Question

Tombe Transporters Ltd depreciates its fleet of trucks using a straight line method. The current accounting year is coming to an end and external

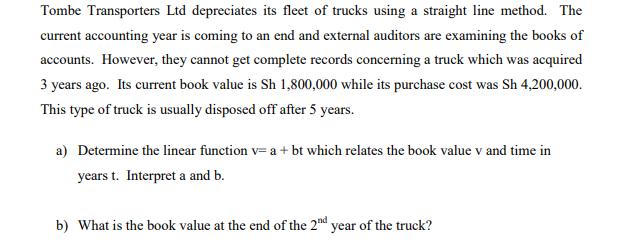

Tombe Transporters Ltd depreciates its fleet of trucks using a straight line method. The current accounting year is coming to an end and external auditors are examining the books of accounts. However, they cannot get complete records concerning a truck which was acquired 3 years ago. Its current book value is Sh 1,800,000 while its purchase cost was Sh 4,200,000. This type of truck is usually disposed off after 5 years. a) Determine the linear function v= a + bt which relates the book value v and time in years t. Interpret a and b. b) What is the book value at the end of the 2nd year of the truck? c) Determine the disposal value of the truck stating any assumptions you may make.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A Critical Approach

Authors: John Friedlan

4th edition

1259066525, 978-1259066528

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App