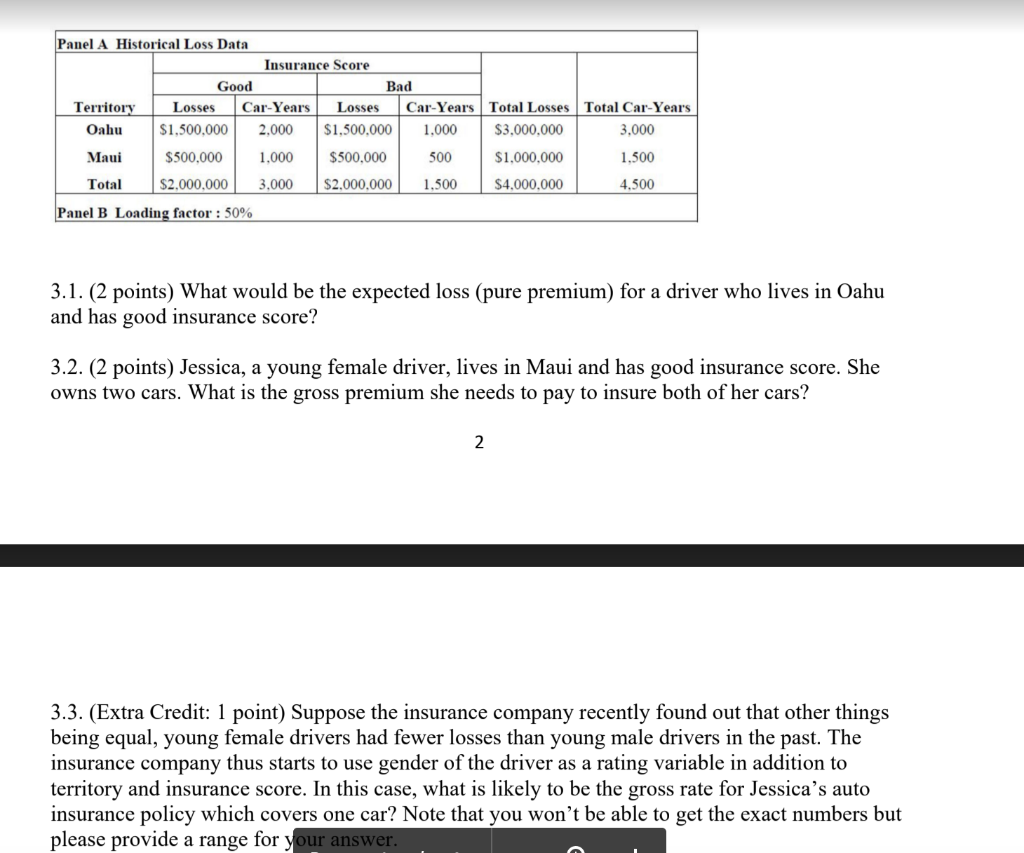

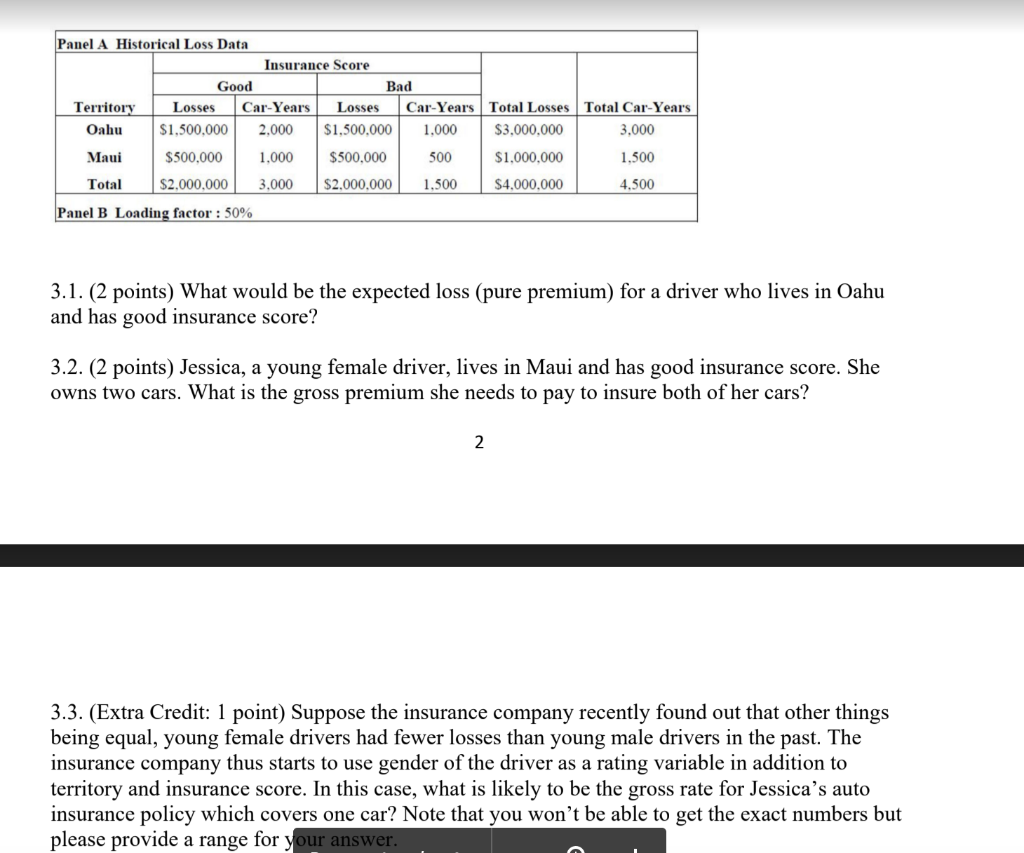

Total Car-Year's Panel A Historical Loss Data Insurance Score Good Bad Territory Losses Car-Year's Losses Car-Year's Oahu $1.500.000 2.000 $1.500.000 1.000 Maui $500,000 1.000 $500,000 500 Total $2.000.000 $2.000.000 1.500 Panel B Loading factor : 50% Total Losses $3.000.000 3,000 $1.000.000 1.500 3.000 $4.000.000 4.500 3.1. (2 points) What would be the expected loss (pure premium) for a driver who lives in Oahu and has good insurance score? 3.2. (2 points) Jessica, a young female driver, lives in Maui and has good insurance score. She owns two cars. What is the gross premium she needs to pay to insure both of her cars? 2 3.3. (Extra Credit: 1 point) Suppose the insurance company recently found out that other things being equal, young female drivers had fewer losses than young male drivers in the past. The insurance company thus starts to use gender of the driver as a rating variable in addition to territory and insurance score. In this case, what is likely to be the gross rate for Jessica's auto insurance policy which covers one car? Note that you won't be able to get the exact numbers but please provide a range for your answer. Total Car-Year's Panel A Historical Loss Data Insurance Score Good Bad Territory Losses Car-Year's Losses Car-Year's Oahu $1.500.000 2.000 $1.500.000 1.000 Maui $500,000 1.000 $500,000 500 Total $2.000.000 $2.000.000 1.500 Panel B Loading factor : 50% Total Losses $3.000.000 3,000 $1.000.000 1.500 3.000 $4.000.000 4.500 3.1. (2 points) What would be the expected loss (pure premium) for a driver who lives in Oahu and has good insurance score? 3.2. (2 points) Jessica, a young female driver, lives in Maui and has good insurance score. She owns two cars. What is the gross premium she needs to pay to insure both of her cars? 2 3.3. (Extra Credit: 1 point) Suppose the insurance company recently found out that other things being equal, young female drivers had fewer losses than young male drivers in the past. The insurance company thus starts to use gender of the driver as a rating variable in addition to territory and insurance score. In this case, what is likely to be the gross rate for Jessica's auto insurance policy which covers one car? Note that you won't be able to get the exact numbers but please provide a range for your