Answered step by step

Verified Expert Solution

Question

1 Approved Answer

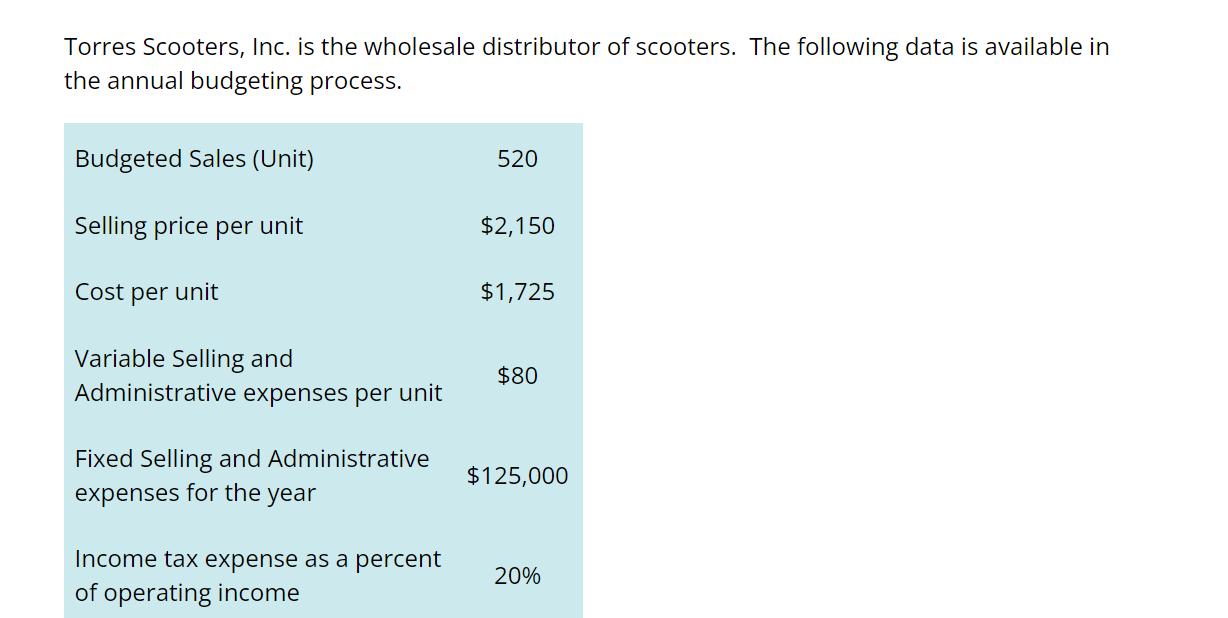

Torres Scooters, Inc. is the wholesale distributor of scooters. The following data is available in the annual budgeting process. Budgeted Sales (Unit) 520 Selling

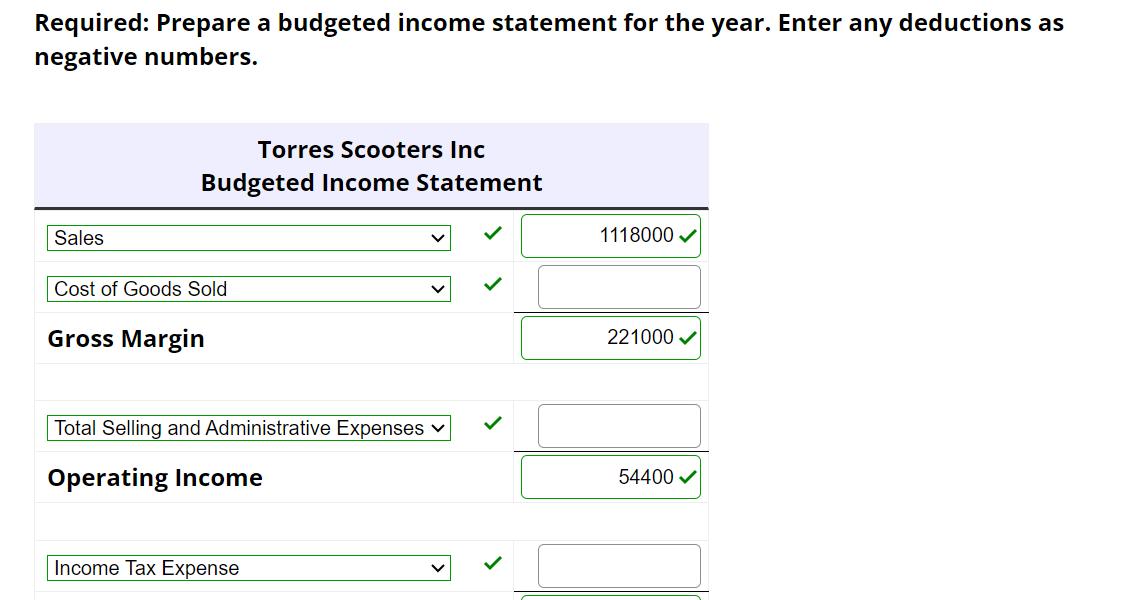

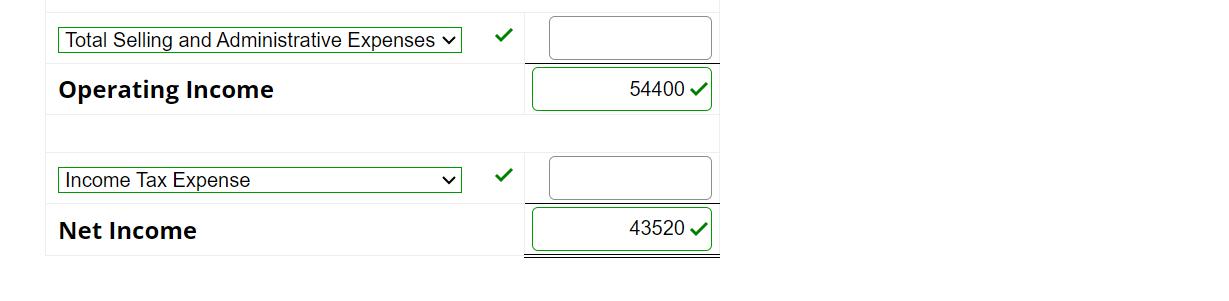

Torres Scooters, Inc. is the wholesale distributor of scooters. The following data is available in the annual budgeting process. Budgeted Sales (Unit) 520 Selling price per unit $2,150 Cost per unit $1,725 Variable Selling and $80 Administrative expenses per unit Fixed Selling and Administrative $125,000 expenses for the year Income tax expense as a percent of operating income 20% Required: Prepare a budgeted income statement for the year. Enter any deductions as negative numbers. Sales Torres Scooters Inc Budgeted Income Statement Cost of Goods Sold Gross Margin Total Selling and Administrative Expenses Operating Income Income Tax Expense 1118000 221000 54400 Total Selling and Administrative Expenses Operating Income Income Tax Expense Net Income 54400 43520

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

It appears that you have provided images showing data related to Torres Scooters Incs budgeting process and part of a completed budgeted income statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started