Topic: Advanced Financial management

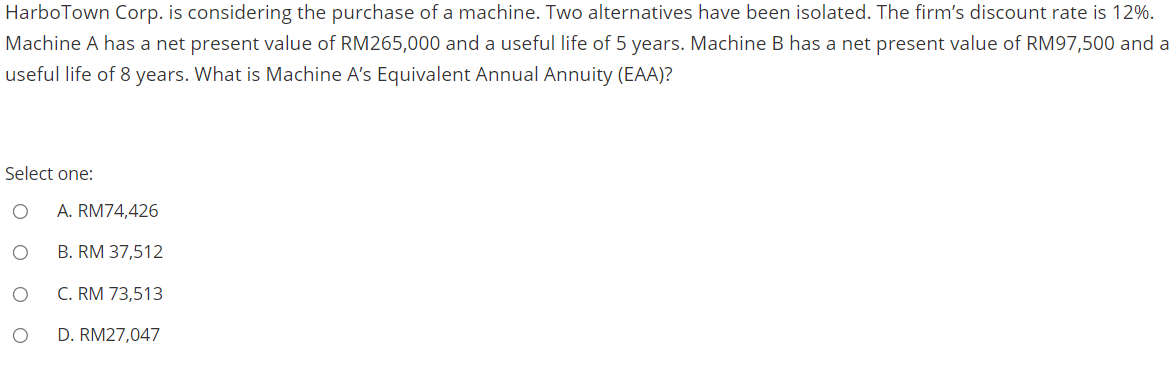

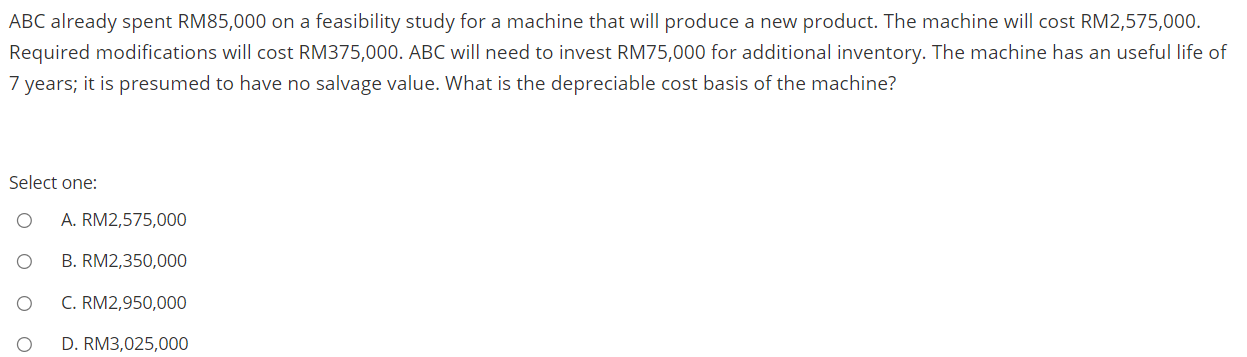

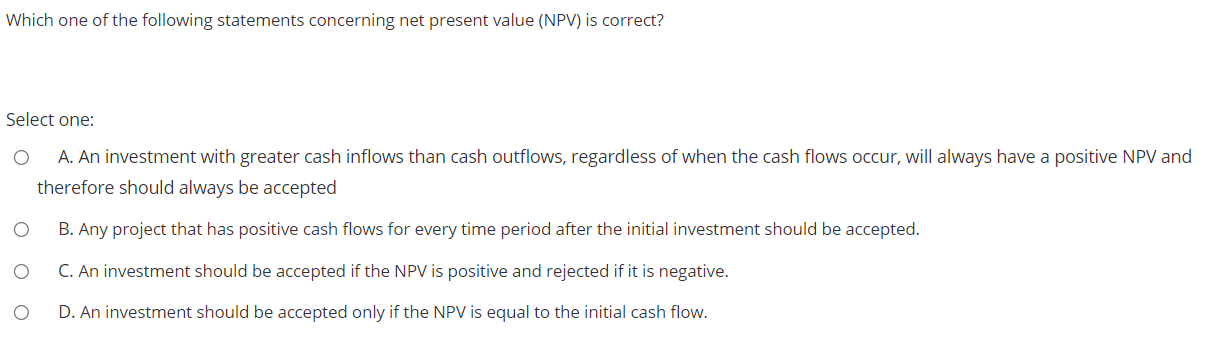

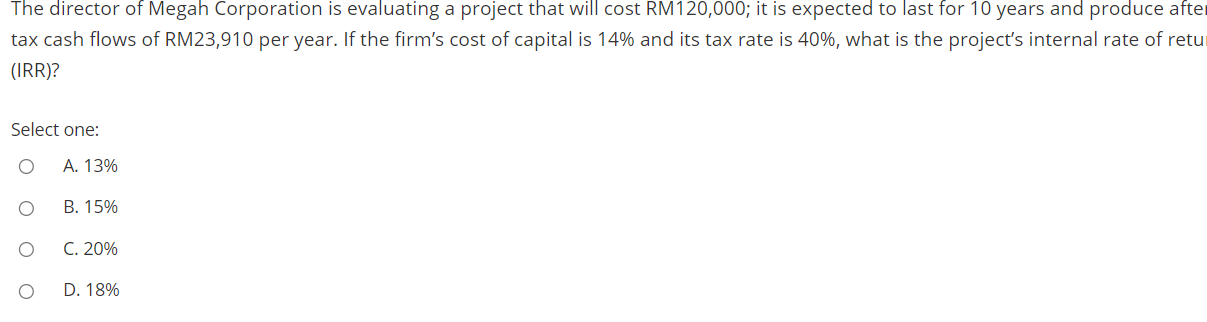

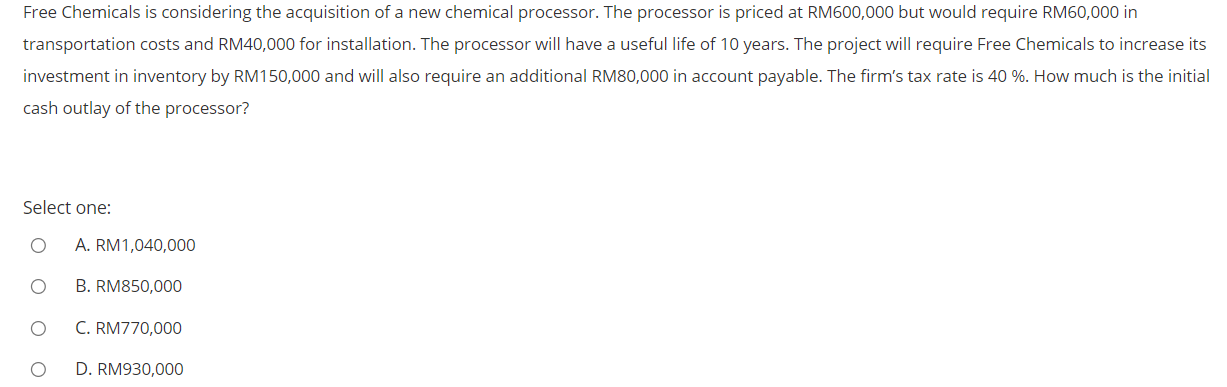

HarboTown Corp. is considering the purchase ofa machine. Two alternatives have been isolated. The firm's discount rate is 12%. Machine A has a net present value of RM265,000 and a useful life of 5 years. Machine B has a net present value of RM97,500 and a useful life 01'8 years. What is Machine A's Equivalent Annual Annuity (EAA)? Select one: 0 A. RM74.426 O B. RM 37,512 0 C. RM 73,513 0 D. RM27,047 ABC already spent RM85,000 on a feasibility study for a machine that will produce a new product. The machine will cost RM2,575,000. Required modications will cost RM375,000. ABC will need to invest RM75,000 for additional inventory. The machine has an useful life of 7 years; it is presumed to have no salvage value. What is the depreciable cost basis of the machine? Select one: 0 A. RM2,575,000 O B. RM2,350,000 O C. RM2,950,000 O D. RM3,025.000 Which one ofthe following statements concerning net present value (NPV) is correct? Select one: 0 A. An investment with greater cash inows than cash outflows, regardless of when the cash flows occur, will always have a positive NPV and therefore should always be accepted 0 B. Any project that has positive cash flows for every time period after the initial investment should be accepted. 0 C. An investment should be accepted if the NPV is positive and rejected if it is negative. 0 D. An investment should be accepted only if the NPV is equal to the initial cash ow. The director of Megah Corporation is evaluating a project that will cost RM120,000; it is expected to last for 10 years and produce afte tax cash flows of RM23,910 per year. If the firm's cost of capital is 14% and its tax rate is 40%, what is the project's internal rate of retu (IRR)? Select one: O A. 13% O B. 15% O C. 20% O D. 18%Free Chemicals is considering the acquisition of a new chemical processor. The processor is priced at RM600,000 but would require RM60,000 in transportation costs and RM40,000 for installation. The processor will have a useful life of 10 years. The project will require Free Chemicals to increase its investment in inventory by RM150,000 and will also require an additional RM80,000 in account payable. The rm's tax rate is 40 %. How much is the initial cash outlay of the processor? Select one: 0 A. RM 1 040,000 0 B. RM850,000 O C. RM7?0.000 O D. RM930,000