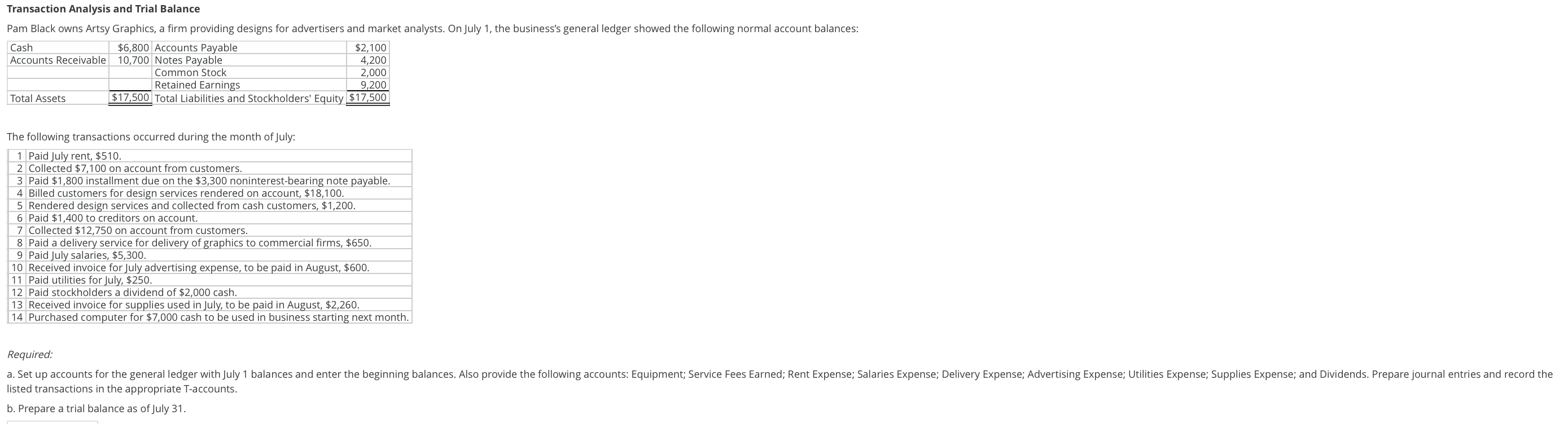

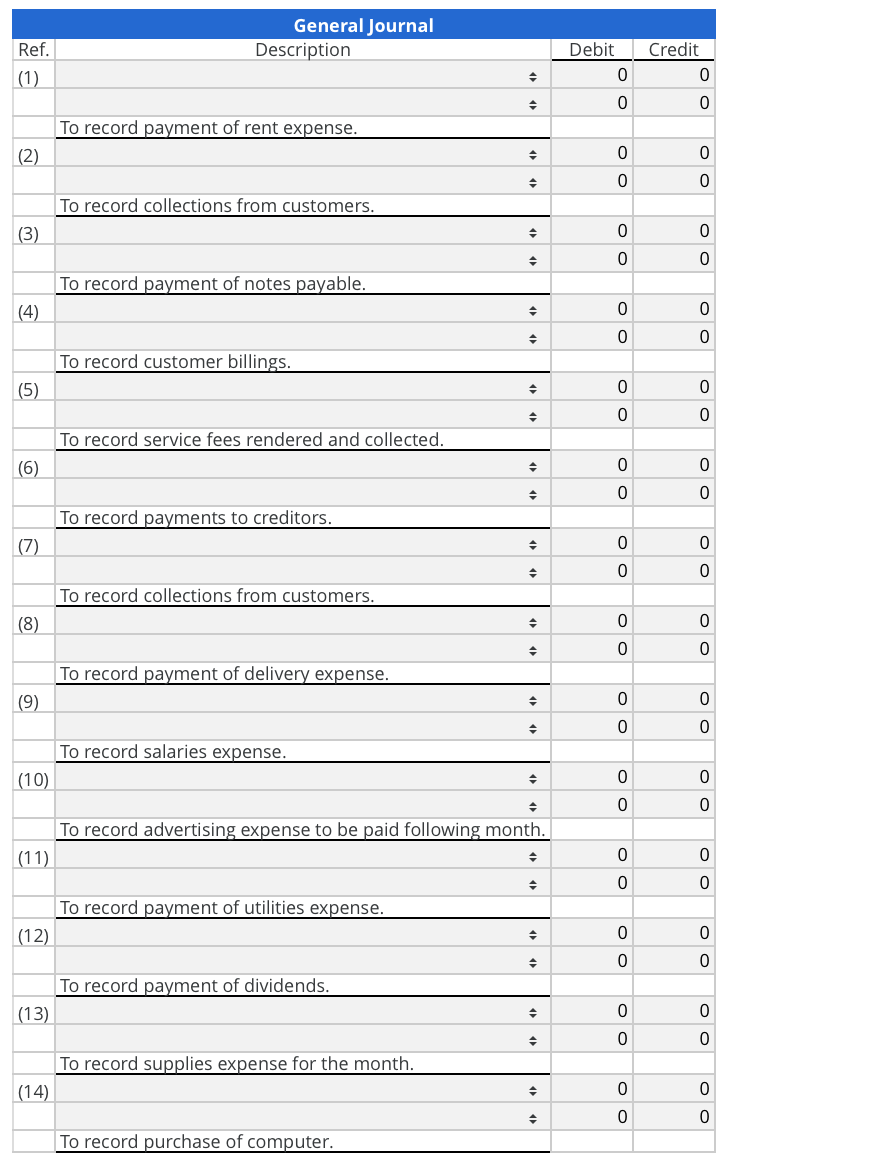

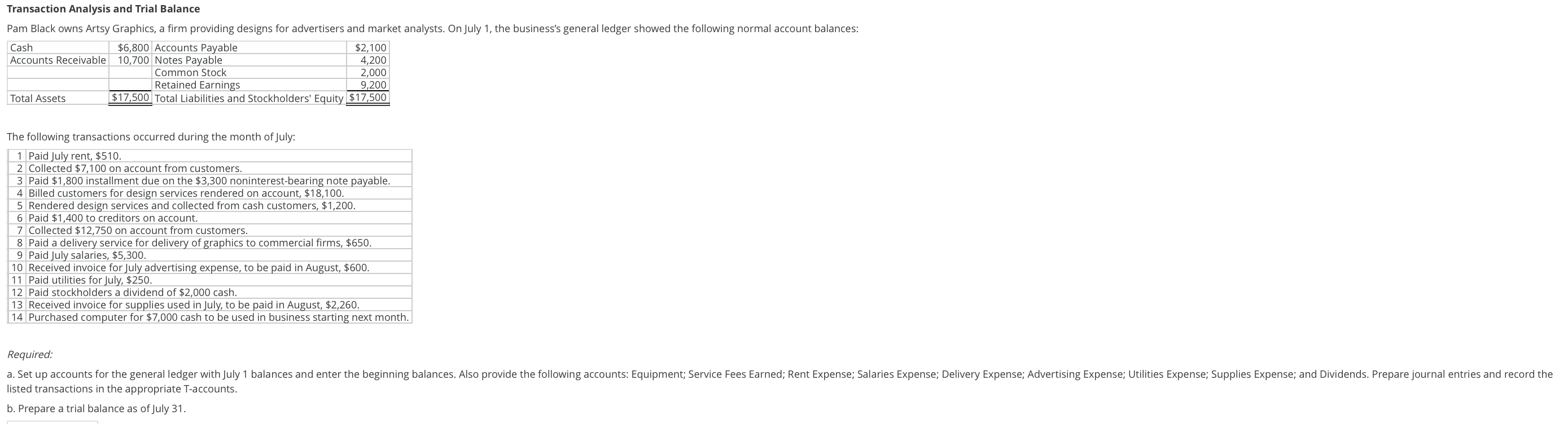

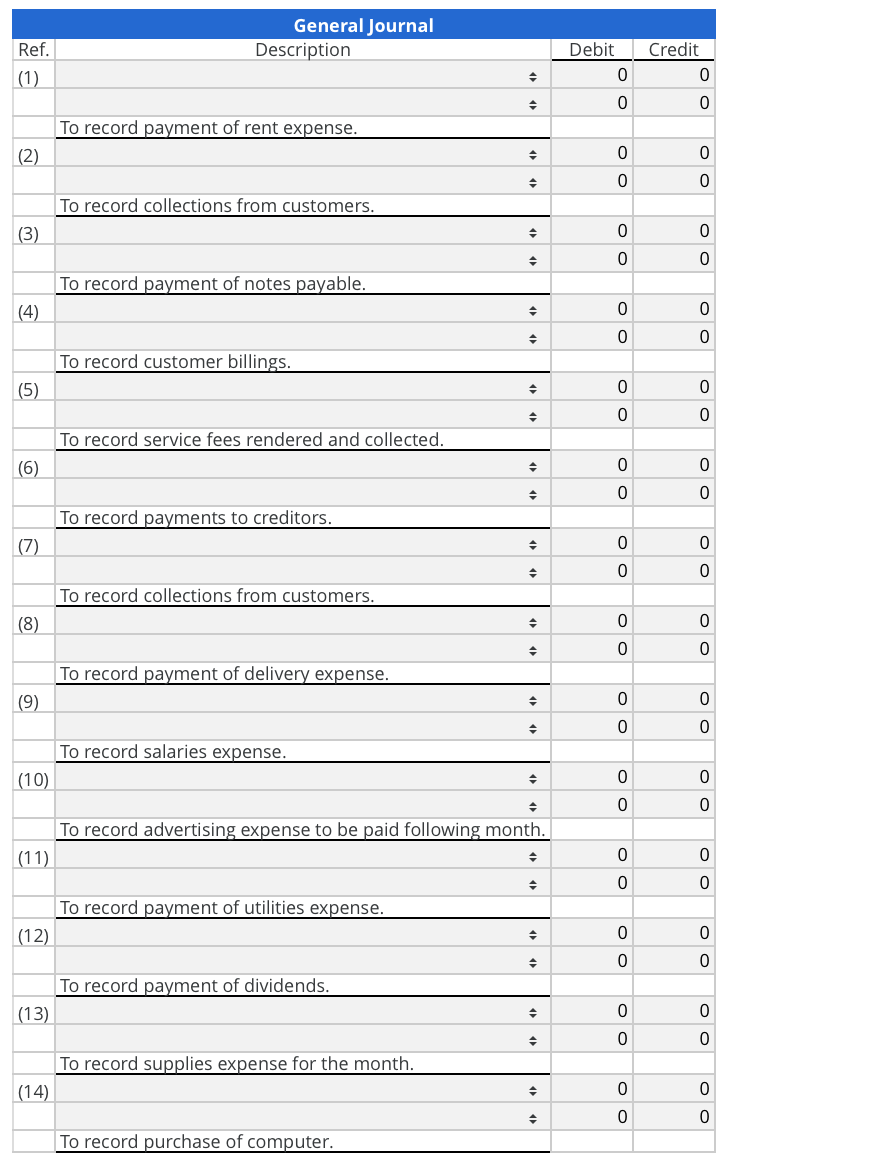

Transaction Analysis and Trial Balance Pam Black owns Artsy Graphics, a firm providing designs for advertisers and market analysts. On July 1, the business's general ledger showed the following normal account balances: Cash $6,800 Accounts Payable $2,100 Accounts Receivable 10,700 Notes Payable 4,200 Common Stock 2,000 Retained Earnings 9,200 Total Assets $17,500 Total Liabilities and Stockholders' Equity $17,500 The following transactions occurred during the month of July: 1 Paid July rent, $510. 2 Collected $7,100 on account from customers. 3 Paid $1,800 installment due on the $3,300 noninterest-bearing note payable. 4 Billed customers for design services rendered on account, $18,100. 5 Rendered design services and collected from cash customers, $1,200. 6 Paid $1,400 to creditors on account. 7 Collected $12,750 on account from customers. 8 Paid a delivery service for delivery of graphics to commercial firms, $650. 9 Paid July salaries, $5,300. 10 Received invoice for July advertising expense, to be paid in August, $600. 11 Paid utilities for July, $250. 12 Paid stockholders a dividend of $2,000 cash. 13 Received invoice for supplies used in July, to be paid in August, $2,260. 14 Purchased computer for $7,000 cash to be used in business starting next month. Required: a. Set up accounts for the general ledger with July 1 balances and enter the beginning balances. Also provide the following accounts: Equipment; Service Fees Earned; Rent Expense; Salaries Expense; Delivery Expense; Advertising Expense; Utilities Expense; Supplies Expense; and Dividends. Prepare journal entries and record the listed transactions in the appropriate T-accounts. b. Prepare a trial balance as of July 31. General Journal Description Ref. (1) Debit 0 0 Credit 0 0 To record payment of rent expense. (2) 0 0 To record collections from customers. (3) To record payment of notes payable. (4) To record customer billings. (5) To record service fees rendered and collected. (6) To record payments to creditors. To record collections from customers. (8) 0 To record payment of delivery expense. (9) 0 0 To record salaries expense. (10) To record advertising expense to be paid following month. (11) To record payment of utilities expense. (12) To record payment of dividends. (13) To record supplies expense for the month. (14) To record purchase of computer