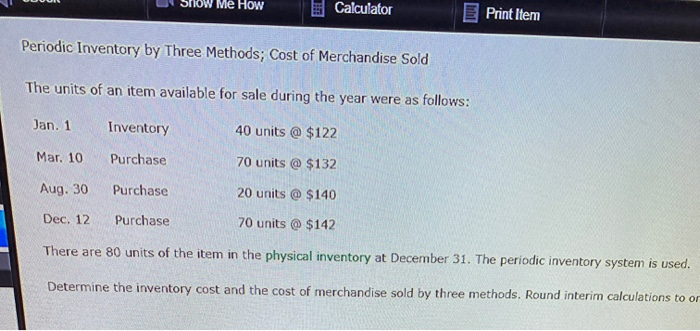

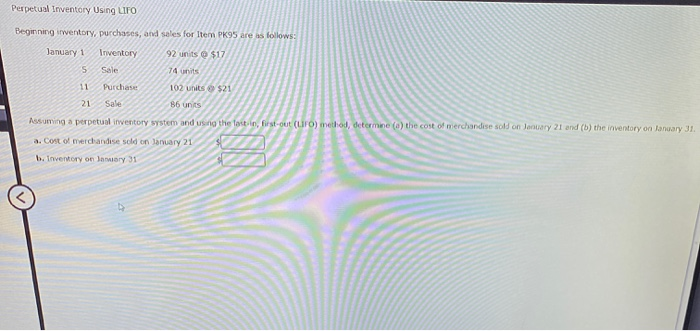

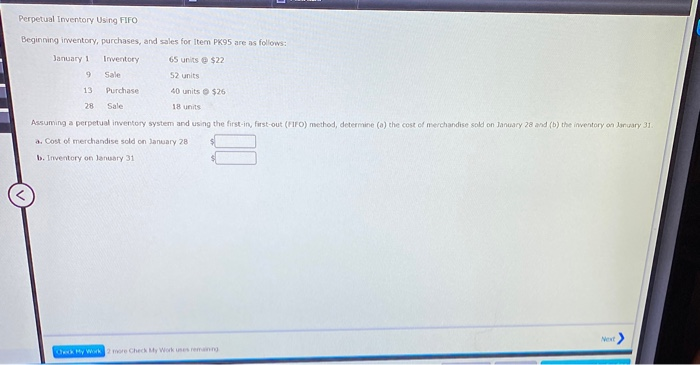

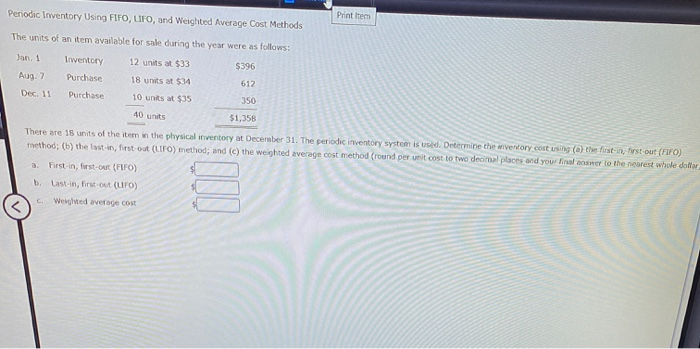

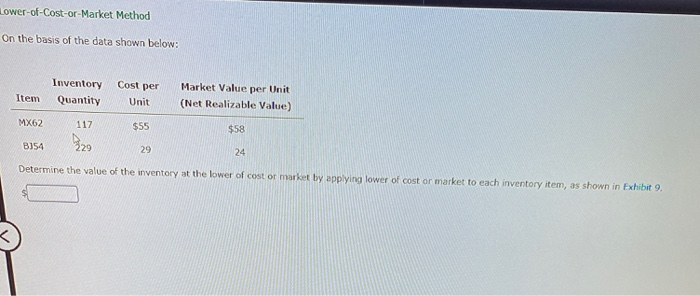

TOW Me HOW Calculator Print Item Periodic Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for sale during the year were as follows: Jan. 1 Inventory 40 units @ $122 Mar. 10 Purchase 70 units @ $132 Aug. 30 Purchase 20 units @ $140 Dec. 12 Purchase 70 units @ $142 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods. Round interim calculations to or Perpetual Inventory Using LITO Beginning twentory, purchases, and sales for Item PK95 are as follows: January 1 Inventory 92 units $17 5 Sale 74 units 11 Purchase 102 units $21 21 Sale 86 units Assuming a perpetual inventory system and using the last in, first-out (ro) method, determine (cthe cost of merchandise sold on January 21 and (b) the inventory on January 31 a. Cost of merchandise sold on January 21 b. Inventory on Intiary 31 Perpetual Inventory Using FIFO Beginning irwentory, purchases, and sales for Item PK95 are as follows: January 1 Inventory 65 units @ $22 9 Sale 13 Purchase 40 units $26 28 Sale 18 units Assuming a perpetual inventory system and using the first-in, first-out (FFO) method, determine () the cost of merchandise sold on January 28 and (b) the inventory on January 31 a. Cost of merchandise sold on January 28 b. Inventory on January 31 Next CHY WW2 Che Workeren Printem Periodic Inventory Using FIFO, UFO, and Weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan 1 12 units at $33 $396 Aug. 7 Inventory Purchase Purchase 18 units at $34 612 Dec. 11 10 units at $35 350 40 units $1,358 There are 18 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the eventory cost using (a) the first in first out (Firo) method; (b) the last in, first oot (LIFO) method; and (c) the weighted average cost method (round per unit cost to two decimal places and your finansnor to the nearest whole dollar First in, forst-out (FIFO) Last-in, first-out (LFO) C Weighted average cost 3 Lower-of-Cost-or-Market Method On the basis of the data shown below: Cost per Inventory Quantity Item Market Value per Unit (Net Realizable Value) Unit MX62 $55 $58 117 zo B354 29 24 Determine the value of the inventory at the lower of cost or market by applying lower of cost or market to each inventory item, as shown in Exhibit 9