Question

Toshiro group Inc is a fast growing global conglomerate. He has hired some bright graduates from EU to help him modernise the company. He must

Toshiro group Inc is a fast growing global conglomerate. He has hired some bright graduates from EU to help him modernise the company. He must close his consolidated accounts for December 2019 and do some planning for 2020 so all this can be presented to the board. You have been recruited as a consultant by the CEO at the head office to help him. You are recent graduate from EU Business School. Your first assignment is to help the various finance heads and provide all details in a report. The CEO, Toshiro is very busy and fully expects you to help him get through this busy period and show your deep insights about finance and accounting.

ANNEX 1 - The CEO's questions.

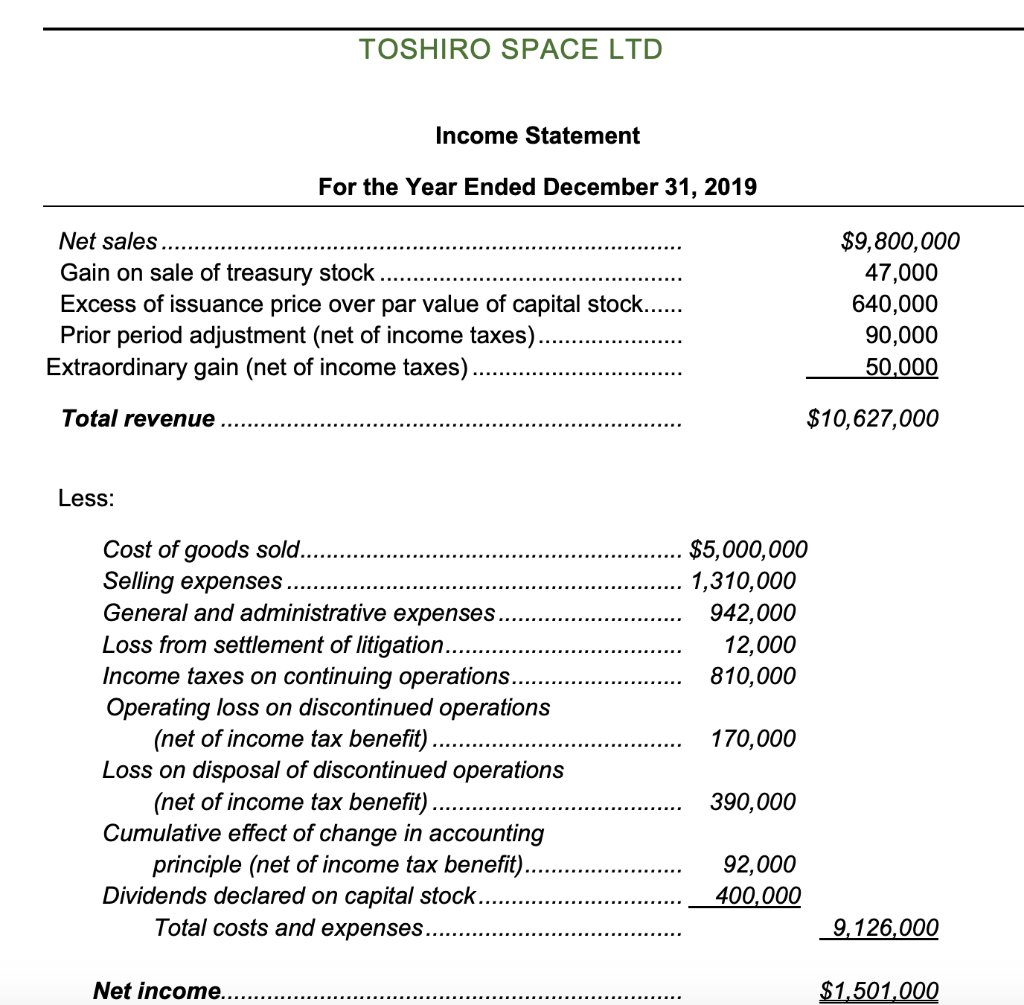

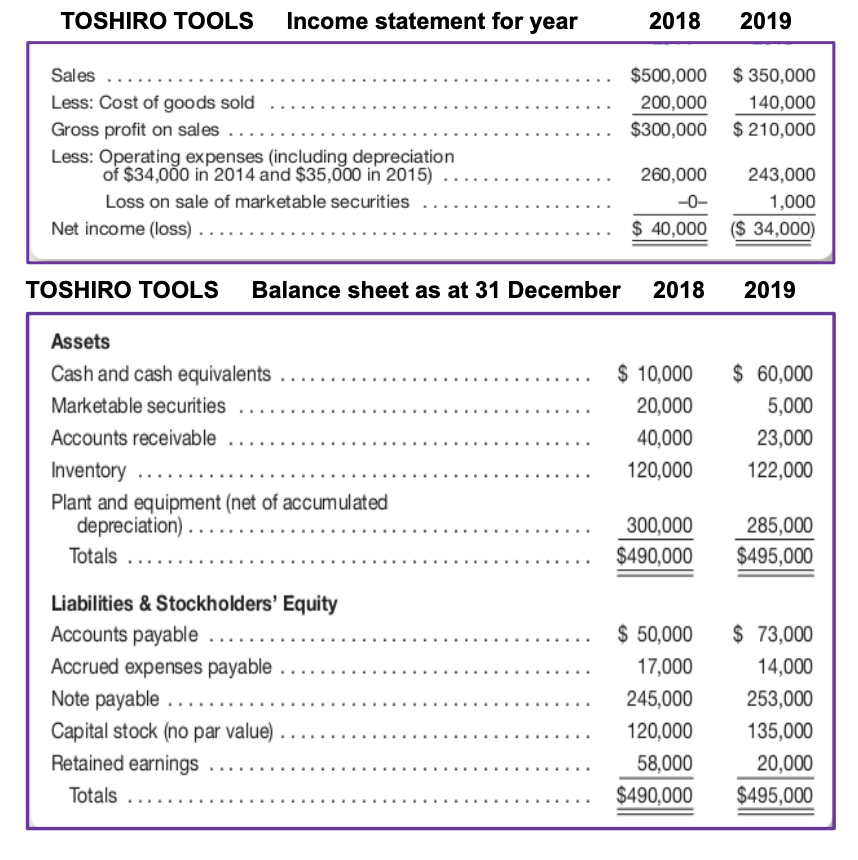

1. QUESTION 1: The income statement below was prepared by a new and inexperienced employee in the accounting department of Toshiro Space Ltd a new California based business venture in the group:

a) Make corrected income statement for the year ended December 31, 2019, include at the bottom of your income statement all appropriate earnings per share figures. Assume that throughout the year the company had outstanding a weighted average of 100,000 shares of a single class of capital stock of par value $1.

b) Make a statement of retained earnings for 2019. (As originally reported, retained earnings at December 31, 2018, amount to $2,000,000.)

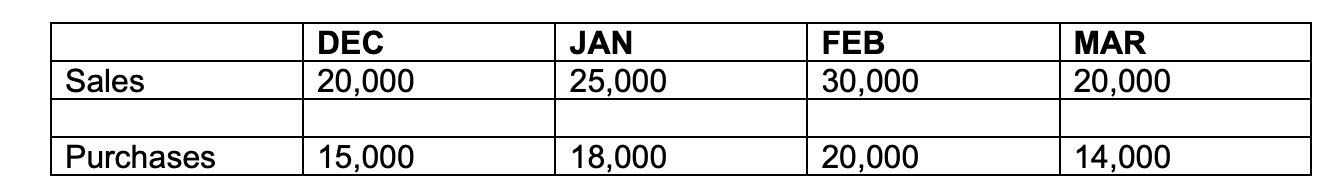

2) QUESTION 2: Laura a recent EU Geneva graduate is the CFO at a Toshiro fashions Ltd based in Lisbon and is trying to make a cash budget for Q1 2021

She is confident of the following information.

- She know the Bank balance at 1 January 2020 which is $50,000

-Each month 70% of sales are for cash and 30% on credit. The funds for credit sales are received the following month.

-The Company buys inventory/purchases on one months credit. It pays for purchases the following month.

-The rent is $8,000 for the year and is paid quarterly, in the first week of each quarter. -Salaries are paid monthly and the annual payroll is $24,000

-Depreciation is $500 per month -Insurance for the building for the year is paid in January. - $1000

She has following information from the budget for expected sales and purchases (all numbers are $ the group reporting currency):

a) Given the above information please make a cash budget by completing the template provided to calculate the funds in the bank at 31.3.2020.

a) Given the above information please make a cash budget by completing the template provided to calculate the funds in the bank at 31.3.2020.

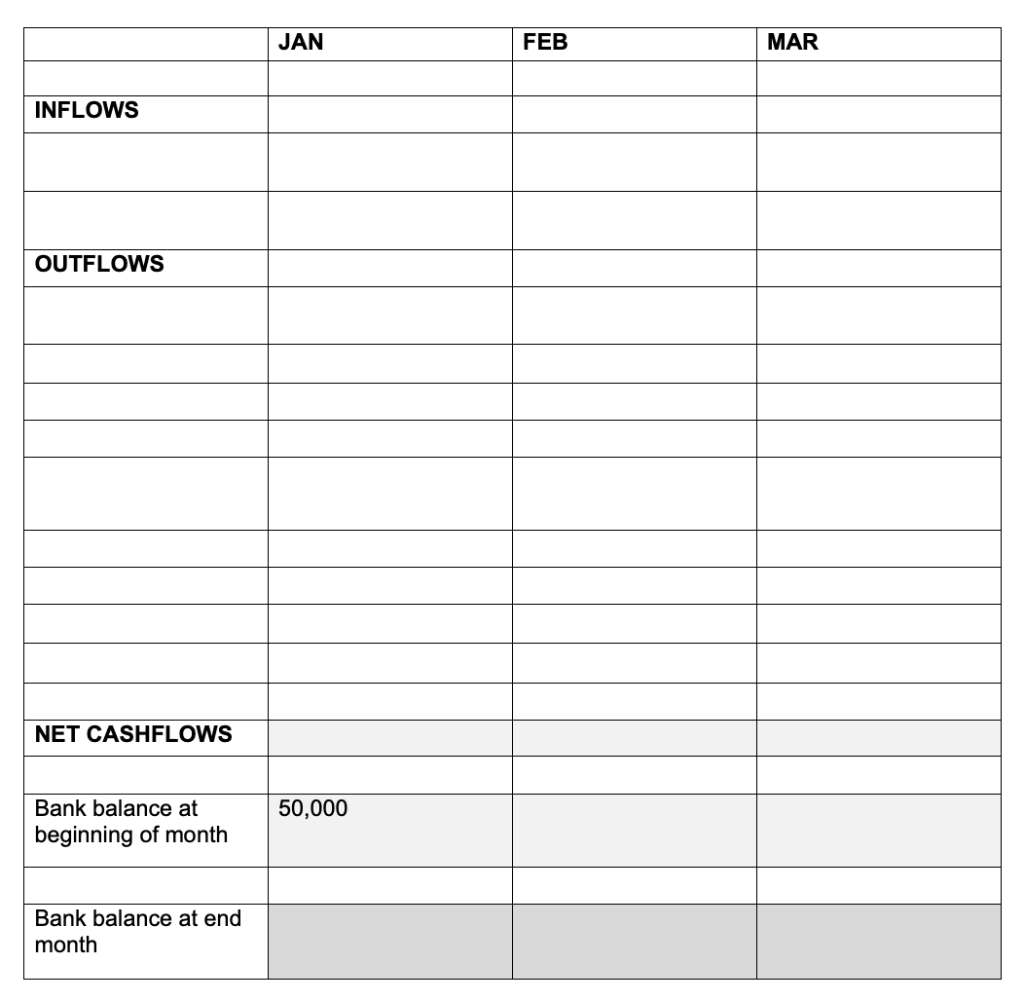

3) QUESTION 3: Toshiro Tools Ltd sells car parts through an online platform. Mkyta a very bright graduate from EU has been given comparative income statements and balance sheets for the past two years so that he can make a cash flow statement. He has also been given following additional information.

Additional Information

The following information regarding the company's operations in 2019 is available from the company's accounting records:

a) Early in the year the company declared and paid a $4,000 cash dividend.

b) During the year marketable securities costing $15,000 were sold for $14,000 cash, resulting in a $1,000 non operating loss.

c) The company purchased plant assets for $20,000, paying $2,000 in cash and issuing a note payable for the $18,000 balance.

d) During the year the company repaid a $10,000 note payable, but incurred an additional $18,000 in long-term debt as described in c.

e)The owners invested $15,000 cash in the business as a condition of the new loans described in d.

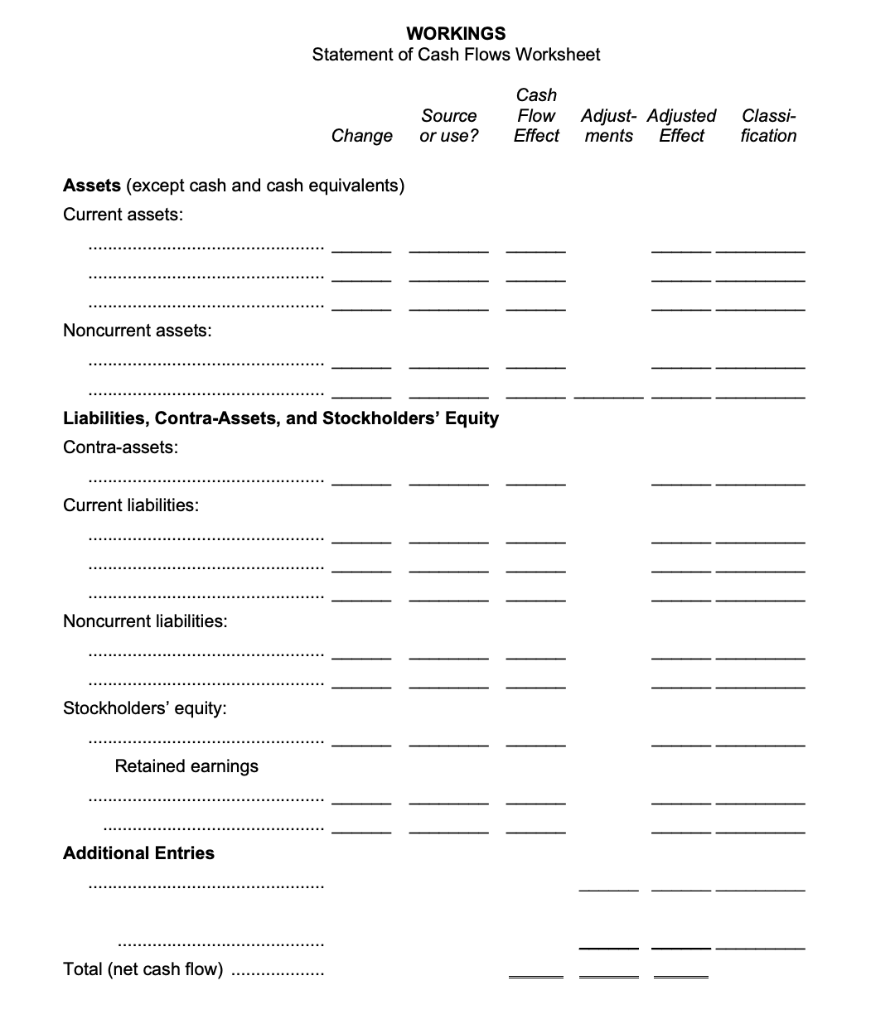

a) Make a formal statement of cash flows for 2015 to be presented by the indirect method. Please show workings. You may use template provided below.

b) Explain how Toshiro tools Ltd., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

Show calculations please, thank you!

TOSHIRO SPACE LTD Income Statement For the Year Ended December 31, 2019 Net sales Gain on sale of treasury stock Excess of issuance price over par value of capital stock... Prior period adjustment (net of income taxes). Extraordinary gain (net of income taxes). $9,800,000 47,000 640,000 90,000 50,000 Total revenue $10,627,000 Less: $5,000,000 1,310,000 942,000 12,000 810,000 Cost of goods sold. Selling expenses General and administrative expenses Loss from settlement of litigation...... Income taxes on continuing operations.. Operating loss on discontinued operations (net of income tax benefit). Loss on disposal of discontinued operations (net of income tax benefit). Cumulative effect of change in accounting principle (net of income tax benefit).. Dividends declared on capital stock. Total costs and expenses........ 170,000 390,000 92,000 400,000 9,126,000 Net income.. $1.501,000 DEC 20,000 JAN 25,000 FEB 30,000 MAR 20,000 Sales Purchases 15,000 18,000 20,000 14,000 JAN FEB MAR INFLOWS OUTFLOWS NET CASHFLOWS 50,000 Bank balance at beginning of month Bank balance at end month TOSHIRO TOOLS Income statement for year 2018 2019 $500,000 $350,000 200,000 140,000 $300,000 $ 210,000 Sales Less: Cost of goods sold Gross profit on sales .. Less: Operating expenses (including depreciation of $34,000 in 2014 and $35,000 in 2015) Loss on sale of marketable securities Net income (loss) .... 260,000 243,000 1,000 $ 40,000 ($ 34,000) TOSHIRO TOOLS Balance sheet as at 31 December 2018 2019 Assets Cash and cash equivalents Marketable securities Accounts receivable Inventory Plant and equipment (net of accumulated depreciation)... Totals ... $ 10,000 20,000 40,000 120,000 $ 60,000 5,000 23,000 122,000 300,000 $490,000 285,000 $495,000 Liabilities & Stockholders' Equity Accounts payable Accrued expenses payable Note payable .. Capital stock (no par value) Retained earnings Totals $ 50,000 17,000 245,000 120,000 58,000 $490,000 $ 73,000 14,000 253,000 135,000 20,000 $495,000 WORKINGS Statement of Cash Flows Worksheet Cash Flow Adjust- Adjusted Effect ments Effect Source or use? Change Classi- fication Assets (except cash and cash equivalents) Current assets: Noncurrent assets: Liabilities, Contra-Assets, and Stockholders' Equity Contra-assets: Current liabilities: Noncurrent liabilities: Stockholders' equity: Retained earnings = Additional Entries Total (net cash flow) TOSHIRO SPACE LTD Income Statement For the Year Ended December 31, 2019 Net sales Gain on sale of treasury stock Excess of issuance price over par value of capital stock... Prior period adjustment (net of income taxes). Extraordinary gain (net of income taxes). $9,800,000 47,000 640,000 90,000 50,000 Total revenue $10,627,000 Less: $5,000,000 1,310,000 942,000 12,000 810,000 Cost of goods sold. Selling expenses General and administrative expenses Loss from settlement of litigation...... Income taxes on continuing operations.. Operating loss on discontinued operations (net of income tax benefit). Loss on disposal of discontinued operations (net of income tax benefit). Cumulative effect of change in accounting principle (net of income tax benefit).. Dividends declared on capital stock. Total costs and expenses........ 170,000 390,000 92,000 400,000 9,126,000 Net income.. $1.501,000 DEC 20,000 JAN 25,000 FEB 30,000 MAR 20,000 Sales Purchases 15,000 18,000 20,000 14,000 JAN FEB MAR INFLOWS OUTFLOWS NET CASHFLOWS 50,000 Bank balance at beginning of month Bank balance at end month TOSHIRO TOOLS Income statement for year 2018 2019 $500,000 $350,000 200,000 140,000 $300,000 $ 210,000 Sales Less: Cost of goods sold Gross profit on sales .. Less: Operating expenses (including depreciation of $34,000 in 2014 and $35,000 in 2015) Loss on sale of marketable securities Net income (loss) .... 260,000 243,000 1,000 $ 40,000 ($ 34,000) TOSHIRO TOOLS Balance sheet as at 31 December 2018 2019 Assets Cash and cash equivalents Marketable securities Accounts receivable Inventory Plant and equipment (net of accumulated depreciation)... Totals ... $ 10,000 20,000 40,000 120,000 $ 60,000 5,000 23,000 122,000 300,000 $490,000 285,000 $495,000 Liabilities & Stockholders' Equity Accounts payable Accrued expenses payable Note payable .. Capital stock (no par value) Retained earnings Totals $ 50,000 17,000 245,000 120,000 58,000 $490,000 $ 73,000 14,000 253,000 135,000 20,000 $495,000 WORKINGS Statement of Cash Flows Worksheet Cash Flow Adjust- Adjusted Effect ments Effect Source or use? Change Classi- fication Assets (except cash and cash equivalents) Current assets: Noncurrent assets: Liabilities, Contra-Assets, and Stockholders' Equity Contra-assets: Current liabilities: Noncurrent liabilities: Stockholders' equity: Retained earnings = Additional Entries Total (net cash flow)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started