Answered step by step

Verified Expert Solution

Question

1 Approved Answer

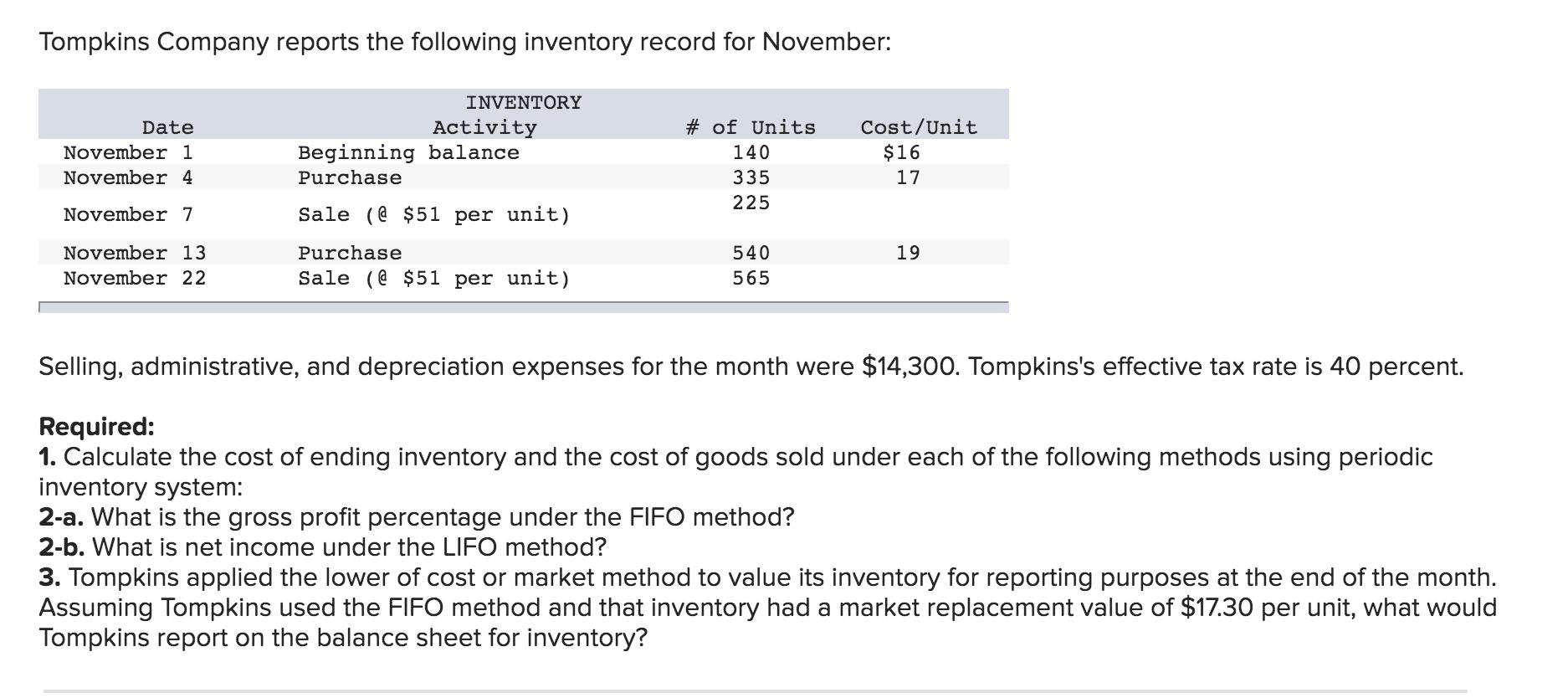

Tompkins Company reports the following inventory record for November: INVENTORY Activity Beginning balance Date # of Units Cost/Unit November 1 November 4 140 $16

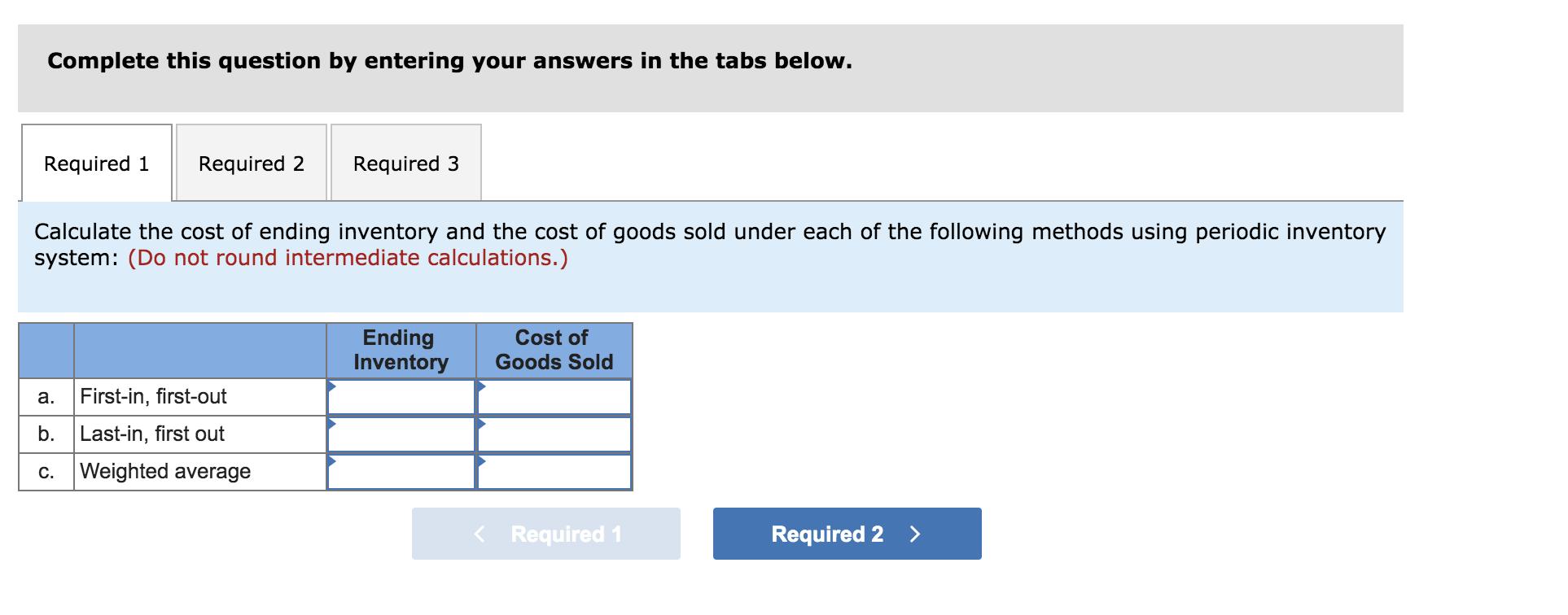

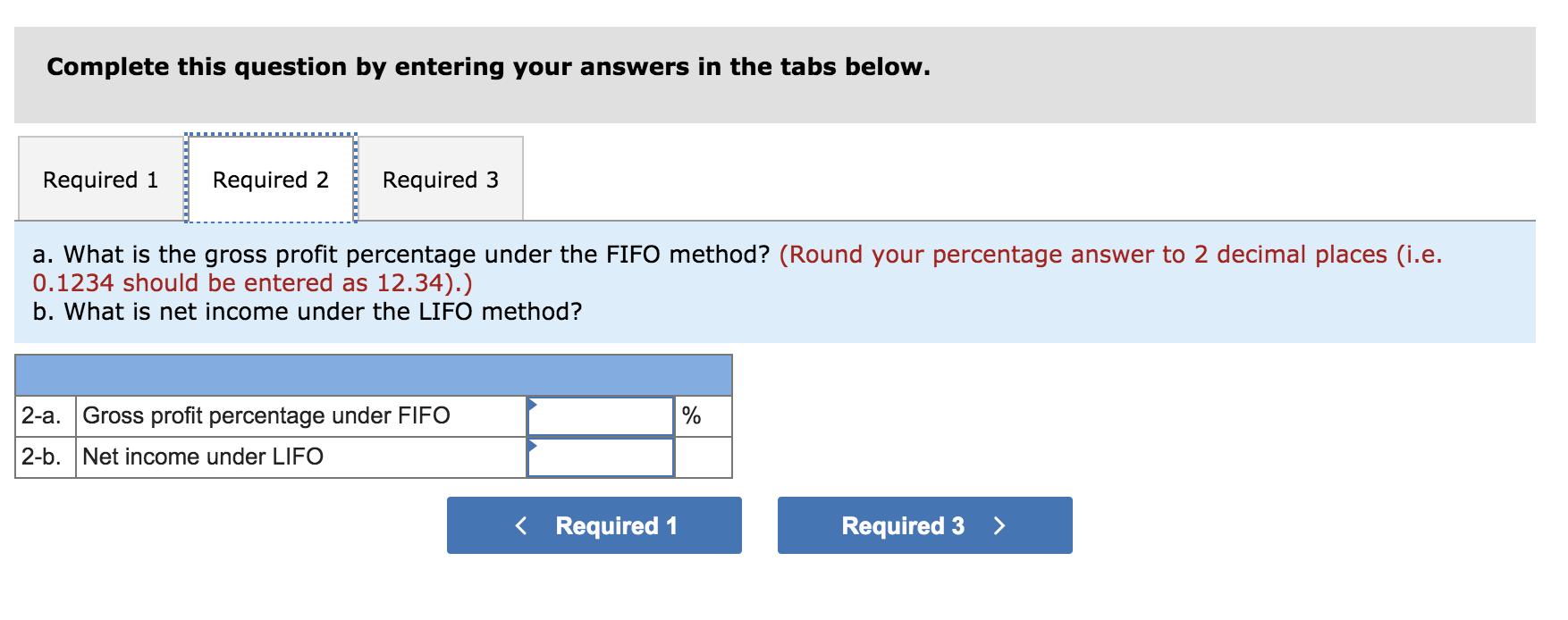

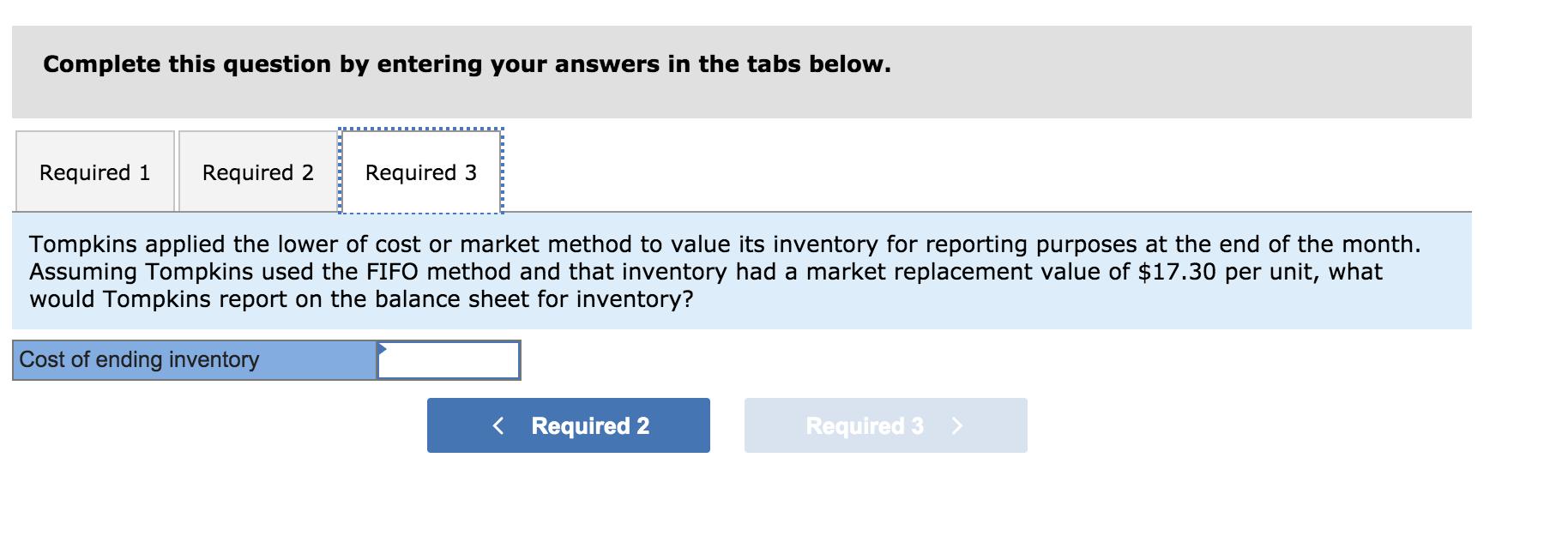

Tompkins Company reports the following inventory record for November: INVENTORY Activity Beginning balance Date # of Units Cost/Unit November 1 November 4 140 $16 Purchase 335 17 225 November 7 Sale (@ $51 per unit) November 13 Purchase 540 19 November 22 Sale (@ $51 per unit) 565 Selling, administrative, and depreciation expenses for the month were $14,300. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $17.30 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory system: (Do not round intermediate calculations.) Ending Inventory Cost of Goods Sold . First-in, first-out b. Last-in, first out . Weighted average < Required 1 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 a. What is the gross profit percentage under the FIFO method? (Round your percentage answer to 2 decimal places (i.e. 0.1234 should be entered as 12.34).) b. What is net income under the LIFO method? 2-a. Gross profit percentage under FIFO 2-b. Net income under LIFO < Required 1 Required 3 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month. Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $17.30 per unit, what would Tompkins report on the balance sheet for inventory? Cost of ending inventory < Required 2 Required 3 >

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ending Cost of Firstin Firstout b Lastin Lastout c Weighted average Inventory 4275 Goods Sold 13920 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started