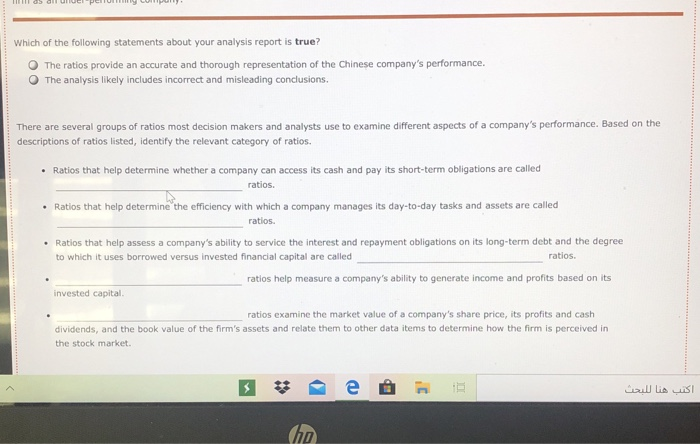

TOS Which of the following statements about your analysis report is true? The ratios provide an accurate and thorough representation of the Chinese company's performance. The analysis likely includes incorrect and misleading conclusions. There are several groups of ratios most decision makers and analysts use to examine different aspects of a company's performance. Based on the descriptions of ratios listed, identify the relevant category of ratios. . Ratios that help determine whether a company can access its cash and pay its short-term obligations are called ratios. Ratios that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. Ratios that help assess a company's ability to service the interest and repayment obligations on its long-term debt and the degree to which it uses borrowed versus invested financial capital are called ratios. ratios help measure a company's ability to generate income and profits based on its invested capital ratios examine the market value of a company's share price, its profits and cash dividends, and the book value of the firm's assets and relate them to other data items to determine how the firm is perceived in the stock market. e ho TOS Which of the following statements about your analysis report is true? The ratios provide an accurate and thorough representation of the Chinese company's performance. The analysis likely includes incorrect and misleading conclusions. There are several groups of ratios most decision makers and analysts use to examine different aspects of a company's performance. Based on the descriptions of ratios listed, identify the relevant category of ratios. . Ratios that help determine whether a company can access its cash and pay its short-term obligations are called ratios. Ratios that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. Ratios that help assess a company's ability to service the interest and repayment obligations on its long-term debt and the degree to which it uses borrowed versus invested financial capital are called ratios. ratios help measure a company's ability to generate income and profits based on its invested capital ratios examine the market value of a company's share price, its profits and cash dividends, and the book value of the firm's assets and relate them to other data items to determine how the firm is perceived in the stock market. e ho