Answered step by step

Verified Expert Solution

Question

1 Approved Answer

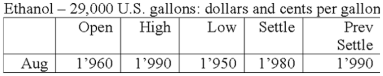

[Total 17 Points] Understand future, option, and risk management. What is the closing value on this day for one August futures contract on ethanol? (1

- [Total 17 Points] Understand future, option, and risk management.

- What is the closing value on this day for one August futures contract on ethanol? (1 pts)

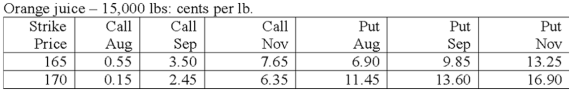

- How much will you pay to purchase three September 165 orange juice futures put option contracts? (2pts)

- You speculate in the market by selling 15 gold futures contracts when the futures price is $648.50 per ounce. The price on the contract maturity date is $662.60. What is your total profit or loss if the contract size is 100 ounces? (2 pts)

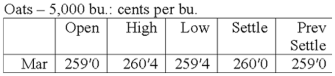

- You are the purchasing agent for a cookie company. You anticipate that your firm will need 15,000 bushels of oats in March. You decide to hedge your position today and did so at the closing price of the day. Assume that the actual market price turns out to be 2610 on the day you actually buy the oats. How much more would you have spent or saved if you had not taken the hedge position? (2 pts)

- Assume that you short sold 100 shares of Enbridge stock and wanted to use an option contract to hedge your position. Using the following coordinate graphs provided, Draw the unhedged risk profile on the left coordinate and illustrate how you hedged your position using an option on the right coordinate. Please indicate what type of option (either Call or Put option) you will use to hedge your position. (5 pts)

| P |

| V |

| P |

| V |

- Using the following coordinate graphs provided, draw the original (unhedged) risk profile for Elina (canola buyer) on the left coordinate and then illustrate how she used futures to hedge her position on the right coordinate. (5 pts)

| P |

| V |

| P |

| V |

Ethanol - 29,000 U.S. gallons: dollars and cents per gallon Open High Low Settle Prev Settle Aug 1'960 1'990 1'950 1'980 1'990 Put Orange juice - 15,000 lbs: cents per lb. Strike Call Call Call Aug Sep Nov 165 0.55 3.50 7.65 170 0.15 2.45 6.35 Price Sep Put Aug 6.90 11.45 Put Nov 13.25 16.90 9.85 13.60 Oats - 5,000 bu.: cents per bu. Open High Low Settle Prev Settle 2590 Mar 259'0 260'4 2594 2600 Ethanol - 29,000 U.S. gallons: dollars and cents per gallon Open High Low Settle Prev Settle Aug 1'960 1'990 1'950 1'980 1'990 Put Orange juice - 15,000 lbs: cents per lb. Strike Call Call Call Aug Sep Nov 165 0.55 3.50 7.65 170 0.15 2.45 6.35 Price Sep Put Aug 6.90 11.45 Put Nov 13.25 16.90 9.85 13.60 Oats - 5,000 bu.: cents per bu. Open High Low Settle Prev Settle 2590 Mar 259'0 260'4 2594 2600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started