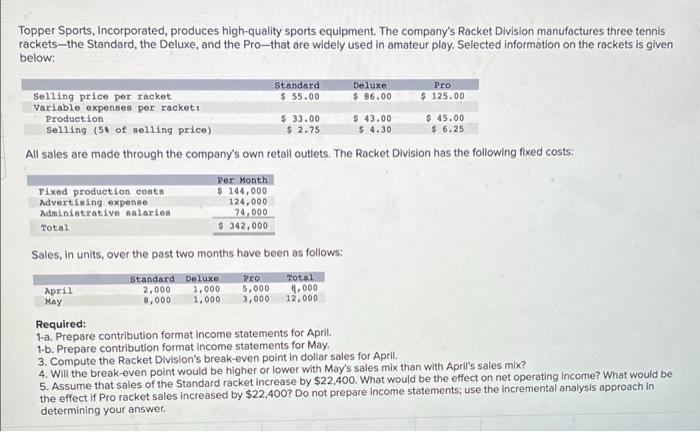

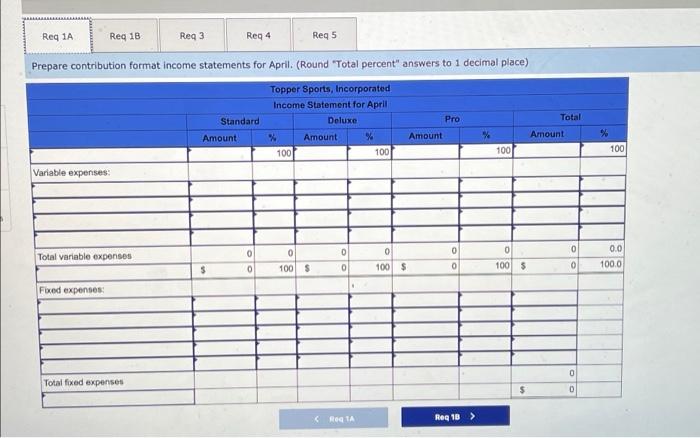

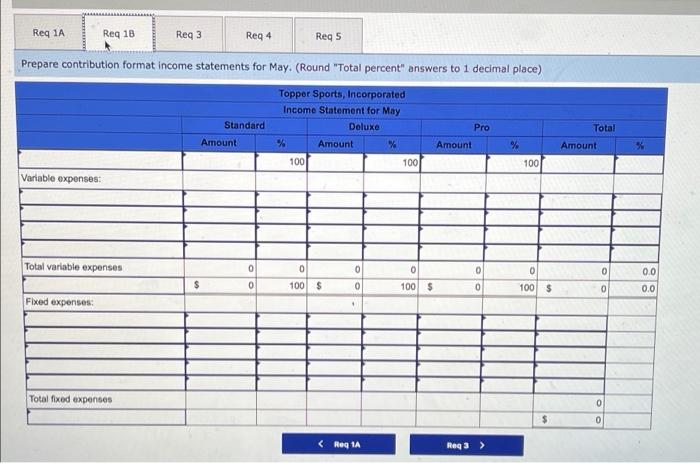

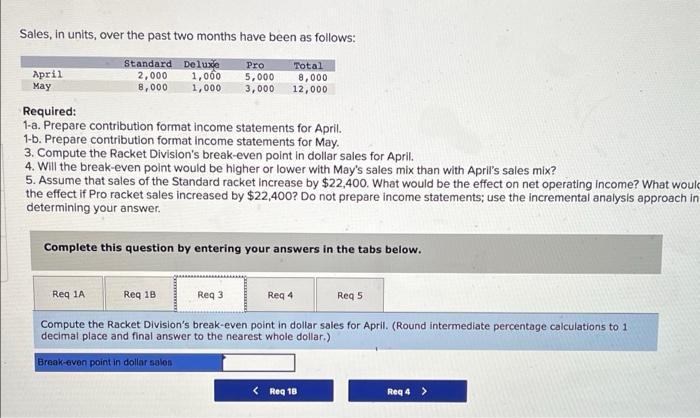

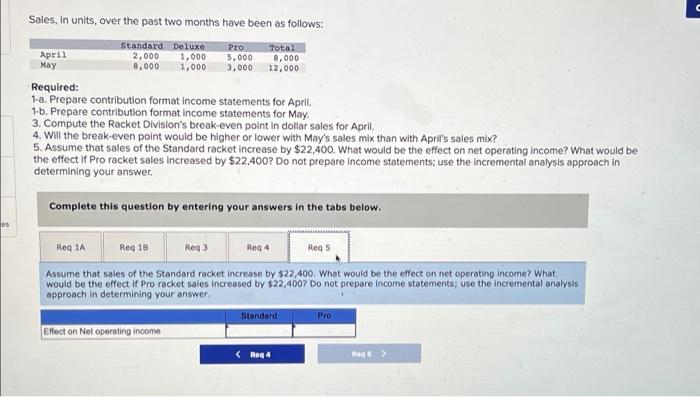

Topper Sports, Incorporated, produces high-quality sports equipment. The company's Racket Division manufactures three tennis rackets-the Standard, the Deluxe, and the Pro-that are widely used in amateur play. Selected information on the rackets is given below: Standard Deluxe Pro Selling price per racket $ 55.00 $ 86.00 $ 125.00 Variable expenses per racket: Production $ 33.00 $ 43.00 $ 45.00 Selling (54 of selling price) $ 2.75 $ 4.30 $ 6.25 All sales are made through the company's own retail outlets. The Racket Division has the following fixed costs: Fixed production costs Advertising expense Administrative salaries Total Per Month $ 144,000 124,000 74,000 $ 342.000 Sales, in units, over the past two months have been as follows: Standard Deluxe Pro Total April 2,000 1,000 5,000 9.000 May 8,000 1.000 3,000 12,000 Required: 1-a. Prepare contribution format Income statements for April 1-b. Prepare contribution format Income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket Increase by $22,400. What would be the effect on net operating Income? What would be the effect if Pro racket sales increased by $22.400? Do not prepare Income statements, use the incremental analysis approach in determining your answer. Reg 1A Reg 1B Reg 3 Req4 Reg 5 Prepare contribution format income statements for April. (Round "Total percent" answers to 1 decimal place) Topper Sports, Incorporated Income Statement for April Standard Deluxe Pro Total Amount Amount % Amount % Amount 100 100 100 Variable expenses: % 100 O 0 0 0 Total variable expenses 0 100 0 0 0 100 $ 0.0 100.0 5 0 $ 0 0 100 Fixed expenses 0 Total fixed expenses $ 0 Reg 1 Reg 18 > Reg 1A Reg 1B Reg 3 Req 4 Reg 5 Prepare contribution format income statements for May. (Round "Total percent" answers to 1 decimal place) Topper Sports, Incorporated Income Statement for May Deluxe % Amount % 100 1001 Standard Amount Pro Total Amount % Amount 100 Variable expenses: Total variable expenses 0 0 0 0 0 0 0.0 0 100 $ 0 100 $ 0 100 $ 0 0 0.0 Fixed expenses . Total foxed expenses 0 $ 0 Sales, in units, over the past two months have been as follows: April May Standard Deluxe 1,000 8,000 1,000 2,000 Pro 5,000 3,000 Total 8,000 12,000 Required: 1-a. Prepare contribution format income statements for April. 1-b. Prepare contribution format income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $22,400. What would be the effect on net operating Income? What would the effect if Pro racket sales increased by $22,400? Do not prepare income statements; use the incremental analysis approach in determining your answer. Complete this question by entering your answers in the tabs below. Req 1A Req 18 Req3 Reg 4 Reg 5 Compute the Racket Division's break-even point in dollar sales for April. (Round intermediate percentage calculations to 1 decimal place and final answer to the nearest whole dollar.) Break-even point in dollar salon Sales, in units, over the past two months have been as follows: April May Standard Deluxe 2,000 1,000 8,000 2,000 Pro 5,000 3,000 Total 8,000 12,000 Required: 1-a. Prepare contribution format Income statements for April 1-b. Prepare contribution format income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $22.400. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $22.400? Do not prepare income statements; use the incremental analysis approach in determining your answer. Complete this question by entering your answers in the tabs below. os Reg 1A Reg 15 Reg 3 Reg 4 Reg 5 Assume that sales of the Standard racket increase by $22,400, What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $22,4007 Do not prepare Income statements; use the incremental analysis approach in determining your answer Standard Pro Effect on Net operating income