Answered step by step

Verified Expert Solution

Question

1 Approved Answer

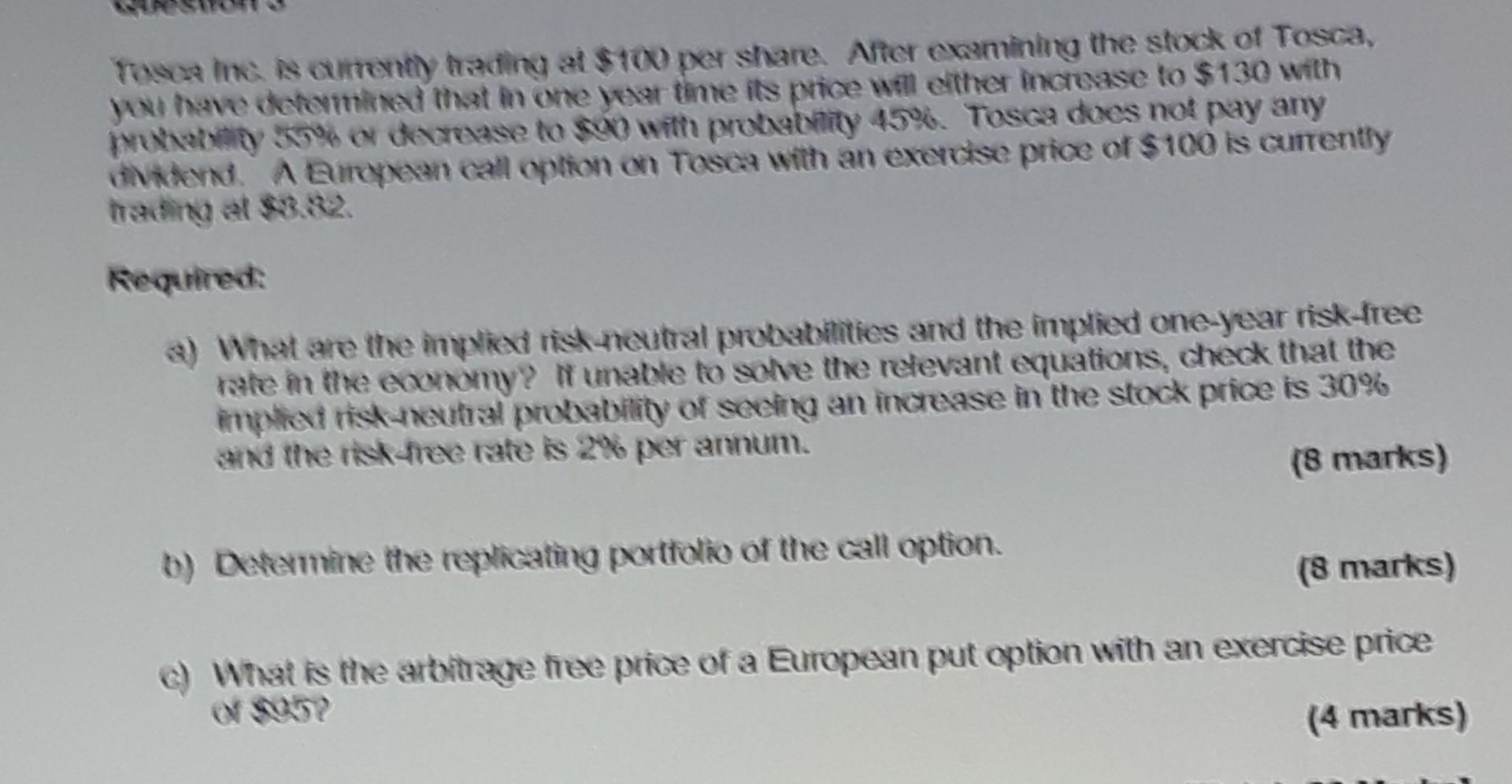

Toscane is currently hading at $100 per share. After examining the stock of Tosca, teve dermal that in one your time its price wil eftherinevase

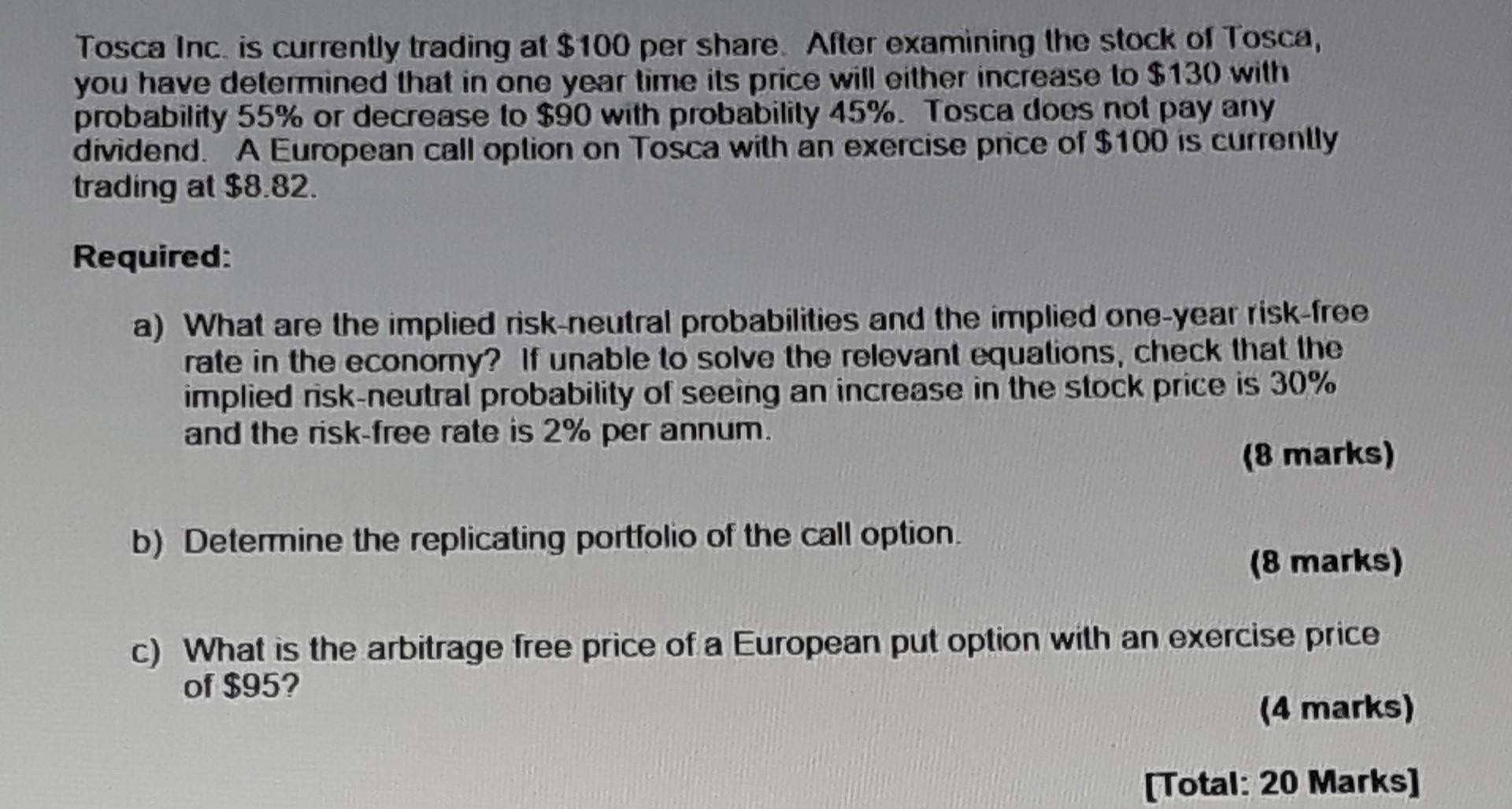

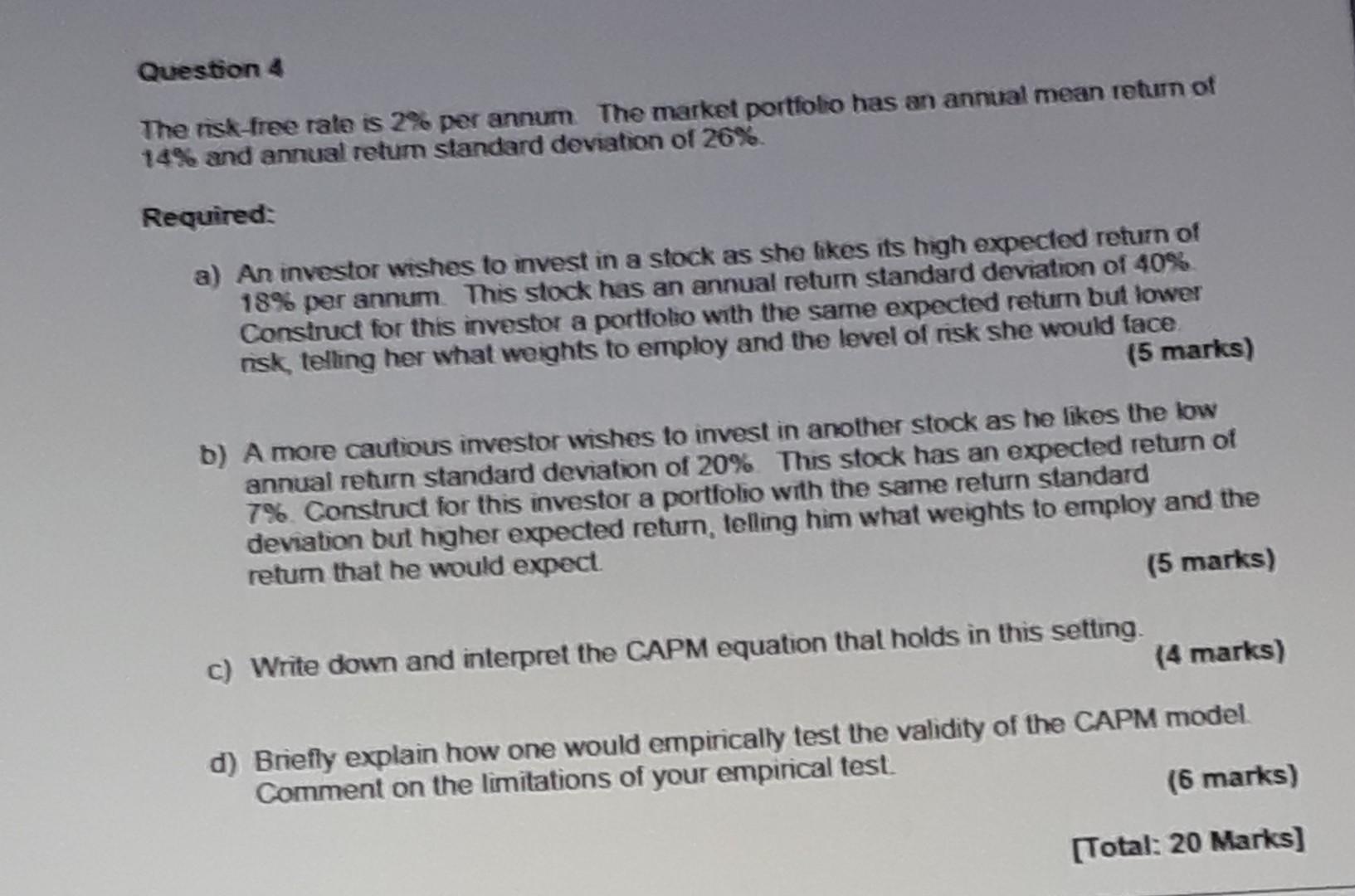

Toscane is currently hading at $100 per share. After examining the stock of Tosca, teve dermal that in one your time its price wil eftherinevase to $130 with unty % of dexase to s with probability 45%. Tosca does not pay any Rent Aeropean call option on Tosca with an exercise price of $100 is currently Required: a) What are the inplied risk neutral probabilities and the implied one-year risk-free rate in the economy? i unable to solve the relevant equations, check that the implexitisketbal probability of seeing an increase in the stock price is 30% and the risk-hee rate is 2% per annum. (8 marks) 0) Demettre replicating portfolio of the call option. (8 marks) c) What is the arbitrage nee price of a European put option with an exercise price (4 marks) Tosca Inc. is currently trading at $100 per share. After examining the stock of Tosca, you have determined that in one year time its price will either increase to $130 with probability 55% or decrease to $90 with probability 45%. Tosca does not pay any dividend. A European call option on Tosca with an exercise price of $100 is currently trading at $8.82. Required: a) What are the implied risk-neutral probabilities and the implied one-year risk-free rate in the economy? If unable to solve the relevant equations, check that the implied risk-neutral probability of seeing an increase in the stock price is 30% and the risk-free rate is 2% per annum. (8 marks) b) Determine the replicating portfolio of the call option (8 marks) c) What is the arbitrage free price of a European put option with an exercise price of $95? (4 marks) (Total: 20 Marks] Question 4 The risk-free rate is 2% per annum The market portfolio has an annual mean return of 14% and annual retum standard deviation of 26% Required: a) An investor wishes to invest in a stock as she likes its high expected return of 18% per annum This stock has an annual retum standard deviation of 40% Construct for this investor a portfolio with the same expected return but lower nsk, telling her what weights to employ and the level of risk she would face (5 marks) b) A more cautious investor wishes to invest in another stock as he likes the low annual return standard deviation of 20% This stock has an expected return of 7% Construct for this investor a portfolio with the same return standard deviation but higher expected return, telling him what weights to employ and the retum that he would expect (5 marks) c) Write down and interpret the CAPM equation that holds in this setting (4 marks) d) Briefly explain how one would empirically test the validity of the CAPM model Comment on the limitations of your empirical test. (6 marks) [Total: 20 Marks) Toscane is currently hading at $100 per share. After examining the stock of Tosca, teve dermal that in one your time its price wil eftherinevase to $130 with unty % of dexase to s with probability 45%. Tosca does not pay any Rent Aeropean call option on Tosca with an exercise price of $100 is currently Required: a) What are the inplied risk neutral probabilities and the implied one-year risk-free rate in the economy? i unable to solve the relevant equations, check that the implexitisketbal probability of seeing an increase in the stock price is 30% and the risk-hee rate is 2% per annum. (8 marks) 0) Demettre replicating portfolio of the call option. (8 marks) c) What is the arbitrage nee price of a European put option with an exercise price (4 marks) Tosca Inc. is currently trading at $100 per share. After examining the stock of Tosca, you have determined that in one year time its price will either increase to $130 with probability 55% or decrease to $90 with probability 45%. Tosca does not pay any dividend. A European call option on Tosca with an exercise price of $100 is currently trading at $8.82. Required: a) What are the implied risk-neutral probabilities and the implied one-year risk-free rate in the economy? If unable to solve the relevant equations, check that the implied risk-neutral probability of seeing an increase in the stock price is 30% and the risk-free rate is 2% per annum. (8 marks) b) Determine the replicating portfolio of the call option (8 marks) c) What is the arbitrage free price of a European put option with an exercise price of $95? (4 marks) (Total: 20 Marks] Question 4 The risk-free rate is 2% per annum The market portfolio has an annual mean return of 14% and annual retum standard deviation of 26% Required: a) An investor wishes to invest in a stock as she likes its high expected return of 18% per annum This stock has an annual retum standard deviation of 40% Construct for this investor a portfolio with the same expected return but lower nsk, telling her what weights to employ and the level of risk she would face (5 marks) b) A more cautious investor wishes to invest in another stock as he likes the low annual return standard deviation of 20% This stock has an expected return of 7% Construct for this investor a portfolio with the same return standard deviation but higher expected return, telling him what weights to employ and the retum that he would expect (5 marks) c) Write down and interpret the CAPM equation that holds in this setting (4 marks) d) Briefly explain how one would empirically test the validity of the CAPM model Comment on the limitations of your empirical test. (6 marks) [Total: 20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started