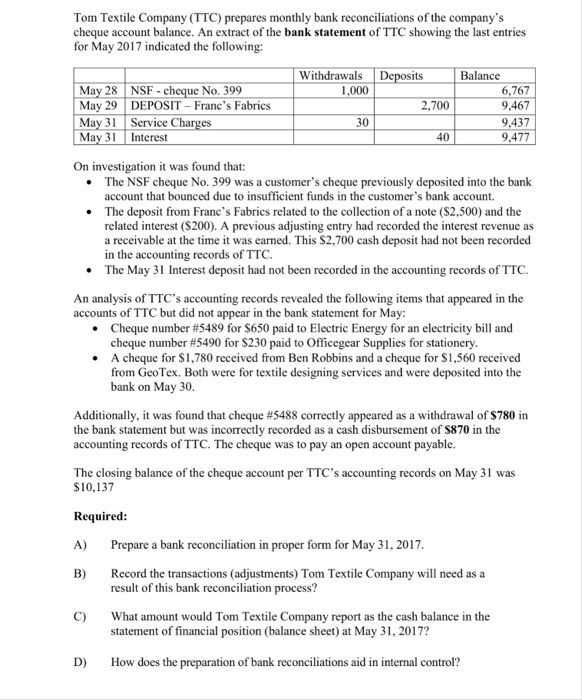

Tom Textile Company (TTC) prepares monthly bank reconciliations of the company's cheque account balance. An extract of the bank statement of TTC showing the last entries for May 2017 indicated the following: Withdrawals sits Balance 1,000 May 28NSF cheque No. 399 May 29 DEPOSIT-Franc's Fabrics May 3Service May 31 Interest 6.767 9,467 9.437 9,477 2,700 30 40 On investigation it was found that The NSF cheque No. 399 was a customer's cheque previously deposited into the bank account that bounced due to insufficient funds in the customer's bank account. . .The deposit from Franc's Fabrics related to the collection of a note ($2,500) and the related interest ($200). A previous adjusting entry had recorded the interest revenue as a receivable at the time it was earned. This $2,700 cash deposit had not been recorded in the accounting records of TTC. . The May 31 Interest deposit had not been recorded in the accounting records of TTC An analysis of TTC's accounting records revealed the following items that appeared in the accounts of TTC but did not appear in the bank statement for May Cheque number #5489 for $650 paid to Electric Energy for an electricity bill and Cheque number #5490 for $230 paid to Officegear Supplies for stationery .A cheque for $1,780 received from Ben Robbins and a cheque for $1,560 received from GeoTex. Both were for textile designing services and were deposited into the bank on May 30. Additionally, it was found that Cheque #5488 correctly appeared as a withdrawal of $780 in the bank statement but was incorrectly recorded as a cash disbursement of S870 in the accounting records of TTC. The cheque was to pay an open account payable. The closing balance of the cheque account per TTC's accounting records on May 31 was 10,137 Required A) Prepare a bank reconciliation in proper form for May 31, 2017 B) Record the transactions (adjustments) Tom Textile Company will need as a result of this bank reconciliation process? C) What amount would Tom Textile Company report as the cash balance in the statement of financial position (balance sheet) at May 31, 2017? D) How does the preparation of bank reconciliations aid in internal control