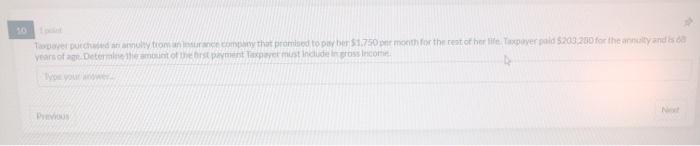

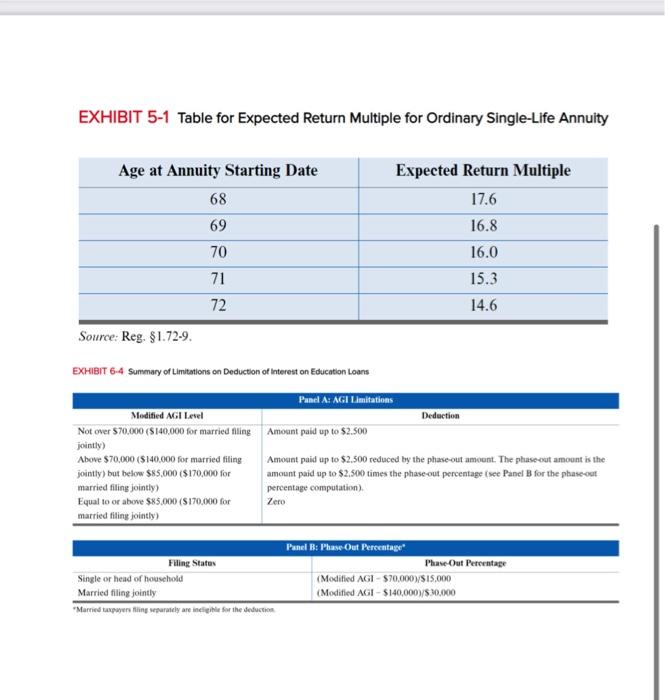

Tore purcharolytronic com that promised to be $1.750 mooth for the rest of her life. Tuxpaverpold 520920 for the annuity and be years of Determent of the payment teremust include Broncom vo N EXHIBIT 5-1 Table for Expected Return Multiple for Ordinary Single-Life Annuity Age at Annuity Starting Date 68 69 70 71 72 Source: Reg. $1.72-9 Expected Return Multiple 17.6 16.8 16.0 15.3 14.6 EXHIBIT 6-4 Summary of Limitations on Deduction of interest on Education Loans Panel A: AGI Limitations Deduction Amount paid up to $2.500 Modified AGI Level Not over 570.000 (S140,000 for married fling jointly) Above $70,000 (S140,000 for married filing jointly) but below $85.000 ($170,000 for married filing jointly) Equal to or above $85.000 (5170.000 for married filing jointly) Amount paid up to $2.500 reduced by the phase-out amount. The pluse-out amount is the amount paid up to $2.500 times the phase-out percentage (see Panel B for the phase-out percentage computation) Zero Filing Status Single or head of household Married filing jointly "Married taxpayers filing separately are ineligible for the deduction Panel B: Phase Out Percentage Phase-Out Percentage (Modified AGI- $70,000)/S15,000 (Modified AGI - $140,000/530,000 Tore purcharolytronic com that promised to be $1.750 mooth for the rest of her life. Tuxpaverpold 520920 for the annuity and be years of Determent of the payment teremust include Broncom vo N EXHIBIT 5-1 Table for Expected Return Multiple for Ordinary Single-Life Annuity Age at Annuity Starting Date 68 69 70 71 72 Source: Reg. $1.72-9 Expected Return Multiple 17.6 16.8 16.0 15.3 14.6 EXHIBIT 6-4 Summary of Limitations on Deduction of interest on Education Loans Panel A: AGI Limitations Deduction Amount paid up to $2.500 Modified AGI Level Not over 570.000 (S140,000 for married fling jointly) Above $70,000 (S140,000 for married filing jointly) but below $85.000 ($170,000 for married filing jointly) Equal to or above $85.000 (5170.000 for married filing jointly) Amount paid up to $2.500 reduced by the phase-out amount. The pluse-out amount is the amount paid up to $2.500 times the phase-out percentage (see Panel B for the phase-out percentage computation) Zero Filing Status Single or head of household Married filing jointly "Married taxpayers filing separately are ineligible for the deduction Panel B: Phase Out Percentage Phase-Out Percentage (Modified AGI- $70,000)/S15,000 (Modified AGI - $140,000/530,000