Answered step by step

Verified Expert Solution

Question

1 Approved Answer

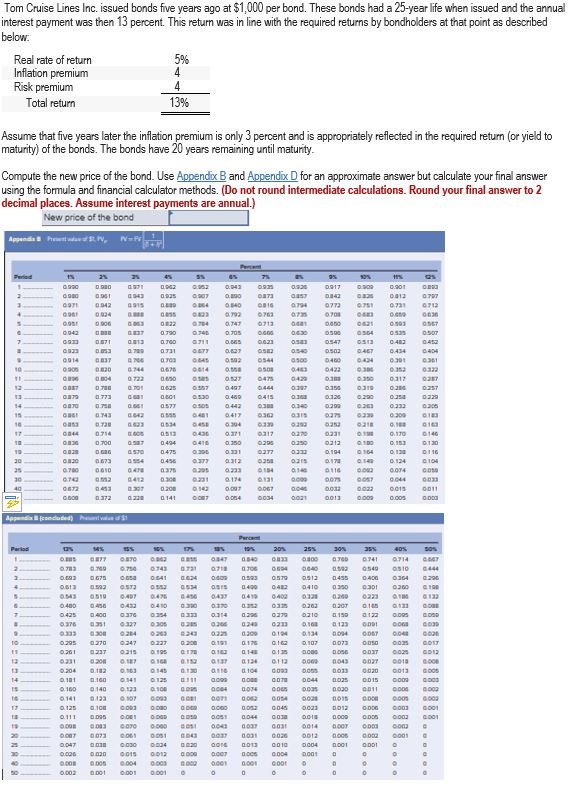

Tom Cruise Lines Inc. issued bonds five years ago at $1,000 per bond. These bonds had a 25-year life when issued and the annual interest

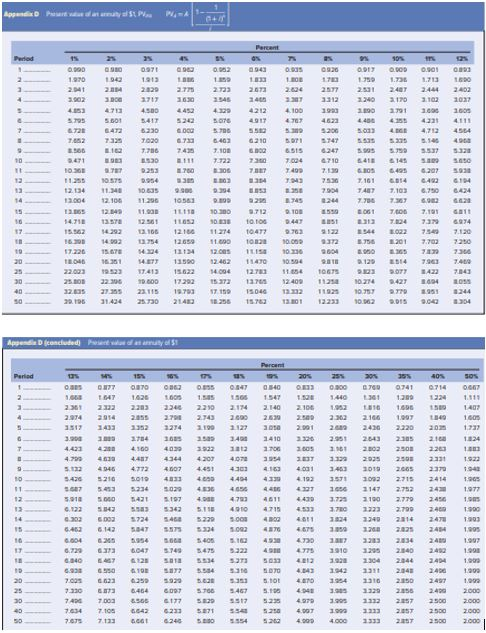

Tom Cruise Lines Inc. issued bonds five years ago at $1,000 per bond. These bonds had a 25-year life when issued and the annual interest payment was then 13 percent. This return was in line with the required returns by bondholders at that point as described below: Real rate of return Inflation premium Risk premium Total return 13% 5% Assume that five years later the inflation premium is only 3 percent and is appropriately reflected in the required return (or yield to maturity) of the bonds. The bonds have 20 years remaining until maturity Compute the new price of the bond. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume interest payments are annual.) New price of the bond Appendia show . 09:42 0 907 OSOB 2014 0.502 544 500 DEST E D.703 545 200 014 094 072000 G 0279 0773 1 0.8010500 13 722 092 0934020304 03 3 0.700 . 7 0.494 0.416 0.350 3300673 350.436 377 312 70 610 375 333 01 0 2 0.412 0.30 033 0.116 06204 3 7 0.200 0.33 0.097 GOOD .72020141007 0.054 353 154 1 .131 09 007 067 004 034 OZDO13 COST 002 0044 0015 033 0011 agama d e 31 % % 19% 20% 25% 30% 35% 0735171007401420121 0504099205490510 9.407 408 0419 4 0.41 07300 040 01. 10 01 02 15 070209010734 24 0.261 0237 208 0.162 021502195 12 16 0.160.145 Q17213 014 015 0.10 1 3 0134 0112 0.130011001040093 0.000 000 0.063 0.06 0043 0033 00 OST 0.020 0 25 2018 2013 123 100 000 QCH ON COS Duos 0.030 000 RNR 98 0.051 004 000018 030-0900-0000000000030014 BOOT 02 03 031 04 DOT 031 01 DOOS 0.00 0.00 0.004 20000 001 00101004 000 0020 00150012 DOG 0.00 0.00 0.00 0.001 000 0004 0000 000 000 000 0 0 0.00 0.00 0.001 0 0 0 0 0 0 DOCT 0.047 0.006 0.003 0.002 0 2167 20 21 22 USE AD 4212 4100 3900 0 1 0 SS SS . 2 733 7020 566 1.25 SS S SS ES 7.004 7 10 749 .1 5.45 20 30 7161 014 4 14 12.034 704 747 7130 12.16 11.26 01 13. 0 2. 11. 11 10 9.712 10 061 700 701 31 14 1 TO 9491 13 704 094 15.62 22 166 1210611274 10477 9763 9122 SE2 77 10 1 972 755 01 op 20 17.226 15.6E 1494 121342 .0 110 26 95040 57706 10 22.03 923 7.413 15.622 .004 12 16 6 3 SOT7 43 784 23.0 22300 960012292 15 272 127 124091 1021427 0940 32,00 27.355 23.115 19.737 159 1504 32 1192 075227 9 51 .244 30195 31.494 257302140 256 13 13 13 233 03 0 5 9040 104 Ape Doncluded Pla y 15 16 h 100 224 S 2290 9 2124 54 2140 2361 2102 223 2106 1997 151 300 152 100 1523274 74 36 2190 35 2127 3400 200 201 1410 2951 40 41 43 4 434 430 4. 0 477246074513 3 5 416 103T 40 1100 1453 1019 5234 SSB SD 541 123 1147 1190 194 4733461 44 1725 27792456 2015 23 OATSSES 10 70 838 25 26 2133 SD 545000 460015332 2500 2000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started