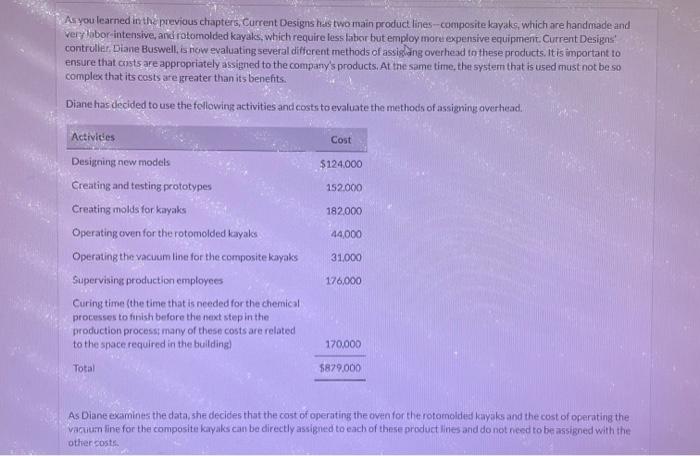

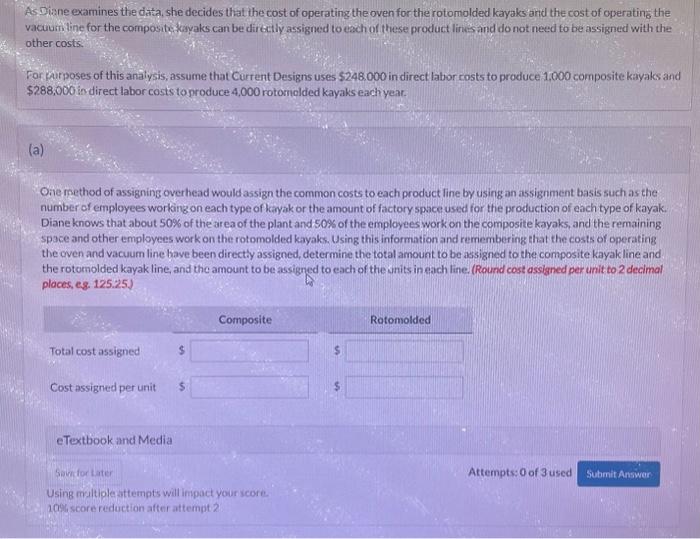

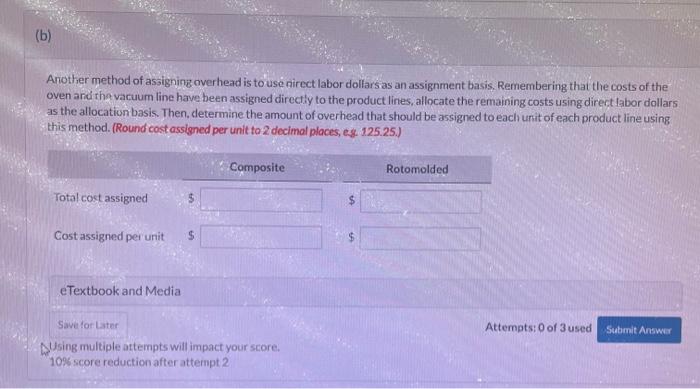

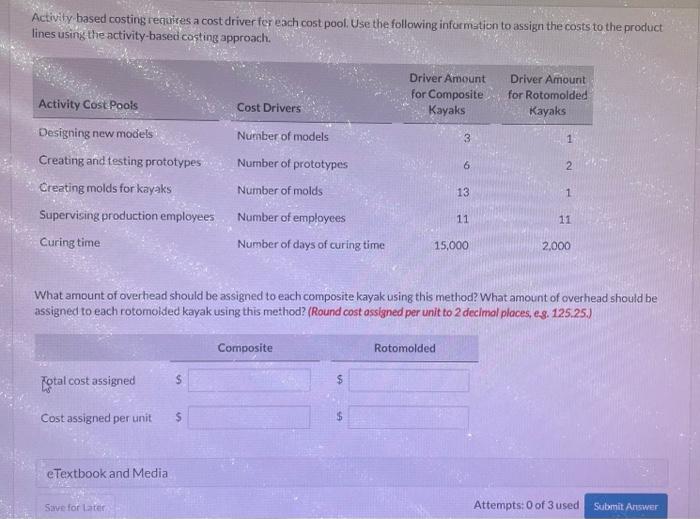

Asyou learned in th previous chapteri, Current Designs has two main product lines-composite kayaks, which are handmade and verilobor intensive, and rotomolded kayalos, which require less latior but employ more expensive equipment. Current Designs' contruller. Diane Buswell, is now evaluatingseveral different methods of assighang overhead in these products. It is amportant to ensure that conts are appropriately assigned to the company's products. At the same time, the system that is used must not be so complex that its costs are greater than its benefits. Diane has decided to use the fellowing activities and costs to evaluate the methods of assigning overhead. As Diane examines the data, she decides that the cost of operating the oven for the rotomolded kayals and the cost of operating the vacuium line for the composite kayaks can be directly assigned to each of these product lines and do not need to be assigned with the othercoste. As Diane examines the data, she decides that the cost of operating the oven for the rotomolded kayaks and the cost of operating the vacuumbine for the compositystayaks can be dirketly assigned to each of these product lines and do not need to be assigned with the other costs. For Zurposes of this analysis, assume that Current Designs uses $248,000 in direct labor costs to produce 1,000 composite kayaks and $288,000 in direct labor costs to produce 4,000 rotomolded kayaks each yeat. (a) Oie method of assigning overhead would assign the common costs to each product line by using an assignment basis such as the number of employees workinz on each type of kayak or the amount of factory space used for the production of each type of kayak. Diane knows that about 50% of the area of the plant and 50% of the employees work on the composite kayaks, and the remaining space and other employees work on the rotomolded kayaks. Using this information and remembering that the costs of operating the oven and vacuum line bave been directly assigned, determine the total amount to be assigned to the composite kayak line and. the rotomolded kayak line, and the amount to be assigned to each of the snits in each line. (Round cost assigned per unit to 2 decimal places, eg. 125.25) eTextbook and Media Attempts: 0 of 3 used Using maltiole attempts will inpact your icore. 10\% score reduction after attempt 2 Another method of assigning overhead is to use nirect labor dollars as an assignment basis. Remembering that the costs of the oven and thg varuum line have been assigned directly to the product lines, allocate the remaining costs using direct labor dollars as the allocation basis. Then, determine the amount of overhead that should be assigned to each unit of each product line using this method. (Round cost assigned per unit to 2 decimal places, ey 125.25.) eTextbook and Media Attempts: 0 of 3 used Using multiple attempts will impact your score. 108 score reduction after atternpt 2 Activity based costing regaires a cost driver for each cost pool. Use the following information to assign the costs to the product lines using the activity-based costing approach. What amount of overhead should be assigned to each composite kayak using this method? What amount of overhead should be assigned to each rotomolded kayak using this method? (Round cost assigned per unit to 2 decimal places, e-g. 125.25.)