SorCo. Inc. has Just entered into a sale agreement with a customer. The contract is for $1,350,000. However, the payments will be made as

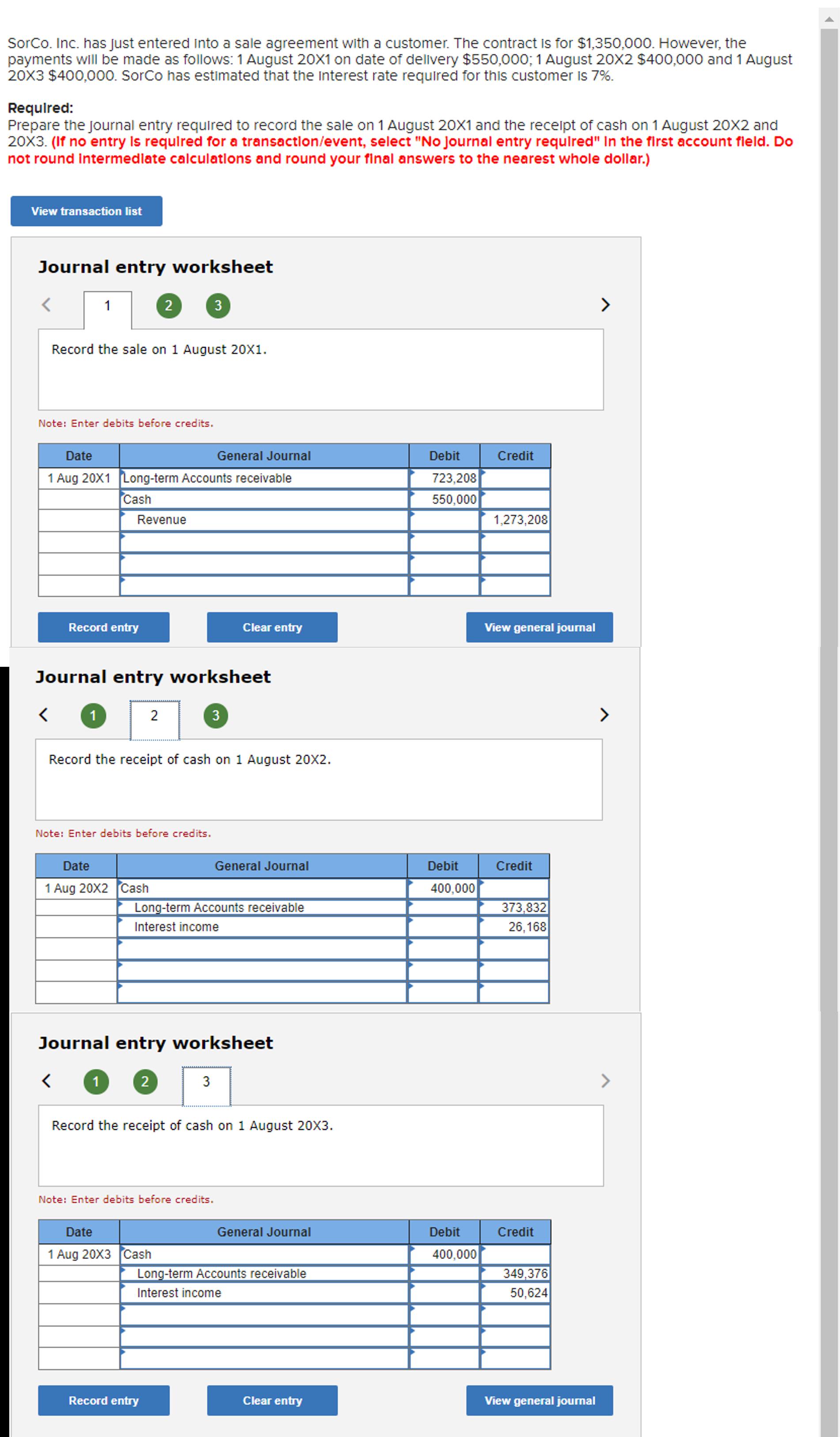

SorCo. Inc. has Just entered into a sale agreement with a customer. The contract is for $1,350,000. However, the payments will be made as follows: 1 August 20X1 on date of delivery $550,000; 1 August 20X2 $400,000 and 1 August 20X3 $400,000. SorCo has estimated that the Interest rate required for this customer is 7%. Requlred: Prepare the journal entry required to record the sale on 1 August 20X1 and the recelpt of cash on 1 August 20X2 and 20X3. (If no entry Is requlred for a transactlon/event, select "No Journal entry requlred" In the first account fleld. Do not round Intermedlate calculatlons and round your final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 3 > Record the sale on 1 August 20X1. Note: Enter debits before credits. Date General Journal Debit Credit 723,208 1 Aug 20X1 Long-term Accounts receivable Cash 550,000 Revenue 1,273,208 Record entry Clear entry View general journal Journal entry worksheet 1 2 3 > Record the receipt of cash on 1 August 20X2. Note: Enter debits before credits. Date General Journal Debit Credit 1 Aug 20X2 Cash 400,000 373,832 26,168 Long-term Accounts receivable Interest income Journal entry worksheet 1 3 Record the receipt of cash on 1 August 20X3. Note: Enter debits before credits. Date General Journal Debit Credit 1 Aug 20X3 Cash 400,000 349,376 50,624 Long-term Accounts receivable Interest income Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A C D G H 1 Date General Journal Debit Credit Long term accounts receivable ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started