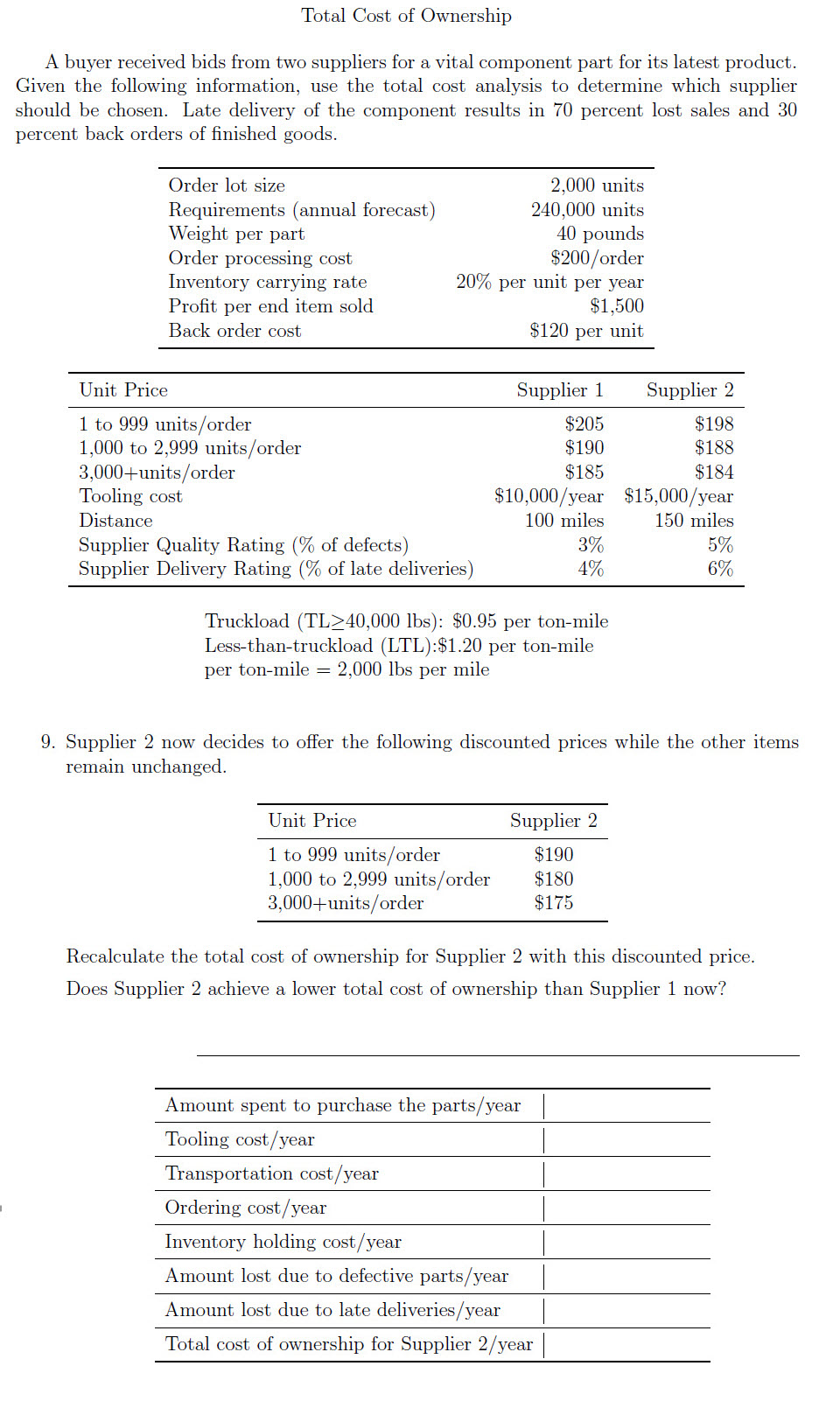

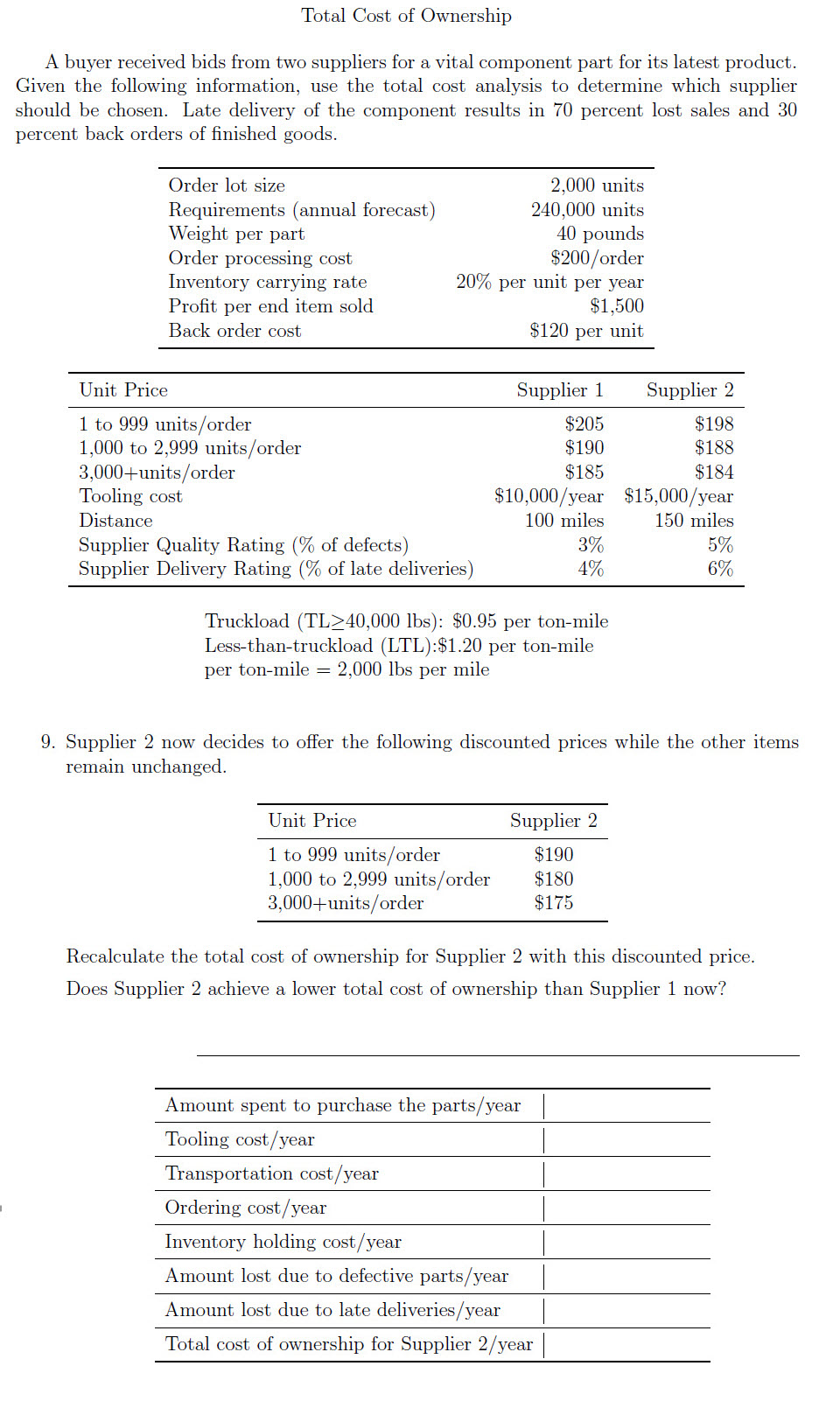

Total Cost of Ownership A buyer received bids from two suppliers for a vital component part for its latest product. Given the following information, use the total cost analysis to determine which supplier should be chosen. Late delivery of the component results in 70 percent lost sales and 30 percent back orders of finished goods. Order lot size Requirements (annual forecast) Weight per part Order processing cost Inventory carrying rate Profit per end item sold Back order cost 2,000 units 240,000 units 40 pounds $200/order 20% per unit per year $1,500 $120 per unit Supplier 1 Supplier 2 Unit Price 1 to 999 units/order 1,000 to 2,999 units order 3,000+units order Tooling cost Distance Supplier Quality Rating (% of defects) Supplier Delivery Rating (% of late deliveries) $205 $198 $190 $188 $185 $184 $10,000/year $15,000/year 100 miles 150 miles 3% 100 5% 4% 6% Truckload (TL>40,000 lbs): $0.95 per ton-mile Less-than-truckload (LTL):$1.20 per ton-mile per ton-mile = 2,000 lbs per mile 9. Supplier 2 now decides to offer the following discounted prices while the other items remain unchanged. Unit Price 1 to 999 units/order 1,000 to 2,999 units/order 3,000+units/order Supplier 2 $190 $180 $175 Recalculate the total cost of ownership for Supplier 2 with this discounted price. Does Supplier 2 achieve a lower total cost of ownership than Supplier 1 now? Amount spent to purchase the parts/year Tooling cost/year Transportation cost/year Ordering cost/year Inventory holding cost/year Amount lost due to defective parts/year Amount lost due to late deliveries/year Total cost of ownership for Supplier 2/year Total Cost of Ownership A buyer received bids from two suppliers for a vital component part for its latest product. Given the following information, use the total cost analysis to determine which supplier should be chosen. Late delivery of the component results in 70 percent lost sales and 30 percent back orders of finished goods. Order lot size Requirements (annual forecast) Weight per part Order processing cost Inventory carrying rate Profit per end item sold Back order cost 2,000 units 240,000 units 40 pounds $200/order 20% per unit per year $1,500 $120 per unit Supplier 1 Supplier 2 Unit Price 1 to 999 units/order 1,000 to 2,999 units order 3,000+units order Tooling cost Distance Supplier Quality Rating (% of defects) Supplier Delivery Rating (% of late deliveries) $205 $198 $190 $188 $185 $184 $10,000/year $15,000/year 100 miles 150 miles 3% 100 5% 4% 6% Truckload (TL>40,000 lbs): $0.95 per ton-mile Less-than-truckload (LTL):$1.20 per ton-mile per ton-mile = 2,000 lbs per mile 9. Supplier 2 now decides to offer the following discounted prices while the other items remain unchanged. Unit Price 1 to 999 units/order 1,000 to 2,999 units/order 3,000+units/order Supplier 2 $190 $180 $175 Recalculate the total cost of ownership for Supplier 2 with this discounted price. Does Supplier 2 achieve a lower total cost of ownership than Supplier 1 now? Amount spent to purchase the parts/year Tooling cost/year Transportation cost/year Ordering cost/year Inventory holding cost/year Amount lost due to defective parts/year Amount lost due to late deliveries/year Total cost of ownership for Supplier 2/year