Answered step by step

Verified Expert Solution

Question

1 Approved Answer

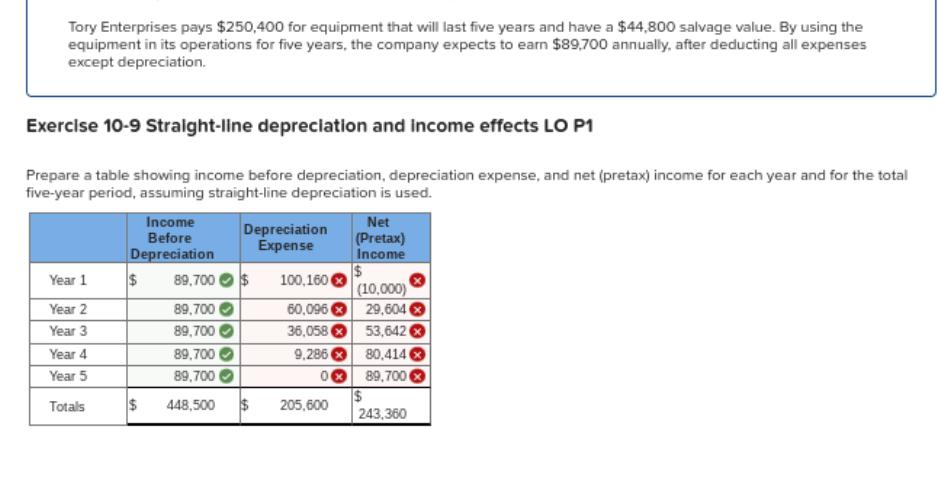

Tory Enterprises pays $250,400 for equipment that will last five years and have a $44,800 salvage value. By using the equipment in its operations

Tory Enterprises pays $250,400 for equipment that will last five years and have a $44,800 salvage value. By using the equipment in its operations for five years, the company expects to earn $89,700 annually, after deducting all expenses except depreciation. Exercise 10-9 Stralght-line depreclation and income effects LO P1 Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming straight-line depreciation is used. Income Before Net Depreciation Expense (Pretax) Income Depreciation 24 89,700 Os Year 1 100,160 (10,000) 60,096 O 29,604 36,058 53,642O 9,286 O 80,414 0 06 Year 2 89,700 Year 3 89,700 Year 4 89,700 Year 5 89,700 89,700 Totals $ 448,500 205,600 243,360

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Year book value at the beginning of year a rate of depre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started