Answered step by step

Verified Expert Solution

Question

1 Approved Answer

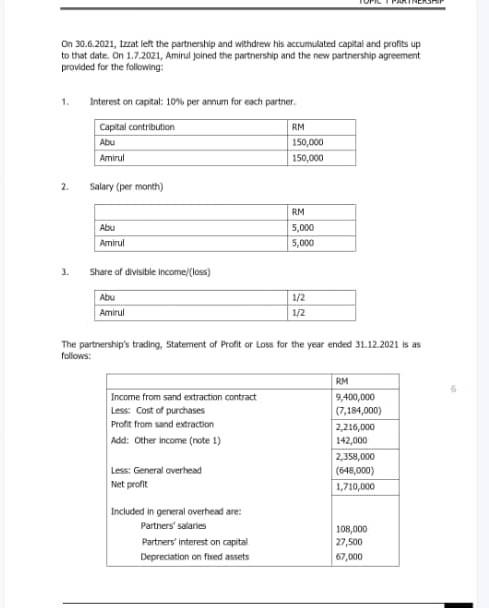

total income On 30.6.2021, tuat left the partresship and withdrew his accumudted capial and profits up to that date. On 1.7.2021, Aminul joined the partnership

total income

On 30.6.2021, tuat left the partresship and withdrew his accumudted capial and profits up to that date. On 1.7.2021, Aminul joined the partnership and the new partnership agreement provided for the following: 1. Interest on captal: 1004 per annum for each partner. 2. Salary (per month) 3. Share af divisible income/(loss) The partnership's trading, Statement of Proft or Loss for the year ended 31.12.2021 is as follons: On 30.6.2021, tuat left the partresship and withdrew his accumudted capial and profits up to that date. On 1.7.2021, Aminul joined the partnership and the new partnership agreement provided for the following: 1. Interest on captal: 1004 per annum for each partner. 2. Salary (per month) 3. Share af divisible income/(loss) The partnership's trading, Statement of Proft or Loss for the year ended 31.12.2021 is as follonsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started