Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Top Notch Homes Ltd. (TNH) is a privately owned company selling a luxury range of home equipment. Fiona Fielding, the daughter of the companys founder,

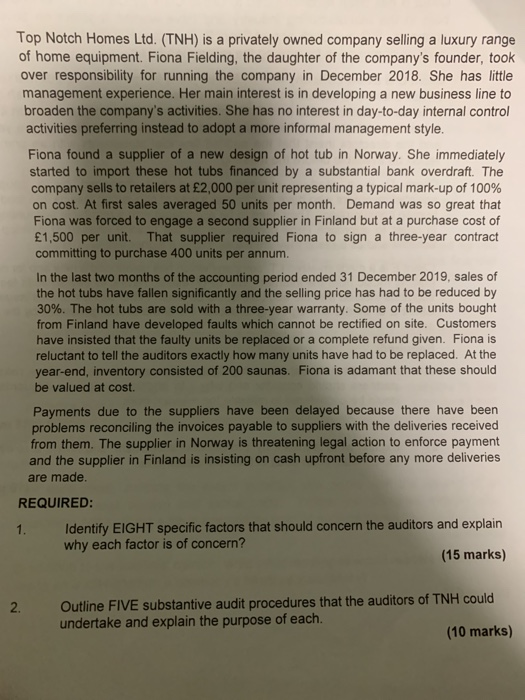

Top Notch Homes Ltd. (TNH) is a privately owned company selling a luxury range of home equipment. Fiona Fielding, the daughter of the companys founder, took over responsibility for running the company in December 2018. She has little management experience. Her main interest is in developing a new business line to broaden the companys activities. She has no interest in day-to-day internal control activities preferring instead to adopt a more informal management style.

Fiona found a supplier of a new design of hot tub in Norway. She immediately started to import these hot tubs financed by a substantial bank overdraft. The company sells to retailers at 2,000 per unit representing a typical mark-up of 100% on cost. At first sales averaged 50 units per month. Demand was so great that Fiona was forced to engage a second supplier in Finland but at a purchase cost of 1,500 per unit. That supplier required Fiona to sign a three-year contract committing to purchase 400 units per annum.

In the last two months of the accounting period ended 31 December 2019, sales of the hot tubs have fallen significantly and the selling price has had to be reduced by 30%. The hot tubs are sold with a three-year warranty. Some of the units bought from Finland have developed faults which cannot be rectified on site. Customers have insisted that the faulty units be replaced or a complete refund given. Fiona is reluctant to tell the auditors exactly how many units have had to be replaced. At the year-end, inventory consisted of 200 saunas. Fiona is adamant that these should be valued at cost.

Payments due to the suppliers have been delayed because there have been problems reconciling the invoices payable to suppliers with the deliveries received from them. The supplier in Norway is threatening legal action to enforce payment and the supplier in Finland is insisting on cash upfront before any more deliveries are made.

2. Outline FIVE substantive audit procedures that the auditors of TNH could

undertake and explain the purpose of each.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started