Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TOPIC: Fundamentals of futures and Option markets Questions 8: Consider the situation of an investor who BUYS an American CALL option with a strike price

TOPIC: Fundamentals of futures and Option markets

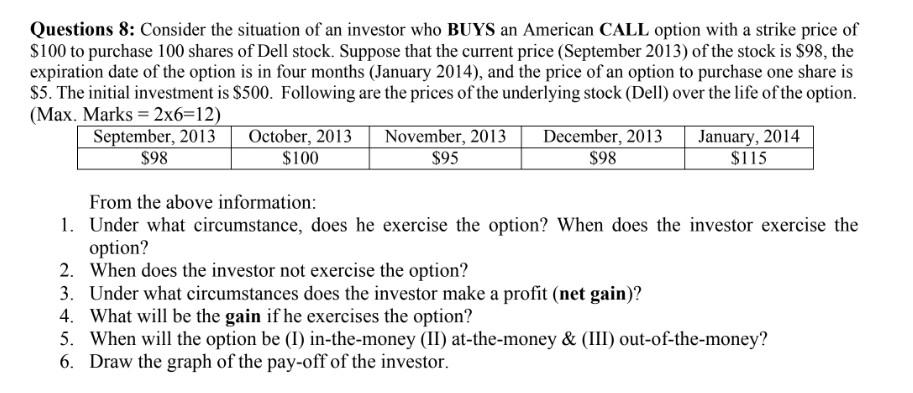

Questions 8: Consider the situation of an investor who BUYS an American CALL option with a strike price of $100 to purchase 100 shares of Dell stock. Suppose that the current price (September 2013) of the stock is $98, the expiration date of the option is in four months (January 2014), and the price of an option to purchase one share is $5. The initial investment is $500. Following are the prices of the underlying stock (Dell) over the life of the option. (Max. Marks = 2x6=12) September, 2013 October, 2013 November, 2013 December, 2013 January, 2014 $98 $100 $95 $98 $115 From the above information: 1. Under what circumstance, does he exercise the option? When does the investor exercise the option? 2. When does the investor not exercise the option? 3. Under what circumstances does the investor make a profit (net gain)? 4. What will be the gain if he exercises the option? 5. When will the option be (1) in-the-money (II) at-the-money & (III) out-of-the-money? 6. Draw the graph of the pay-off of the investorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started