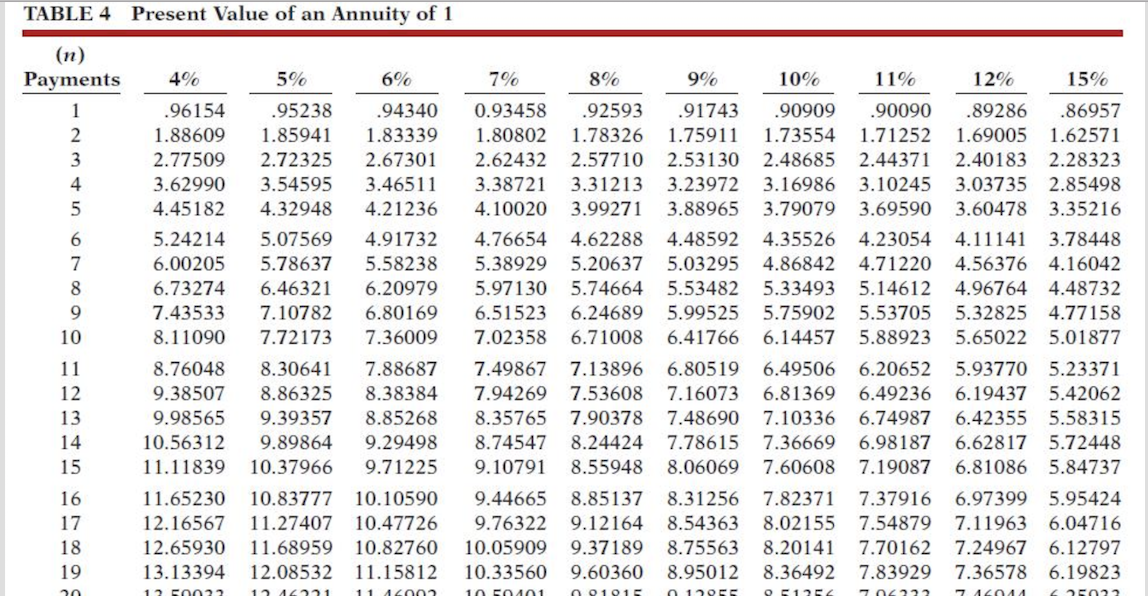

Tom Bat became a baseball enthusiast at a very early age. All of his baseball experience has provided him valuable knowledge of the sport, and he is thinking about going into the batting cage business. He estimates the construction of a state-of-the-art building and the purchase of necessary equipment will cost $840,000. Both the facility and the equipment will be depreciated over 12 years using the straight-line method and are expected to have zero salvage values. His required rate of return is 9% (present value factor of 7.1607). Estimated annual net income and cash flows are as follows: $350,500 Revenue Less: Utility cost Supplies Labor Depreciation Other $40,000 $8,000 141,000 70,000 38,500 297,500 $53,000 Net income For this investment, calculate: TABLE4 Present Value of an Annuity of 1 (n) Payments 4% 5% 6% 7% 8% 1 2 3 4 5 6 7 8 9 10 .96154 1.88609 2.77509 3.62990 4.45182 5.24214 6.00205 6.73274 7.43533 8.11090 8.76048 9.38507 9.98565 10.56312 11.11839 11.65230 12.16567 12.65930 13.13394 .95238 1.85941 2.72325 3.54595 4.32948 5.07569 5.78637 6.46321 7.10782 7.72173 8.30641 8.86325 9.39357 9.89864 10.37966 10.83777 11.27407 11.68959 12.08532 .94340 1.83339 2.67301 3.46511 4.21236 4.91732 5.58238 6.20979 6.80169 7.36009 7.88687 8.38384 8.85268 9.29498 9.71225 10.10590 10.47726 10.82760 11.15812 0.93458 .92593 1.80802 1.78326 2.62432 2.57710 3.38721 3.31213 4.10020 3.99271 4.76654 4.62288 5.38929 5.20637 5.97130 5.74664 6.51523 6.24689 7.02358 6.71008 7.49867 7.13896 7.94269 7.53608 8.35765 7.90378 8.74547 8.24424 9.10791 8.55948 9.44665 8.85137 9.76322 9.12164 10.05909 9.37189 10.33560 9.60360 9% 10% 11% 12% 15% .91743 .90909 .90090 .89286 .86957 1.75911 1.73554 1.71252 1.69005 1.62571 2.53130 2.48685 2.44371 2.40183 2.28323 3.23972 3.16986 3.10245 3.03735 2.85498 3.88965 3.79079 3.69590 3.60478 3.35216 4.48592 4.35526 4.23054 4.11141 3.78448 5.03295 4.86842 4.71220 4.56376 4.16042 5.53482 5.33493 5.14612 4.96764 4.48732 5.99525 5.75902 5.53705 5.32825 4.77158 6.41766 6.14457 5.88923 5.650225.01877 6.80519 6.49506 6.20652 5.93770 5.23371 7.16073 6.81369 6.49236 6.19437 5.42062 7.48690 7.10336 6.74987 6.42355 5.58315 7.78615 7.36669 6.98187 6.62817 5.72448 8.06069 7.60608 7.19087 6.81086 5.84737 8.31256 7.82371 7.37916 6.97399 5.95424 8.54363 8.02155 7.54879 7.11963 6.04716 8.75563 8.20141 7.70162 7.24967 6.12797 8.95012 8.36492 7.839297.36578 6.19823 11 12 13 14 15 16 17 18 19 20 120022 12AL1 11 ALOO 1001 0101 12OFE O 12 702222 ALOAA 2022 The net present value. (Round answer to 0 decimal places, e.g. 5,275.) Net present value $ The internal rate of return. (use the above table.) Internal rate of return % The cash payback period. (Round answer to 2 decimal places, e.g. 15.25.) Cash payback period years