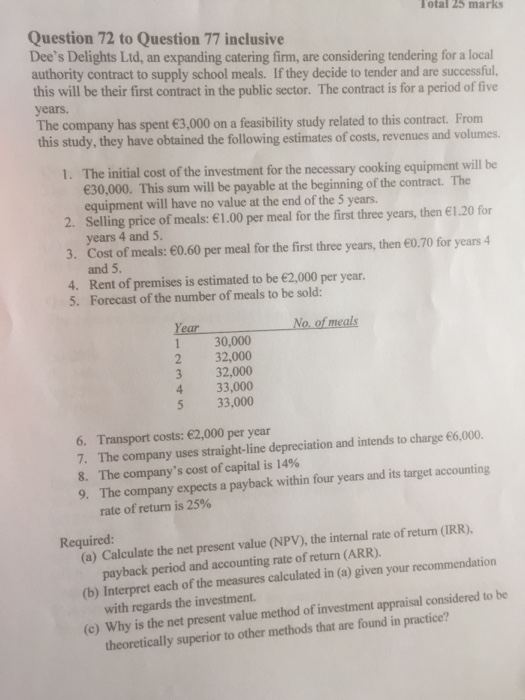

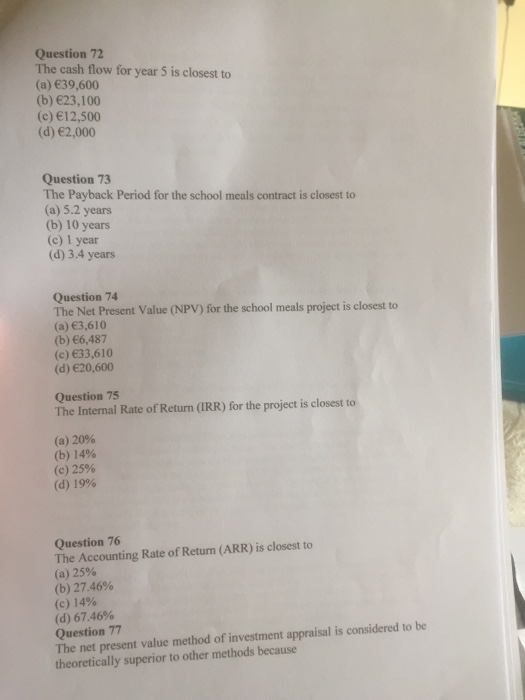

Total 25 marks Question 72 to Question 77 inclusive Dee's Delights Ltd, an expanding catering firm, are considering tendering for a local authority contract to supply school meals. If they decide to tender and are successful. this will be their first contract in the public sector. The contract is for a period of five years. The company has spent 3,000 on a feasibility study related to this contract. From this study, they have obtained the following estimates of costs, revenues and volumes 1. The initial cost of the investment for the necessary cooking equipment will be 30,000. This sum will be payable at the beginning of the contract. The equipment will have no value at the end of the 5 years. 2. Selling price of meals: 1.00 per meal for the first three years, then 1.20 for 3. Cost of meals: 0.60 per meal for the first three years, then 0.70 for years 4 4. Rent of premises is estimated to be 2,000 per year years 4 and 5. and 5. Forecast of the number of meals to be sold: 5. No of meals 1 30,000 2 32,000 3 32,000 4 33,000 5 33,000 6. Transport costs: 2,000 per year 7. The company uses straight-line depreciation and intends to charge 6,.000 8- The company's cost of capital is 14% 9. The company expects a payback within four years and its target accounting rate of return is 25% Required: (a) Calculate the net present value (NPV), the internal rate of return (IRR) (b) Interpret each of the measures calculated in (a) given your recommendation (c) Why is the net present value method of investment appraisal considered to be payback period and accounting rate of return (ARR). with regards the investment. theoretically superior to other methods that are found in practice? Question 72 The cash flow for year 5 is closest to (a) 39,600 (b) 23,100 (c) 12,500 (d) 2,000 Question 73 The Payback Period for the school meals contract is closest to (a) 5.2 years (b) 10 years (c) 1 year (d) 3.4 years Question 74 The Net Present Value (NPV) for the school meals project is closest to (a) 3,610 (b) 66,487 (c) 33,610 (d) 20,600 Question 75 The Internal Rate of Return (IRR) for the project is closest to (a) 20% (b) 14% (c) 25% (d) 19% Question 76 The Accounting Rate of Return (ARR) is closest to (a) 25% (b) 27.46% (c) 14% (d) 67.46% Question 77 The net present value method of investment appraisal is considered to be theoretically superior to other methods because