Answered step by step

Verified Expert Solution

Question

1 Approved Answer

R ecord journal entries transactions. (revenue recognition) T Trans # 3. 4. 5. 6. 7. 8. Transaction description Equipment inventory is sold with installation, extended

Record journal entries transactions. (revenue recognition)

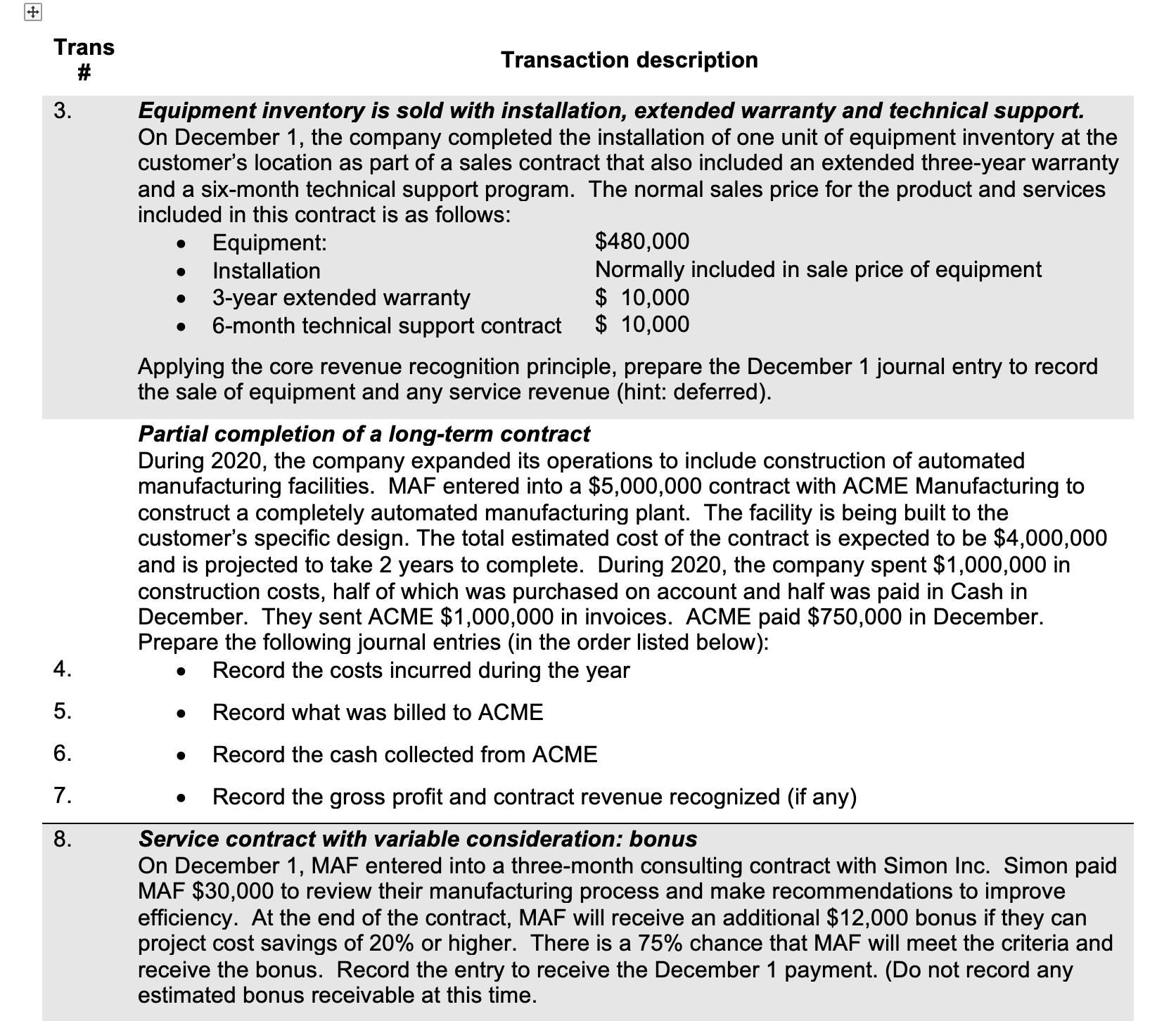

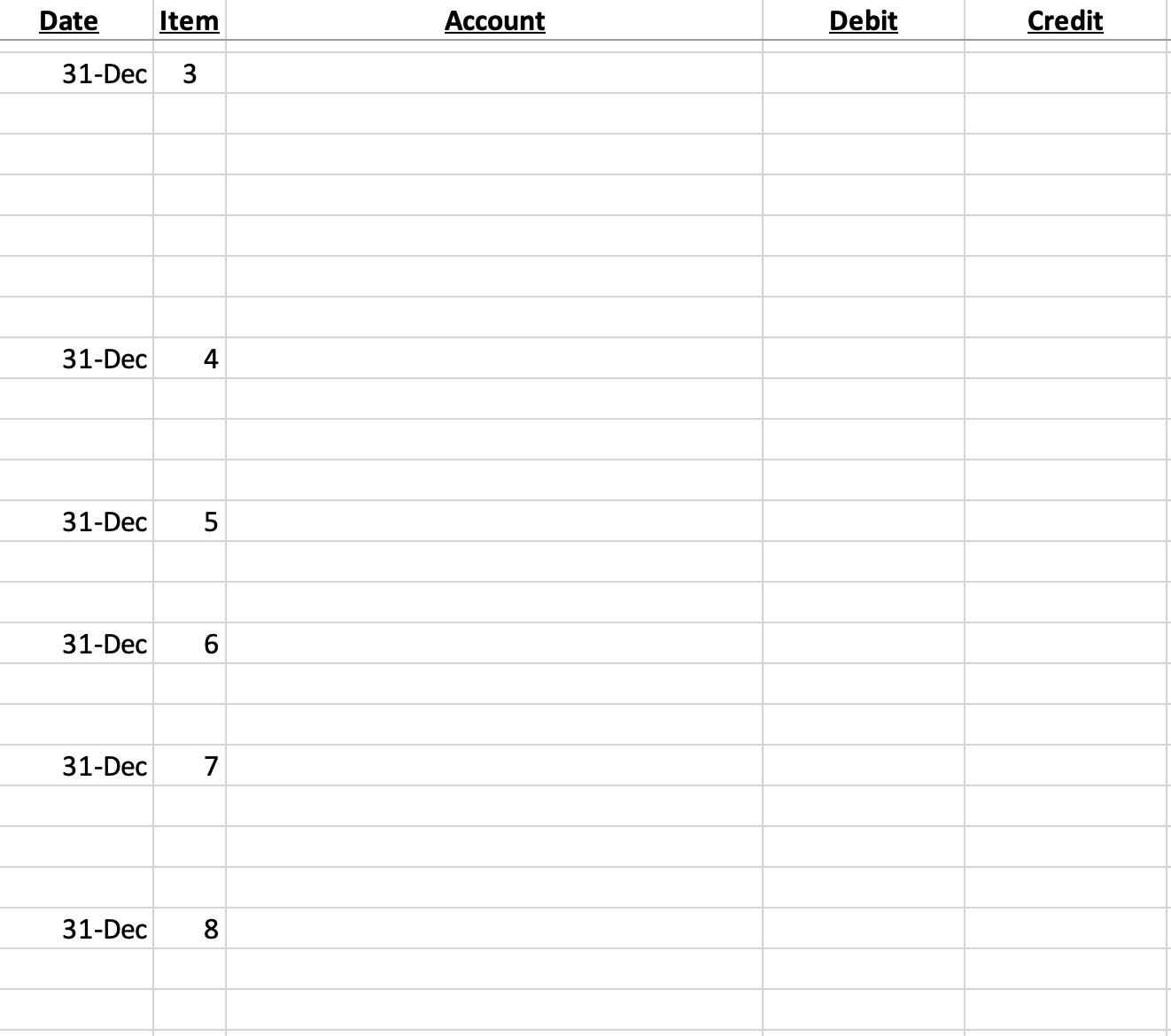

T Trans # 3. 4. 5. 6. 7. 8. Transaction description Equipment inventory is sold with installation, extended warranty and technical support. On December 1, the company completed the installation of one unit of equipment inventory at the customer's location as part of a sales contract that also included an extended three-year warranty and a six-month technical support program. The normal sales price for the product and services included in this contract is as follows: Equipment: Installation 3-year extended warranty 6-month technical support contract $480,000 Normally included in sale price of equipment $ 10,000 $ 10,000 Applying the core revenue recognition principle, prepare the December 1 journal entry to record the sale of equipment and any service revenue (hint: deferred). Partial completion of a long-term contract During 2020, the company expanded its operations to include construction of automated manufacturing facilities. MAF entered into a $5,000,000 contract with ACME Manufacturing to construct a completely automated manufacturing plant. The facility is being built to the customer's specific design. The total estimated cost of the contract is expected to be $4,000,000 and is projected to take 2 years to complete. During 2020, the company spent $1,000,000 in construction costs, half of which was purchased on account and half was paid in Cash in December. They sent ACME $1,000,000 in invoices. ACME paid $750,000 in December. Prepare the following journal entries (in the order listed below): Record the costs incurred during the year Record what was billed to ACME Record the cash collected from ACME Record the gross profit and contract revenue recognized (if any) Service contract with variable consideration: bonus On December 1, MAF entered into a three-month consulting contract with Simon Inc. Simon paid MAF $30,000 to review their manufacturing process and make recommendations to improve efficiency. At the end of the contract, MAF will receive an additional $12,000 bonus if they can project cost savings of 20% or higher. There is a 75% chance that MAF will meet the criteria and receive the bonus. Record the entry to receive the December 1 payment. (Do not record any estimated bonus receivable at this time.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Note for item 7 Calculation of construction revenue Percentage of work completed contrac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started