Answered step by step

Verified Expert Solution

Question

1 Approved Answer

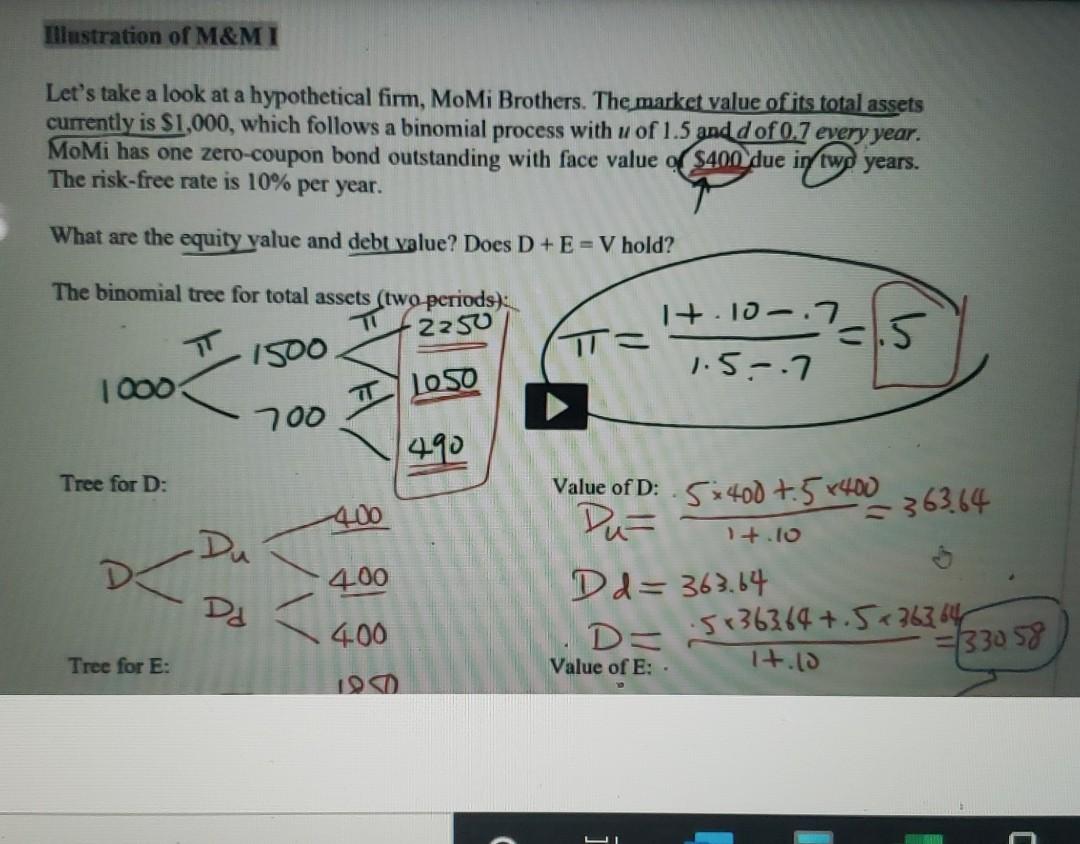

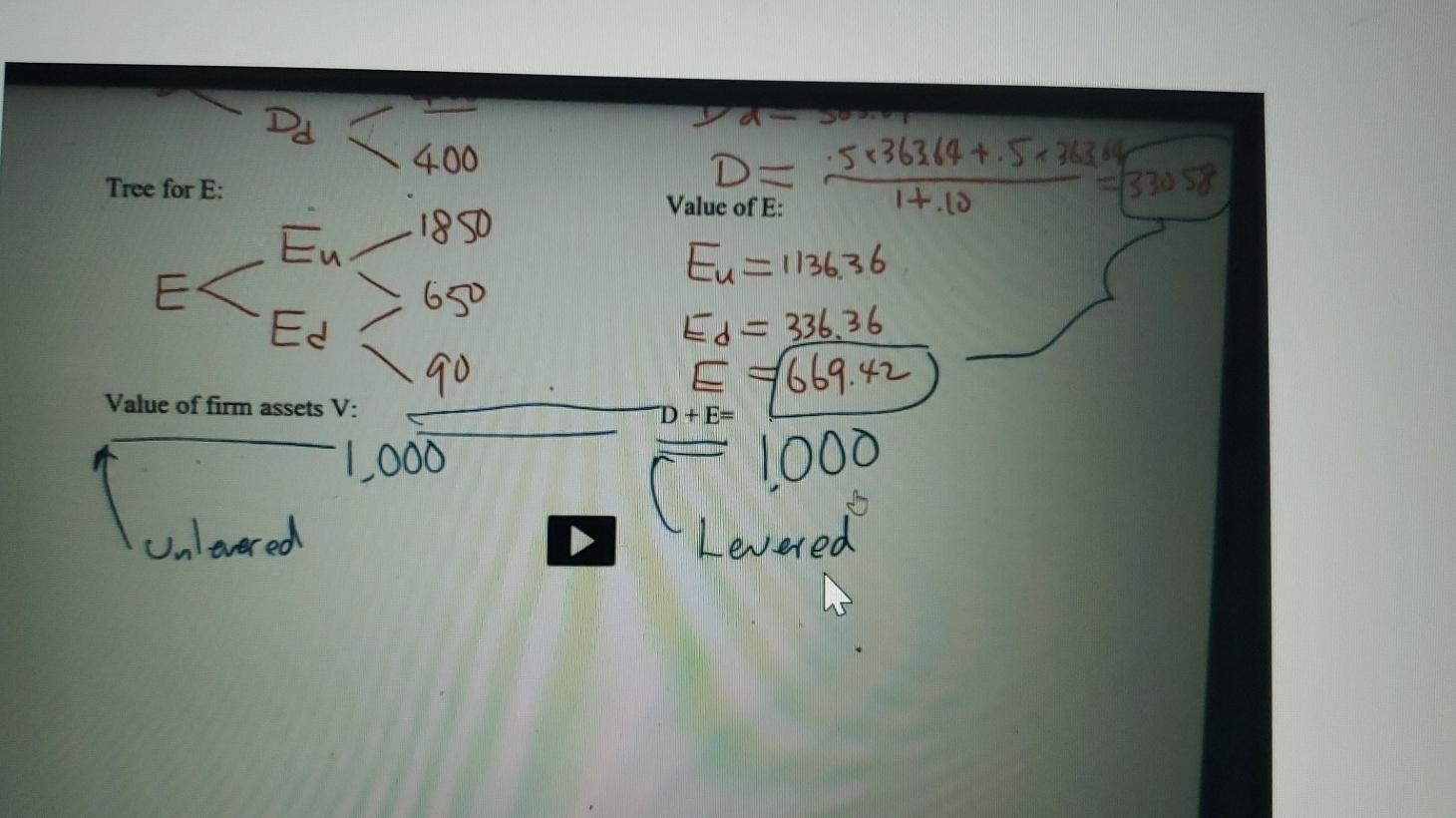

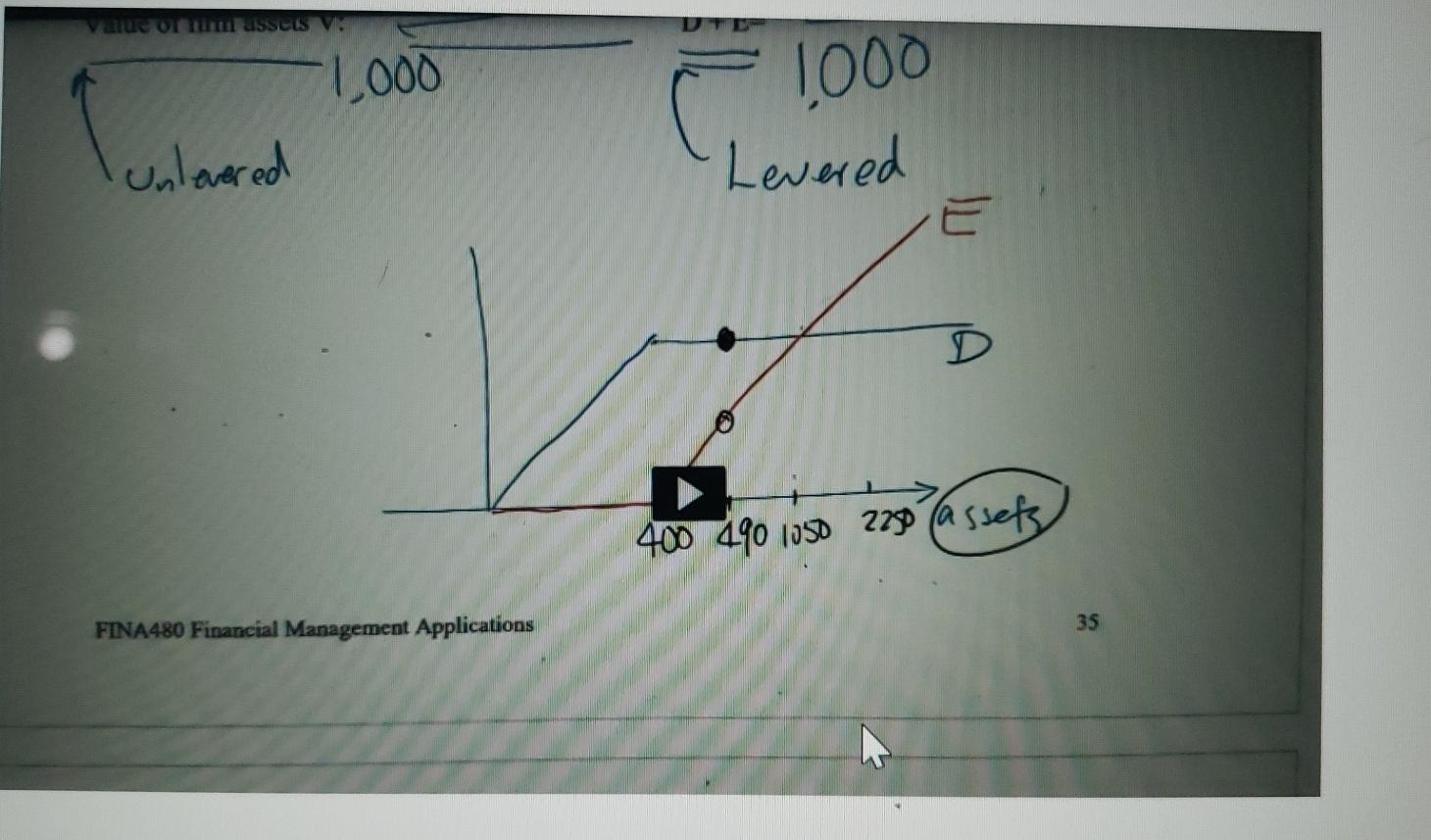

TOP THREE ARE ( pg 36) ^^^^^ These bottom three are ( page 38) These are the previous example^^ In the previous example debt is

TOP THREE ARE ( pg 36) ^^^^^

These bottom three are ( page 38)

These are the previous example^^

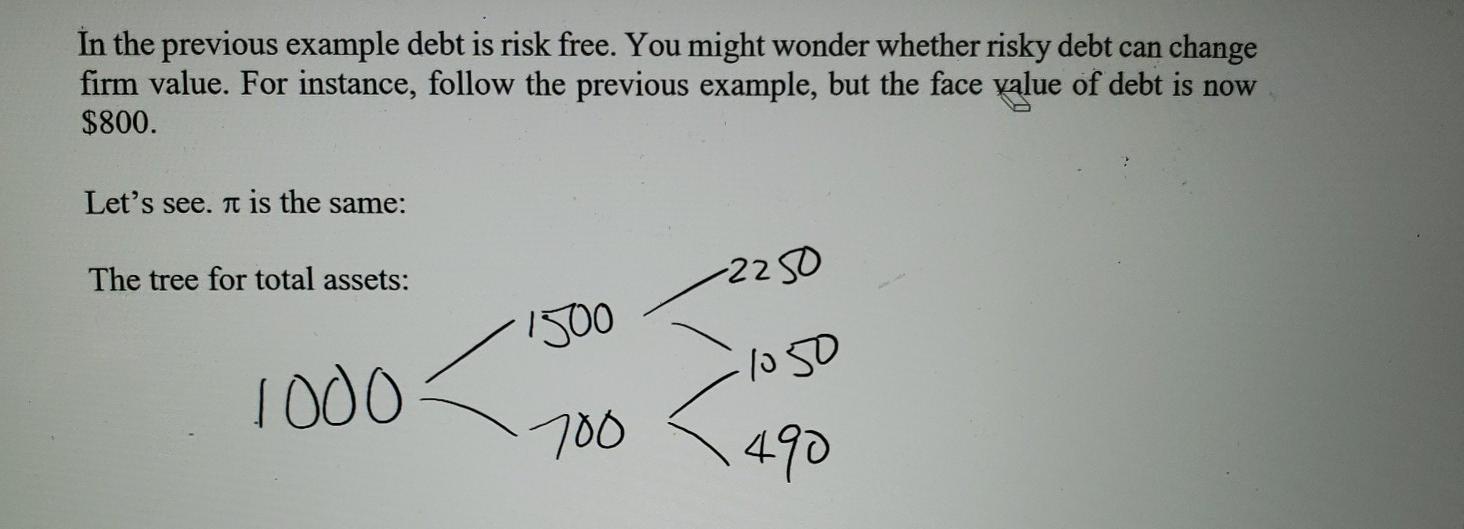

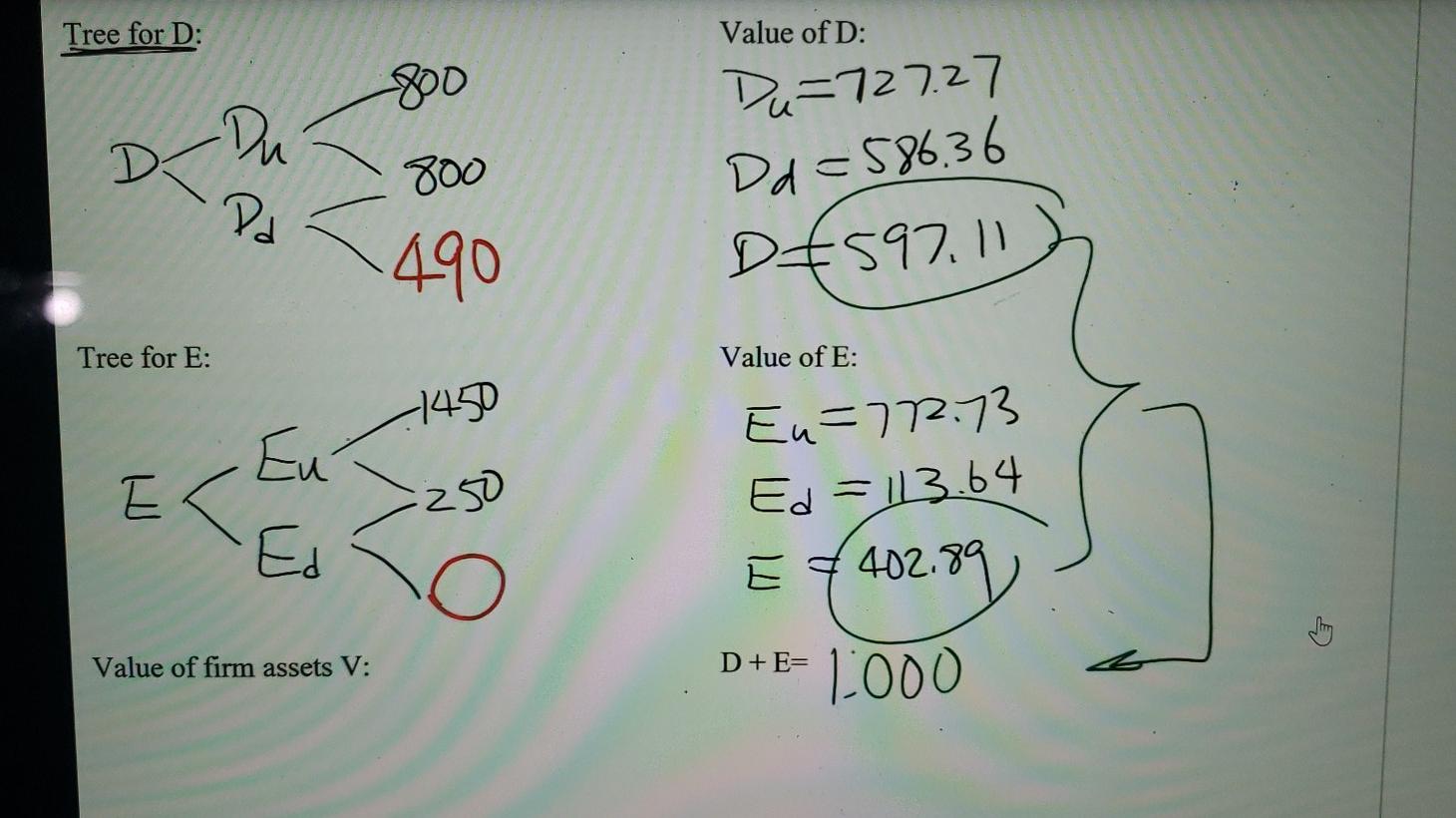

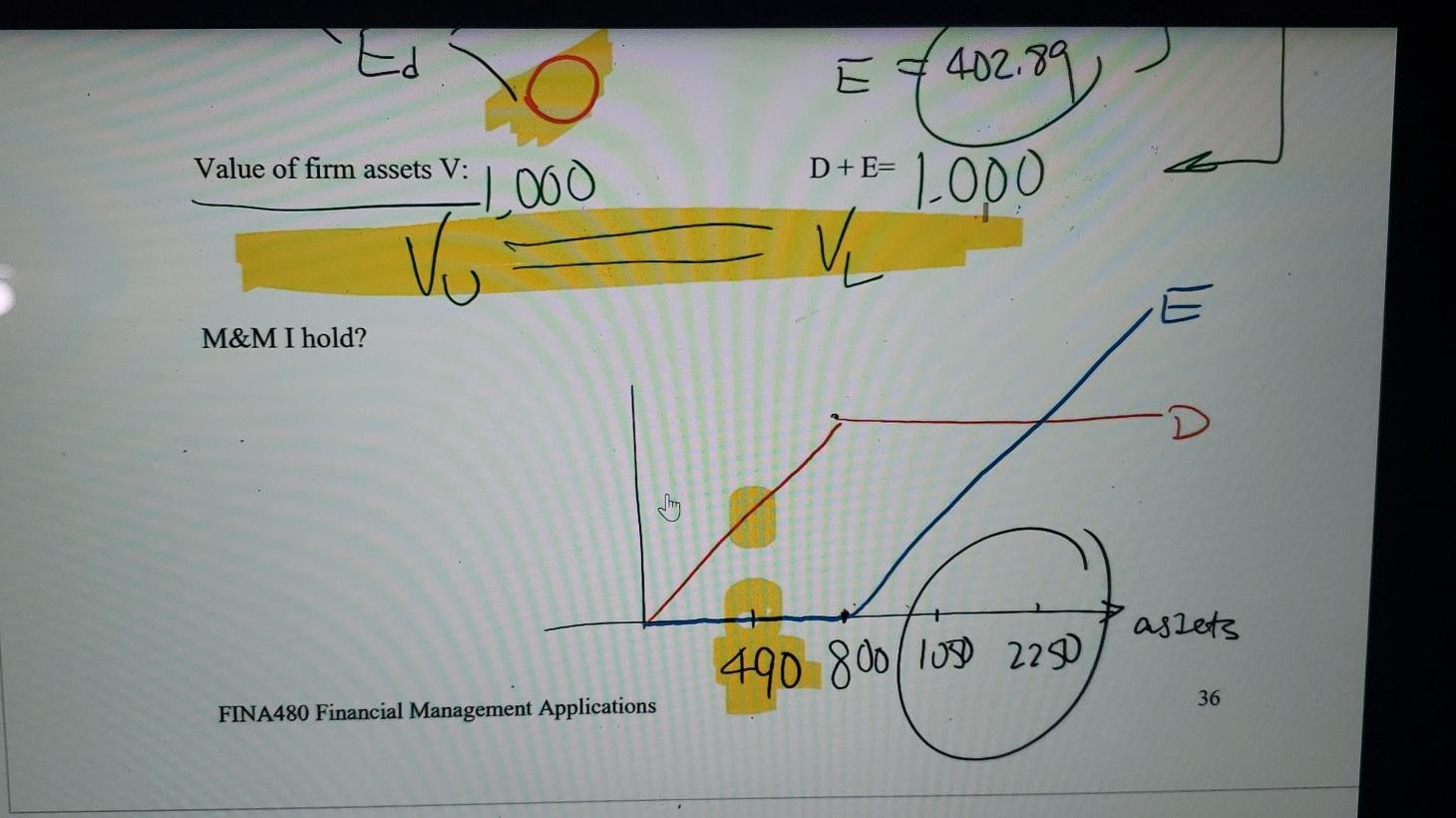

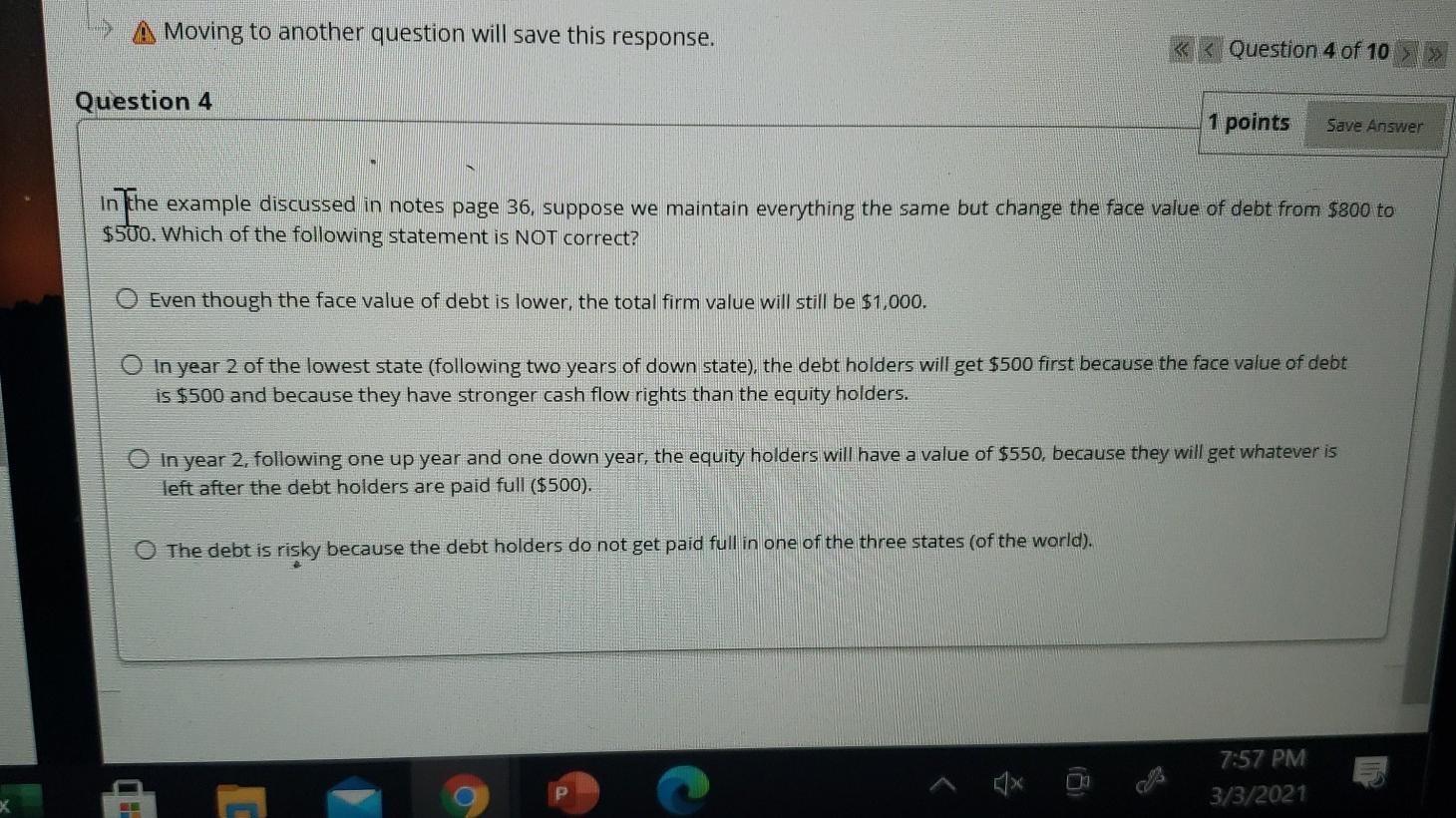

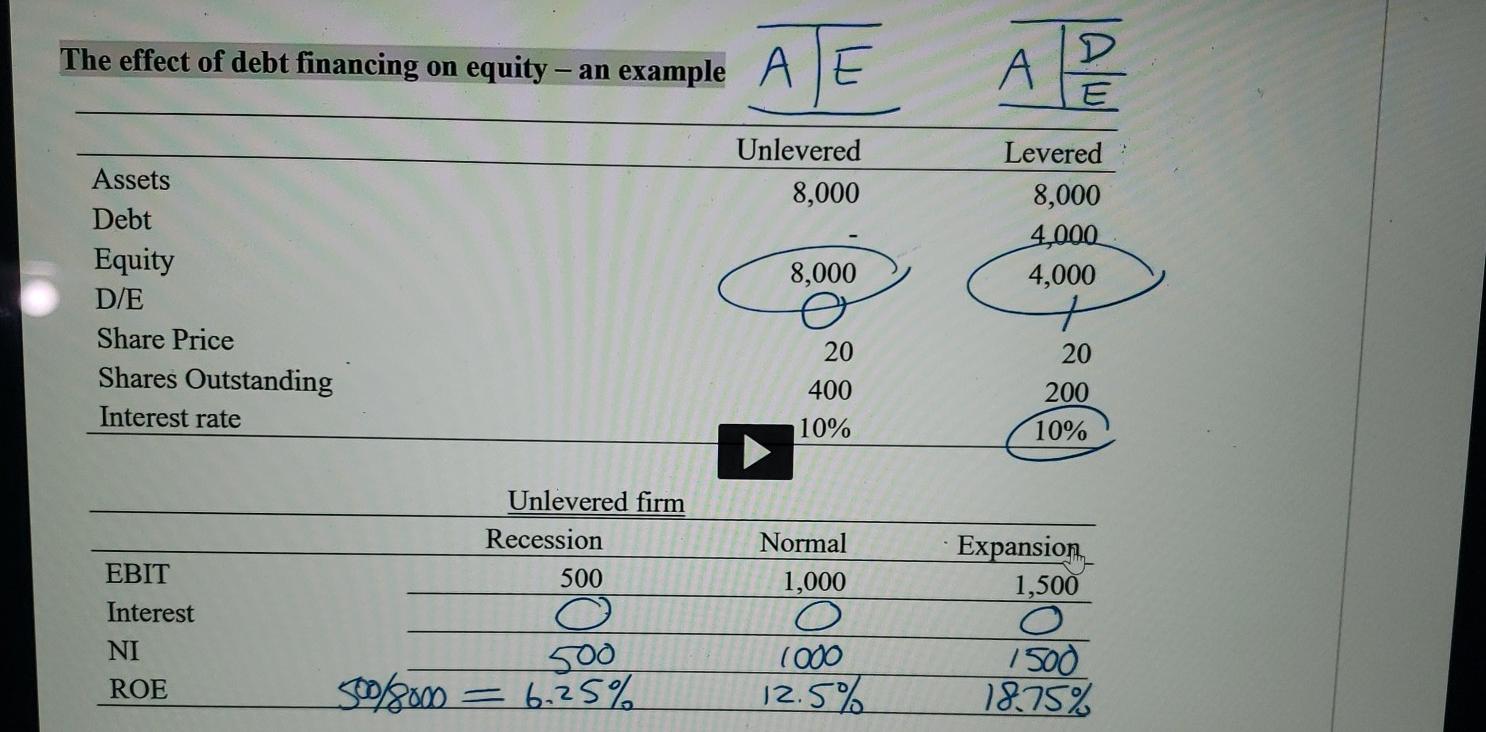

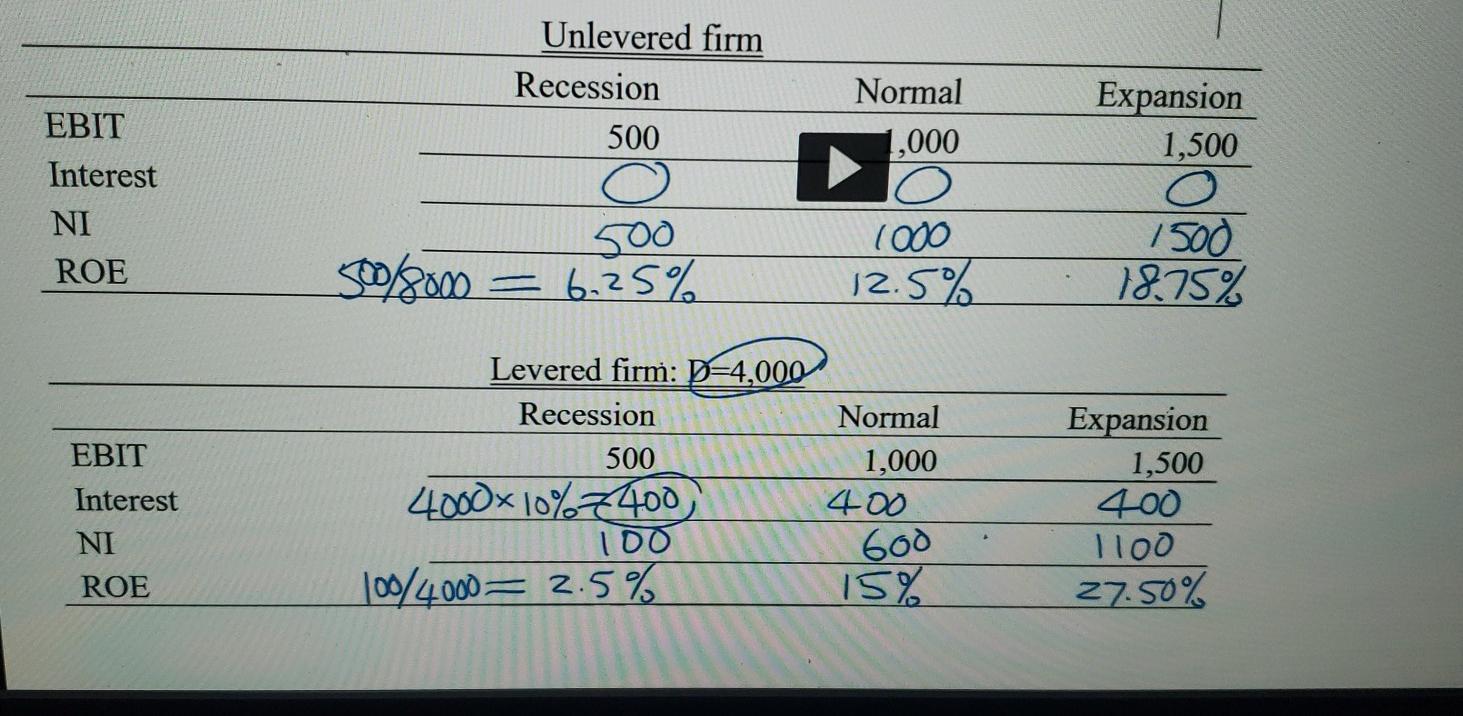

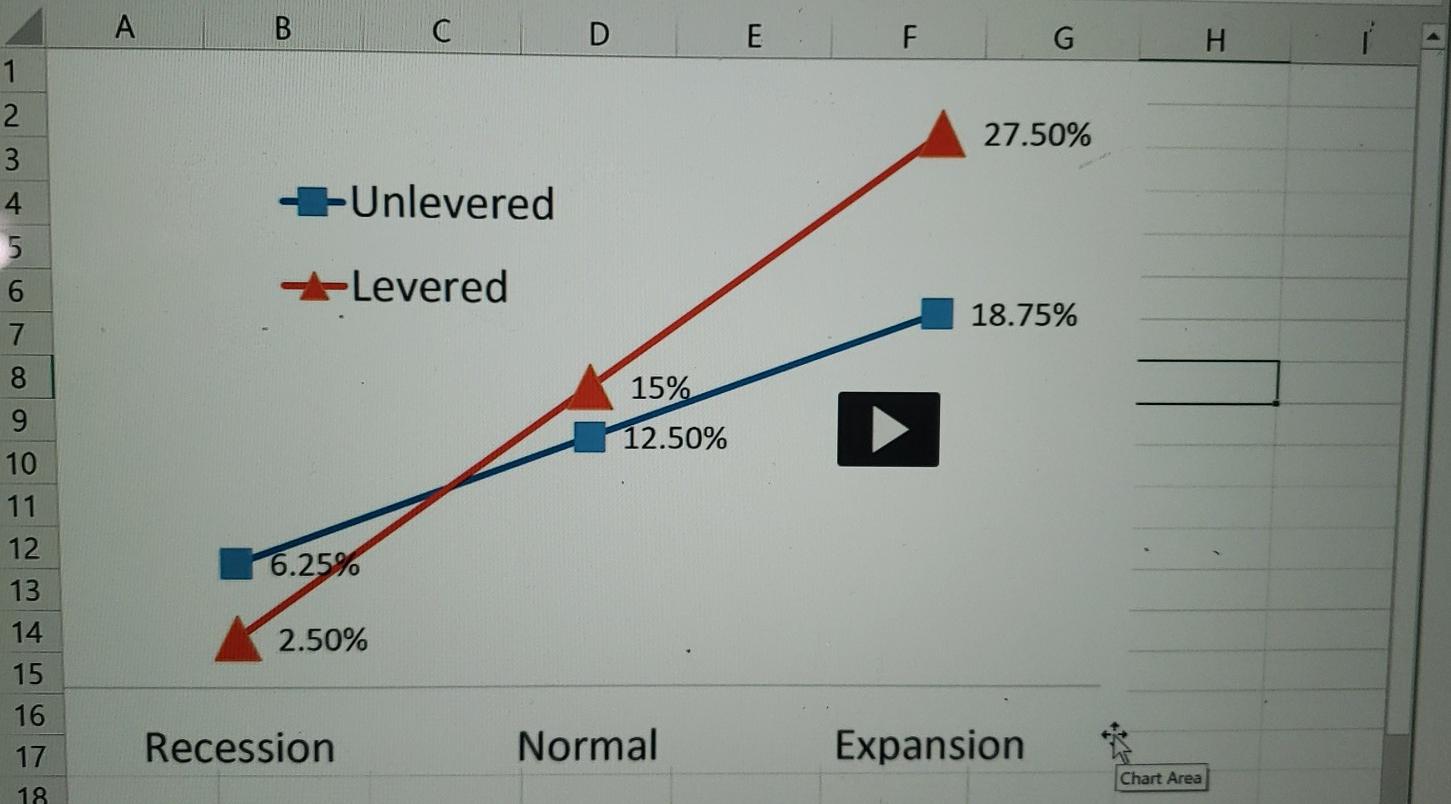

In the previous example debt is risk free. You might wonder whether risky debt can change firm value. For instance, follow the previous example, but the face value of debt is now $800. Let's see. it is the same: The tree for total assets: -2250 1500 1050 1000 700 490 Tree for D: Value of D: Du=727.27 Du De 800 Dd=586.36 Da 490 D#597.11 Tree for E: Value of E: 1450 E E Eu Ed 250 Eu=772.73 Ed=113.64 E 402.89 Value of firm assets V: D + E= 1000 402.89 Value of firm assets V: D+E= 000 1000 V V M&M I hold? aslets 490 800 lub 2250 36 FINA480 Financial Management Applications A Moving to another question will save this response. Question 4 of 10 Question 4 1 points Save Answer in the example discussed in notes page 36, suppose we maintain everything the same but change the face value of debt from $800 to $500. Which of the following statement is NOT correct? Even though the face value of debt is lower, the total firm value will still be $1,000. O In year 2 of the lowest state (following two years of down state), the debt holders will get $500 first because the face value of debt is $500 and because they have stronger cash flow rights than the equity holders. O In year 2, following one up year and one down year, the equity holders will have a value of $550, because they will get whatever is left after the debt holders are paid full ($500). The debt is risky because the debt holders do not get paid full in one of the three states (of the world). (i 7:57 PM 3/3/2021 The effect of debt financing on equity - an example ALE D E Unlevered 8,000 Levered 8,000 4,000 4,000 8,000 Assets Debt Equity D/E Share Price Shares Outstanding Interest rate 20 400 20 200 10% 10% Normal Expansion 1,500 1,000 EBIT Interest NI ROE Unlevered firm Recession 500 O 500 S80m = 6,25% 1000 12.5% 1500 1875% Normal 1,000 Unlevered firm Recession 500 o 500 6.25% Expansion 1,500 EBIT Interest NI ROE 500/8000 1000 12.5% 7500 18.75% EBIT Interest NI ROE Levered firm: D=4,000 Recession 500 4.000* 10% 2400 100 100/4000= 2.5% Normal 1,000 400 600 15% Expansion 1,500 400 1100 27.50% A B D E F G H 27.50% +Unlevered -Levered 18.75% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 15% 12.50% 6.25% 2.50% Recession Normal Expansion Chart Area 18 A Moving to another question will save this response. SUOI UI Question 6 1 points Save Answer For the example discussed in notes page 38, if we reduce the interest rate from 105 to 596 while maintaining everything else the same, which of the following statements is NOT true? The return on equity for the unlevered firm varies across the different states of the economy. The return on equity for the levered firm yaries across the different states of the economy. O The final graph of ROE vs. states of the economy will show a steeper line for the levered firm than that for the unlevered firm. With a lower interest rate, the debt is less risky. As a result, the equity is more valuable, although the total firm value remains the same. Question 8 1 points Save Answer Which of the following statements regarding the features of debt and equity is NOT correct? Even if I only invest in one share of Amazon's stock. I am a owner of the company. O As an Amazon stock investor, I have the rights to elect directors, who monitor managers. I would also have the rights to vote on important corporate issues such as mergers and acquisitions. u When Amazon raises new equity, the managers could issue stocks to local banks or the public equity market. Because local banks know better about the company than the general public, they as equity investors may have stronger cash flow rights than other investors, including the debt investors and the equity investors who bought Amazon stocks from the public equity market. As an investor in corporate equity, one could lose everything when the company is in financial trouble. WX 8:01 PM 3/3/2021 A Moving to another question will save this response.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started