Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Topic: Business Combination Consolidation 33. CPA Corporation purchased a 10% interest in Stock Company on January 1, 2015 as an available for sale investment for

Topic: Business Combination Consolidation

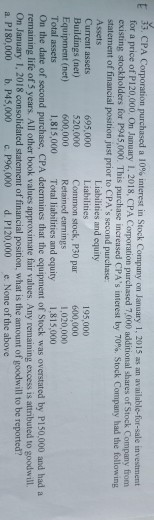

33. CPA Corporation purchased a 10% interest in Stock Company on January 1, 2015 as an available for sale investment for a price of P120,000. On January 1, 2018, CPA Corporation purchased 7.000 additional shares of Stock Company from existing stockholders for P915,000. This purchase increased CPA's interest by 70%. Stock Company had the following statement of financial position just prior to CPA's second purchase Assets Liabilities and equity Current assets 695,000 Liabilities 195,000 Buildings (net) 520,000 Common stock, P30 par 000.000 Equipment (net) 600,000 Retained earnings 1.020,000 Total assets 1,815,000 Total liabilities and equity 1.815,000 On the date of second purchase, CPA determines that the equipment of Stock was overstated by P150,000 and had a remaining life of 5 years. All other book values approximate fair values. Any remaining excess is attributed to goodwill On January 1, 2018 consolidated statement of financial position, what is the amount of goodwill to be reported? a. P180,000 b. P45,000 c.P96,000 d. P120,000 None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started