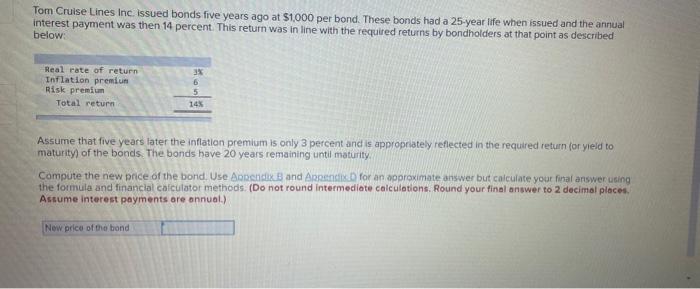

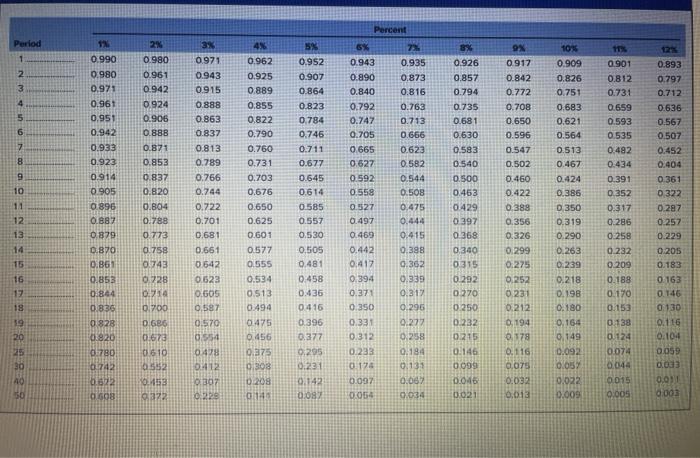

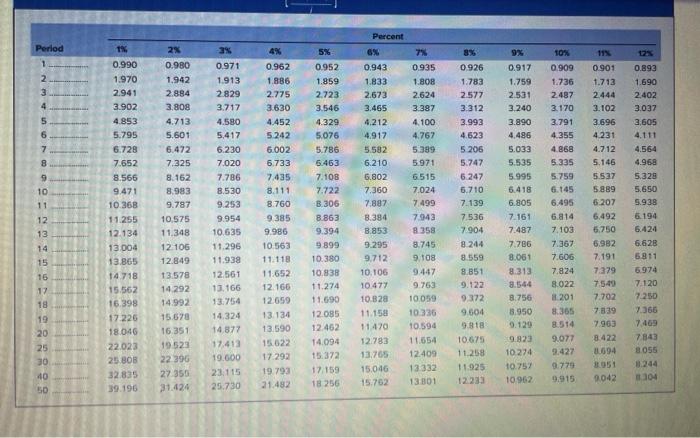

Tom Cruise Lines Inc. issued bonds five years ago at $1,000 per bond. These bonds had a 25-year life when issued and the annual interest payment was then 14 percent. This return was in line with the required returns by bondholders at that point as described below: Real rate of return Inflation premium Risk premium Total return 3% 6 5 14% Assume that five years later the inflation premium is only 3 percent and is appropriately reflected in the required return (or yield to maturity) of the bonds. The bonds have 20 years remaining until maturity Compute the new price of the bond. Use Appendix 3 and Appendix for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places Assume interest payments are annual) Now price of the bond Percent 3% ON 0990 Period 1 2 3 11 0.901 4 0.926 0.857 0.794 0.735 0.681 0.630 5 6 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0:592 0.558 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.882 7 8 9 10 2 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 08743 0.228 0.214 0.700 DGBO 0.678 01610 0552 0453 32 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.542 0.623 0.505 0.587 0.570 0.554 0.478 0412 307 022 11 12 13 14 15 16 13 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0475 0.456 0.375 0.308 0.208 011 7 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0,475 0.444 0.415 0.398 0.362 0.339 0.312 0.296 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0,505 0.481 0:458 0.436 0416 0.396 0.377 9,295 0.231 0917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0:275 0.252 0.231 0.212 0,194 0.583 0.540 0.500 0.453 0.429 0.397 0.368 0.340 0315 ( 01292 0.270 0.250 0.232 0.215 01146 0099 0.045 0021 0.527 0.497 0.469 0.442 0:412 0.394 0.371 0.350 0.33 0.312 0.233 0.17 0.097 02054 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.385 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0,164 0 149 0.092 0.05% 0.022 0.009 0.812 0.731 0.659 0.593 0.535 0.492 0.434 0.391 0.352 0.317 0.286 0258 0.232 0.209 0.188 0.170 0.153 0.138 01124 0.829 0.870 0.861 0.853 0.864 0.836 0828 0.820 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.746 0 130 0.116 0.104 0.059 0.03 0.011 0003 18 19 20 25 30 40 07B0 742 862 0.277 0,258 0.184 0.13 0.06% 0.034 0.179 0.116 0.075 0:032 0,613 0.074 0.04 0.015 0.005 0.142 0.087 50 0508 Percent Period 4% 1X 0.990 10% 1 0.935 2 3 4 2% 0.980 1.942 2.884 3.808 0.943 1.833 2.673 3.465 4.212 4.917 0.893 1.690 2402 3.037 3,605 5 6 7 4.564 4.968 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 8 9 10 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12134 13 004 13.865 14 718 15.562 16.398 17.226 18.046 22.023 25 BOB 32835 39.196 0.971 1.913 2829 3.717 4.580 5,417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.000 23.115 25.730 4.713 5.601 6.472 7.325 8. 162 8.983 9.787 10.575 11.348 12 106 12.849 13578 14.292 14.992 15.578 16 351 19523 22396 27 355 31.424 11 12 13 14 15 16 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11,652 12.166 12 659 13:134 13 590 15.622 17.292 19.793 21.482 1.808 2.624 3.387 4.100 4.762 5389 5.971 6515 7.024 7.499 7943 8358 8.745 9. 108 9.447 9.763 10.059 10.336 10.594 11.654 12409 13332 13 101 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11420 12.783 13.765 15.046 15.762 8% 0926 1.783 2577 3.312 3.993 4.623 5 206 5.747 6.247 6.710 7.139 7.536 7904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11025 12233 0.917 1.759 2531 3.240 3.890 4.486 5.033 5.535 5.995 5.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 0.909 1.736 2487 2.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 1201 8.365 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7379 7.549 7.702 7.839 7903 8422 694 5.329 5.650 5.938 6.194 6.424 6.628 5811 6.974 7120 7.250 7.365 7.469 7843 8.055 3.244 9899 10.380 10.838 11.274 11.690 12.085 12 462 14.094 15.372 17.159 18 256 17 18 19 20 25 30 40 50 9.823 10.274 10.757 10.962 9.077 9.427 9.779 9.915 9.042