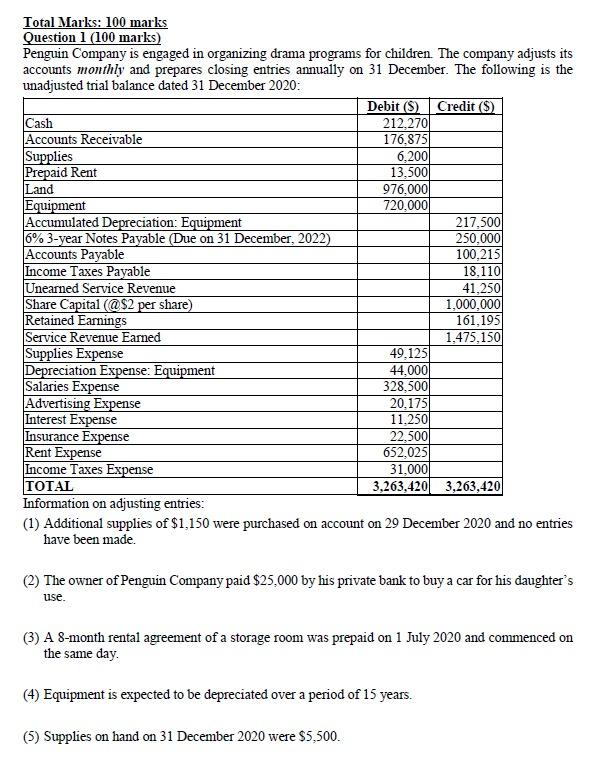

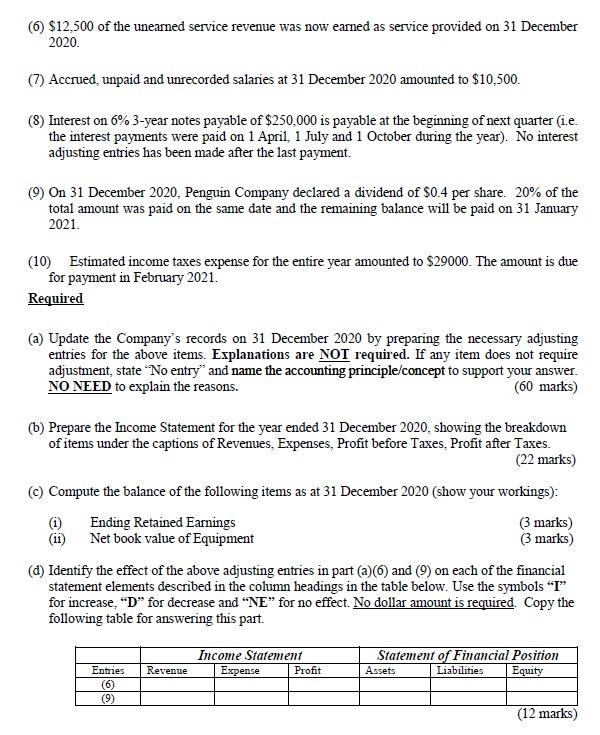

Total Marks: 100 marks Question 1 (100 marks) Penguin Company is engaged in organizing drama programs for children. The company adjusts its accounts monthly and prepares closing entries annually on 31 December. The following is the unadjusted trial balance dated 31 December 2020: Debit (9) Credit (S) Cash 212,2701 Accounts Receivable 176.875 Supplies 6,200 Prepaid Rent 13,500 Land 976,000 Equipment 720,000 Accumulated Depreciation: Equipment 217,500 6% 3-year Notes Payable (Due on 31 December, 2022) 250,000 Accounts Payable 100.215 Income Taxes Payable 18,110 Unearned Service Revenue 41.250 Share Capital (@$2 per share) 1,000,000 Retained Earnings 161,195 Service Revenue Earned 1,475,150 Supplies Expense 49.125 Depreciation Expense: Equipment 44,000 Salaries Expense 328,500 Advertising Expense 20.175 Interest Expense 11.250 Insurance Expense 22,500 Rent Expense 652,025 Income Taxes Expense 31,000 TOTAL 3,263,420 3,263,420 Information on adjusting entries: (1) Additional supplies of $1,150 were purchased on account on 29 December 2020 and no entries have been made. (2) The owner of Penguin Company paid $25,000 by his private bank to buy a car for his daughter's use. (3) A 8-month rental agreement of a storage room was prepaid on 1 July 2020 and commenced on the same day. (4) Equipment is expected to be depreciated over a period of 15 years. (5) Supplies on hand on 31 December 2020 were $5,500. (6) $12.500 of the unearned service revenue was now earned as service provided on 31 December 2020 (7) Accrued unpaid and unrecorded salaries at 31 December 2020 amounted to $10,500. (8) Interest on 6% 3-year notes payable of $250.000 is payable at the beginning of next quarter (i.e. the interest payments were paid on 1 April, 1 July and 1 October during the year). No interest adjusting entries has been made after the last payment. (9) On 31 December 2020, Penguin Company declared a dividend of $0.4 per share. 20% of the total amount was paid on the same date and the remaining balance will be paid on 31 January 2021 (10) Estimated income taxes expense for the entire year amounted to $29000. The amount is due for payment in February 2021. Required (a) Update the Company's records on 31 December 2020 by preparing the necessary adjusting entries for the above items. Explanations are NOT required. If any item does not require adjustment, state "No entry" and name the accounting principle/concept to support your answer. NO NEED to explain the reasons. (60 marks) (6) Prepare the Income Statement for the year ended 31 December 2020, showing the breakdown of items under the captions of Revenues. Expenses, Profit before Taxes. Profit after Taxes. (22 marks) Compute the balance of the following items as at 31 December 2020 (show your workings): (1) Ending Retained Earnings (3 marks) (11) Net book value of Equipment (3 marks) (d) Identify the effect of the above adjusting entries in part (a)) and (9) on each of the financial statement elements described in the column headings in the table below. Use the symbols "I" for increase, D for decrease and "NE" for no effect. No dollar amount is required. Copy the following table for answering this part. Income Statement Expense Profit Statement of Financial Position Assets Liabilities Equity Revenue Entries (6) (12 marks)