Answered step by step

Verified Expert Solution

Question

1 Approved Answer

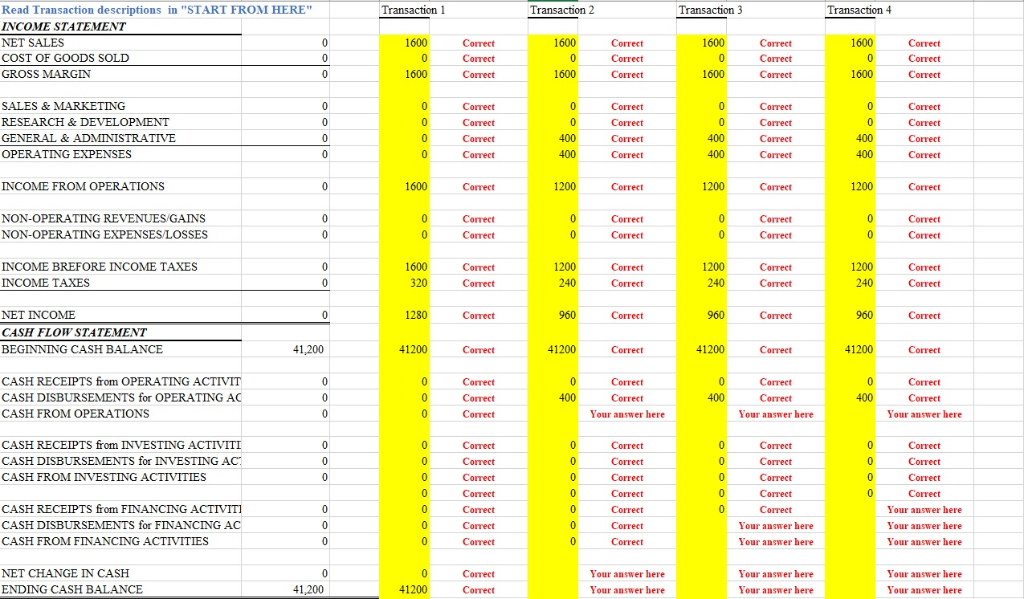

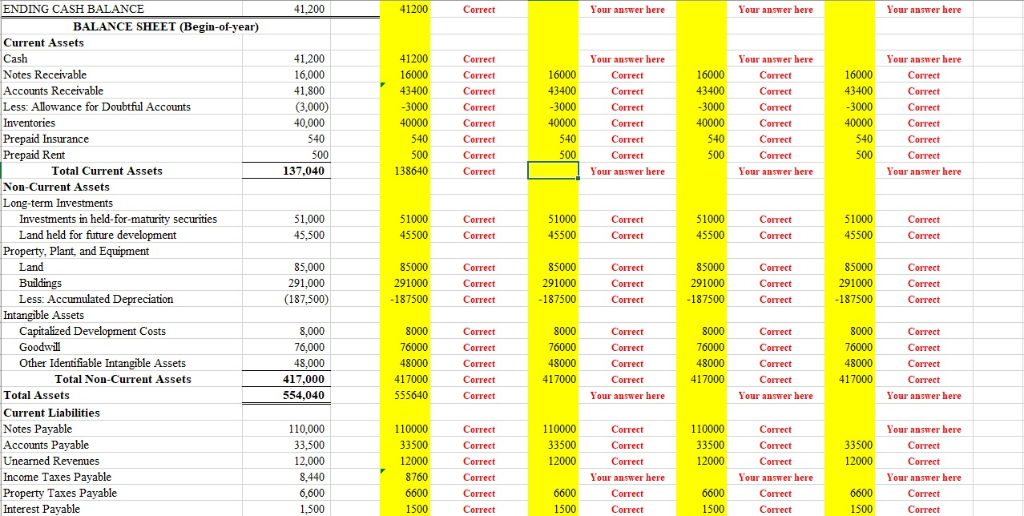

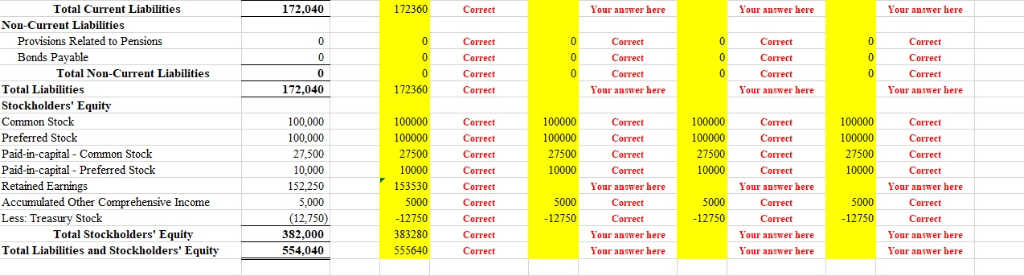

Transaction 1: sell merchandise on account for $1,600 (ignore the COGS for this transaction). Transaction 2: Pay $400 cash for office supplies. All supplies are

Transaction 1: sell merchandise on account for $1,600 (ignore the COGS for this transaction).

Transaction 2: Pay $400 cash for office supplies. All supplies are considered G&A expenses.

Transaction 3: Cash dividends totaling $800 are declared and paid.

Transaction 4: borrow $120,000 from bank (notes payable)

Read Transaction descriptions in "START FROM HERE" INCOME STATEMENT NET SALES COST OF GOODS SOLD GROSS MARGIN Transaction1 Transaction 2 Transaction 3 Transaction 4 1600 1600 Correct Correct Correct 1600 Correct Correct Correct 1600 1600 Correct 1600 1600 SALES & MARKETING RESEARCH & DEVELOPMENT GENERAL & ADMINISTRATIVE OPERATING EXPENSES Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct 400 400 Correct INCOME FROM OPERATIONS 1600 Correct 1200 Correct 1200 Correct 1200 NON-OPERATING REVENUES GAINS NON-OPERATING EXPENSESLOSSES Correct Correct Correct Correct INCOME BREFORE INCOME TAXES INCOME TAXES 1600 1200 Correct Correct 1200 Correct Correct 1200 NET INCOME CASH FLOW STATEMENT BEGINNING CASH BALANCE 1280 Correct 960 Correct 41,200 41200 Correct 41200 Correct 41200 Correct 41200 CASH RECEIPTS from OPERATING ACTIVIT CASH DISBURSEMENTS for OPERATINGAC CASH FROM OPERATIONS Correct Correct Correct Correct Correct Correct Your answer here Your answer here Your answer here CASH RECEIPTS from INVESTING ACTIVITI CASH DISBURSEMENTS for INVESTING AC CASH FROM INVESTING ACTIVITIES Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Correct Your answer here Your answer here CASH RECEIPTS from FINANCING ACTIVIT CASH DISBURSEMENTS for FINANCING CASH FROM FINANCING ACTIVITIES Your answer here Your answer here Your answer here NET CHANGE IN CASH ENDING CASH BALANCE Correct Correct Your answer here Your answer here Your answer here Your answer here Your answer here Your answer here 41,200 41200 ENDING CASH BALANCE 41,200 41200 Your answer here Your answer here Your answer here BALANCE SHEET (Begin-of-year) Current Assets 41.200 16,000 41,800 (3,000) 41200 16000 43400 Correct Your answer here Your answer here Correct Correct Correct Correct Correct Correct Your answer here Your answer here Correct Correct Correct Correct Correct Correct Your ansrer here 16000 43400 Notes Receivable 16000 43400 16000 43400 3000 Less: Allowance for Doubtful Accounts Inventories Prepaid Insurance Prepaid Rent 500 138640 Total Current Assets 137,040 Your answer here Non-Current Assets Long-term Investments Investments in held-for-maturity securities Land held for future development 51,000 45,500 51000 45500 51000 45500 51000 45500 51000 Correct Correct Correct Correct Property, Plant, and Equipment 85,000 291,000 187,500) 85000 291000 187500 85000 85000 85000 291000 187500 Correct Correct Correct Correct Correct Correct Less: Accumulated Depreciation Correct 187500 187500 Capitalized Development C Goodwil Other Identifiable Intangible Assets 8000 76000 48000 417000 555640 8000 76000 8000 76000 48000 417000 8000 Correct Correct Correct Correct Correct Correct Correct Correct Correct Your answer here Correct Correct Correct Correct Your answer here 48000 417000 Total Non-Current Assets 417,000 554,040 417000 Total Assets Your answer here Current Liabilities 110000 33500 110000 33500 110000 33500 12000 Correct Correct Correct Your answer here Correct Correct Your answer here Correct Correct Your answer here Correct Correct Accounts Pavable Unearned Revenues income Taxes Payable 33500 Your answer here 6600 1500 Interest Payable 1500 Correct 1500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started