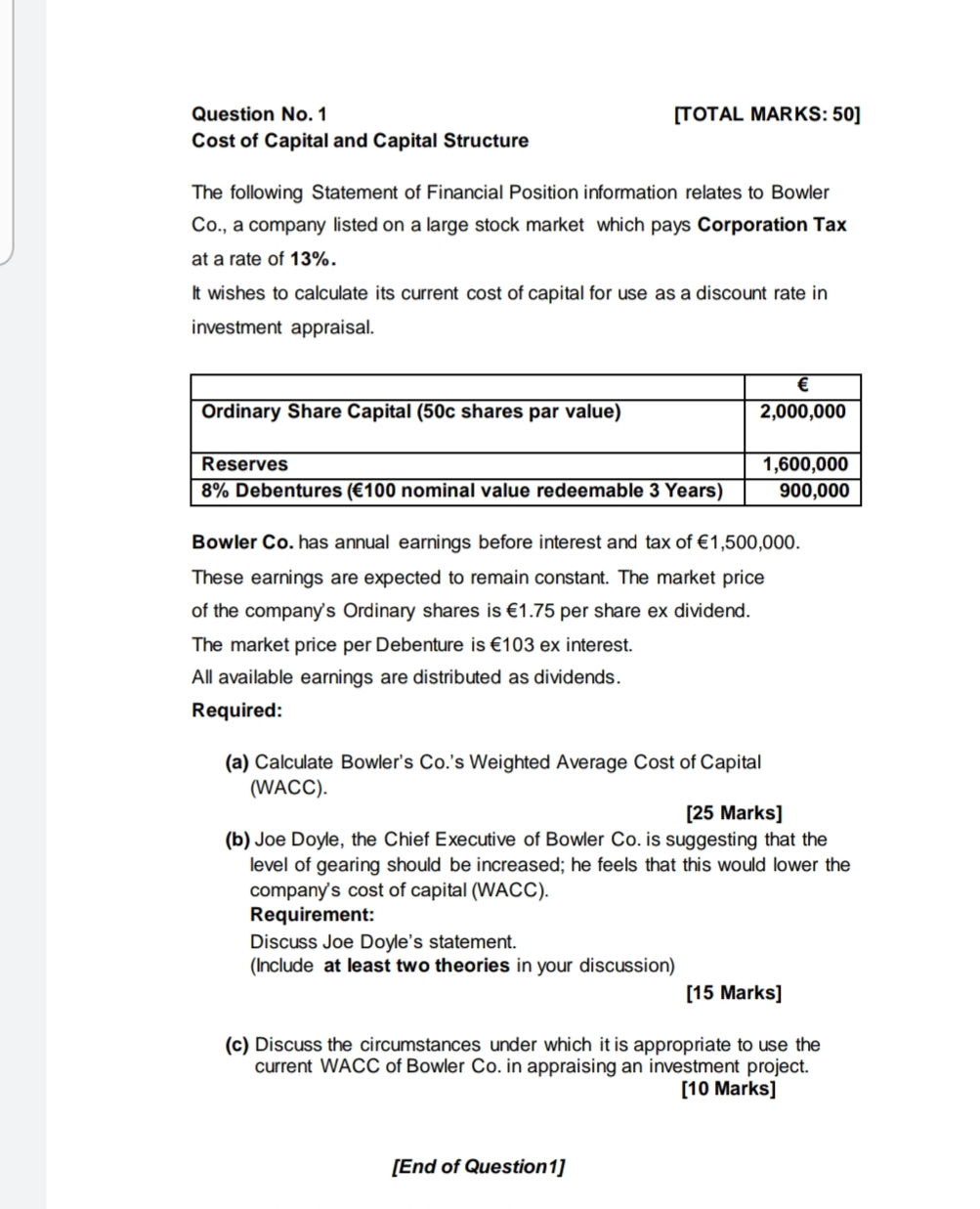

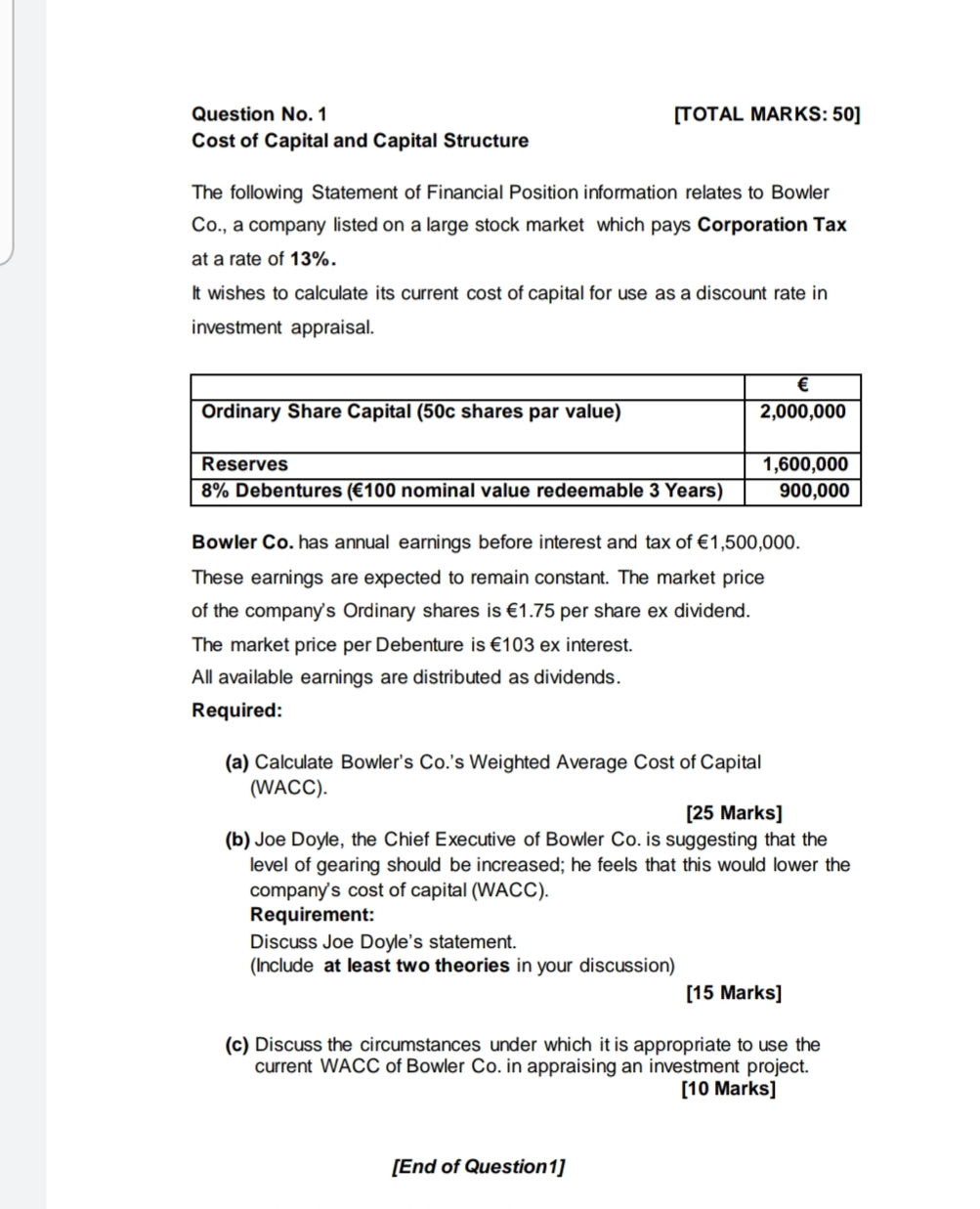

[TOTAL MARKS:50] Question No. 1 Cost of Capital and Capital Structure The following Statement of Financial Position information relates to Bowler Co., a company listed on a large stock market which pays Corporation Tax at a rate of 13%. It wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. 2,000,000 Ordinary Share Capital (500 shares par value) Reserves 8% Debentures (100 nominal value redeemable 3 Years) 1,600,000 900,000 Bowler Co. has annual earnings before interest and tax of 1,500,000. These earnings are expected to remain constant. The market price of the company's Ordinary shares is 1.75 per share ex dividend. The market price per Debenture is 103 ex interest. All available earnings are distributed as dividends. Required: (a) Calculate Bowler's Co.'s Weighted Average Cost of Capital (WACC). [25 Marks] (b) Joe Doyle, the Chief Executive of Bowler Co. is suggesting that the level of gearing should be increased; he feels that this would lower the company's cost of capital (WACC). Requirement: Discuss Joe Doyle's statement. (Include at least two theories in your discussion) [15 Marks] (c) Discuss the circumstances under which it is appropriate to use the current WACC of Bowler Co. in appraising an investment project. [10 Marks] [End of Question 1] [TOTAL MARKS:50] Question No. 1 Cost of Capital and Capital Structure The following Statement of Financial Position information relates to Bowler Co., a company listed on a large stock market which pays Corporation Tax at a rate of 13%. It wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. 2,000,000 Ordinary Share Capital (500 shares par value) Reserves 8% Debentures (100 nominal value redeemable 3 Years) 1,600,000 900,000 Bowler Co. has annual earnings before interest and tax of 1,500,000. These earnings are expected to remain constant. The market price of the company's Ordinary shares is 1.75 per share ex dividend. The market price per Debenture is 103 ex interest. All available earnings are distributed as dividends. Required: (a) Calculate Bowler's Co.'s Weighted Average Cost of Capital (WACC). [25 Marks] (b) Joe Doyle, the Chief Executive of Bowler Co. is suggesting that the level of gearing should be increased; he feels that this would lower the company's cost of capital (WACC). Requirement: Discuss Joe Doyle's statement. (Include at least two theories in your discussion) [15 Marks] (c) Discuss the circumstances under which it is appropriate to use the current WACC of Bowler Co. in appraising an investment project. [10 Marks] [End of Question 1]