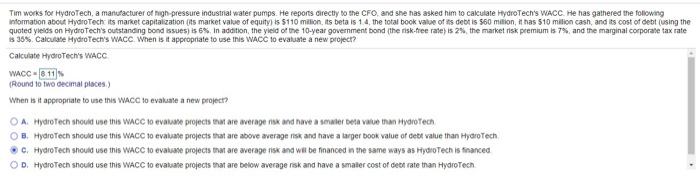

Ton works for HydroTech, manufacturer of high pressure water pumps Herrectly to the crown the has to protette WACC Heered the information about HydroTech in male capot net value fequity 5110 milioni 14 the food to this contene quoted yields on Technolanding to in the yield of the toy gorement de la 13 Cudio Tech WACC when it appriate towac to Calculate Home WACC WC- on totoo ecimales When ist appropriate to use this WACC Jo a new DA Hydro Tech should use the WACC ove projects that are wetges and have a smaller betaltech OB HydroTech should use the WACC ve projects that are above and have a prova Tech HydroTech should use the WACC o un projects three and will be traced the same ways Hoechstranded OD. Hidioten should use this WACCO projects and cost of Tech Tom works for Hydrotech a manufacturer of the industrial water pumps He reports decly to the road the asked him to do Teds WACC Honas gatheredeng information about HydroTech mastion market value of equity) $110 minit bis 14. the total book value of its debt is cominhas $10 octh, and its cost of using the quoted yields on Hydro Tech's outstanding on at they of the year government bond the themes and the main corpore like 34 Cake HydioTech WAO Wien pro WACO to WORCE Caca Hydrotech's WACO WACG.0.0 Round to two decimal places When it appropriate to use the WACC to evaluate a new prod? DA HydroTech should use this who evitate projects that an average and have a smaller et value adotech O. HydroTech should use this WACC to evaluate projects that are above average and veger booke of debt than yoro Tech C. HydroTech should use this WACC Holste projects that everage and will be traced in the same ways drotechnie OD HydroTech should use this WACC to evaluate projects that are below averagers and have a ser conto de retra Hydrotech Click to your ING IN 304 AM Wednesday 321 BI Type here to search Tim works for HydroTech, a manufacturer of high pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate HydroTech's WACC. He has gathered the following Information about Hydro Tech its market capitalization (ts market value of equity is $110 milion, its beta is 14 the total book value of as debt is 560 milion, it has 510 milion cash, and its cost of debt (using the quoted yields on HydroTech's outstanding bond issues) is 6%. In addition, the yield of the 10-year government bond (the risk-free rate is 2%, the market risk premium is 7%, and the marginal corporate tax rate is 36% Calculate Hydro Tech's WACC When is it appropriate to use this WACC to evaluate a new project? Calculate Hydro Tech's WACC WACC -0.11% (Round to two decimal places) When is it appropriate to use this WACC to evaluate a new project? OA Hydrotech should use this WACC to evawe projects that are average risk and have a sterbeta value than hydrotech 8. HydroTech should use this WACC to evaluate projects that are above average risk and have a larger book value of debt value than Hydro Tech C Hydro Tech should use this WACC to evaluate projects that are average risk and will be financed in the same ways as HydroTech is financed OD HydroTech should use this WACC to evaluate projects that are below average risk and have a smater cost of debt rate than HydroTech