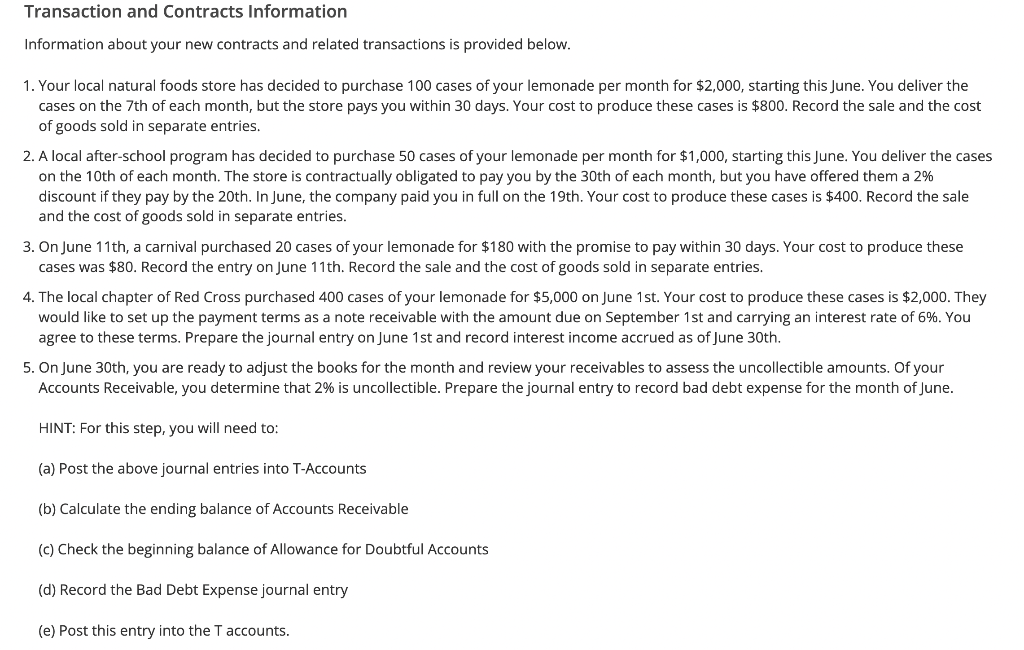

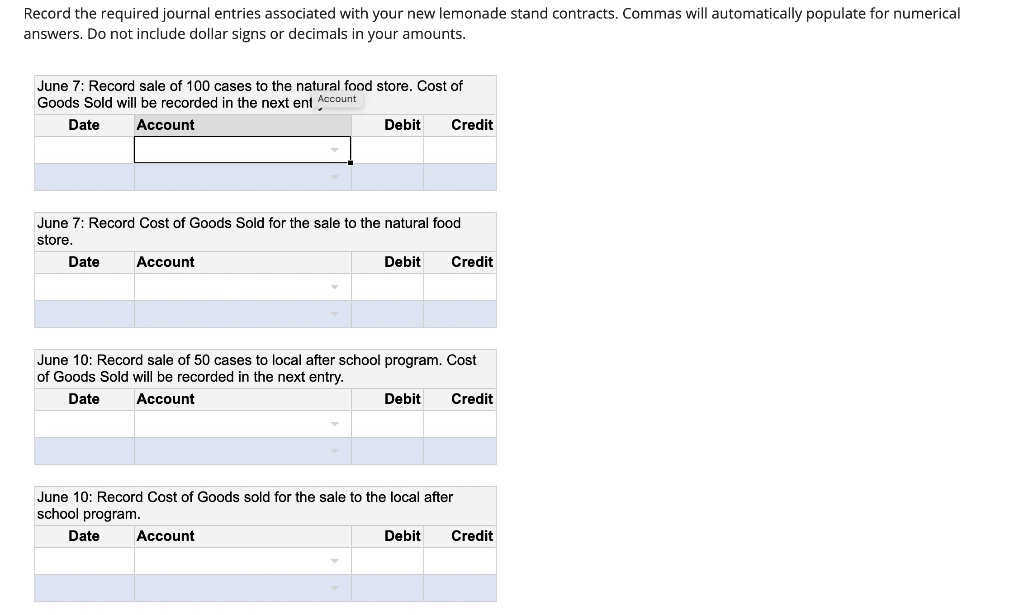

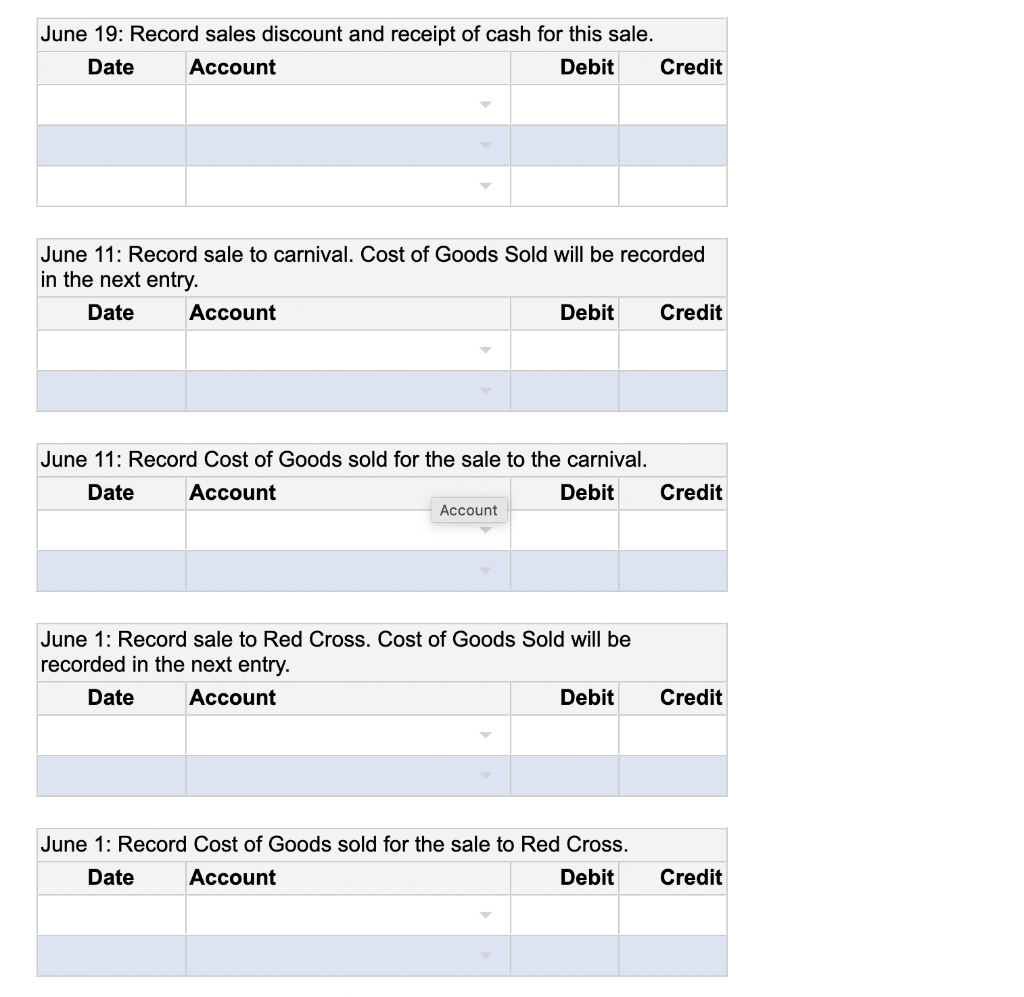

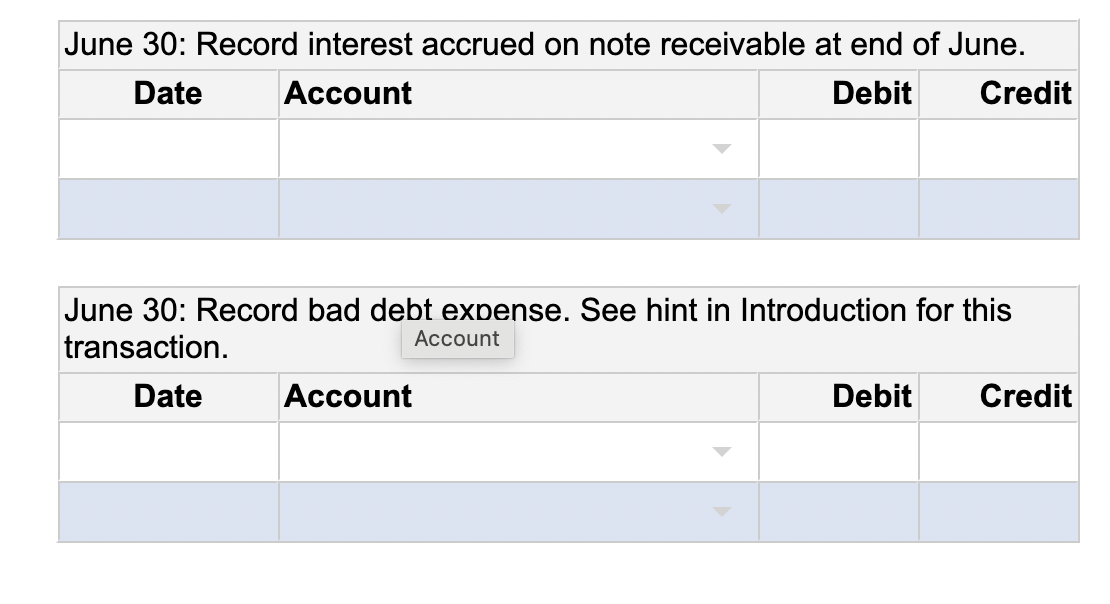

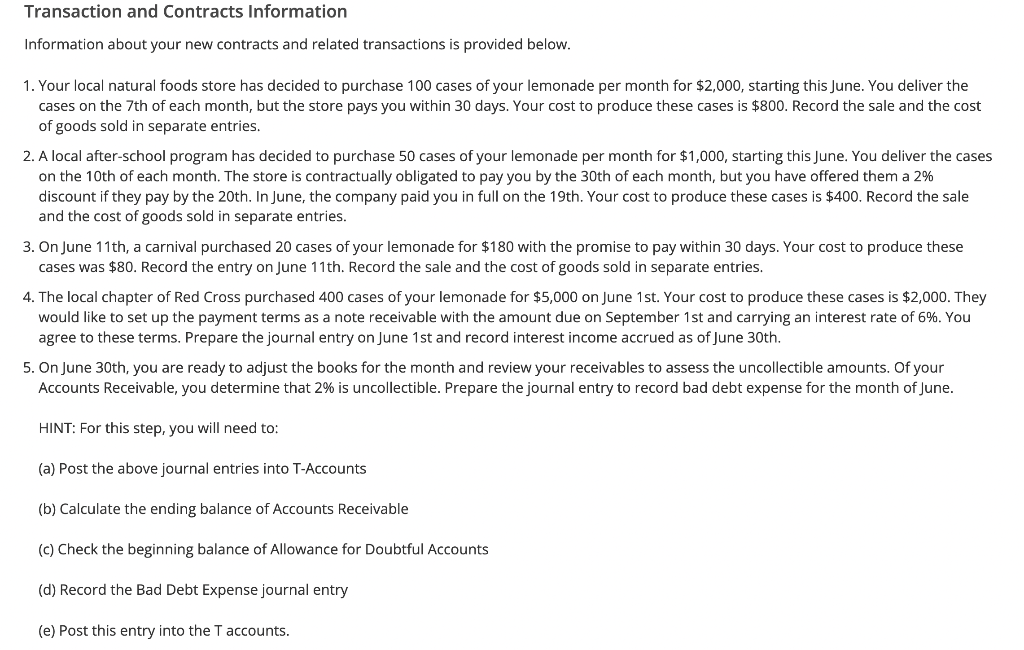

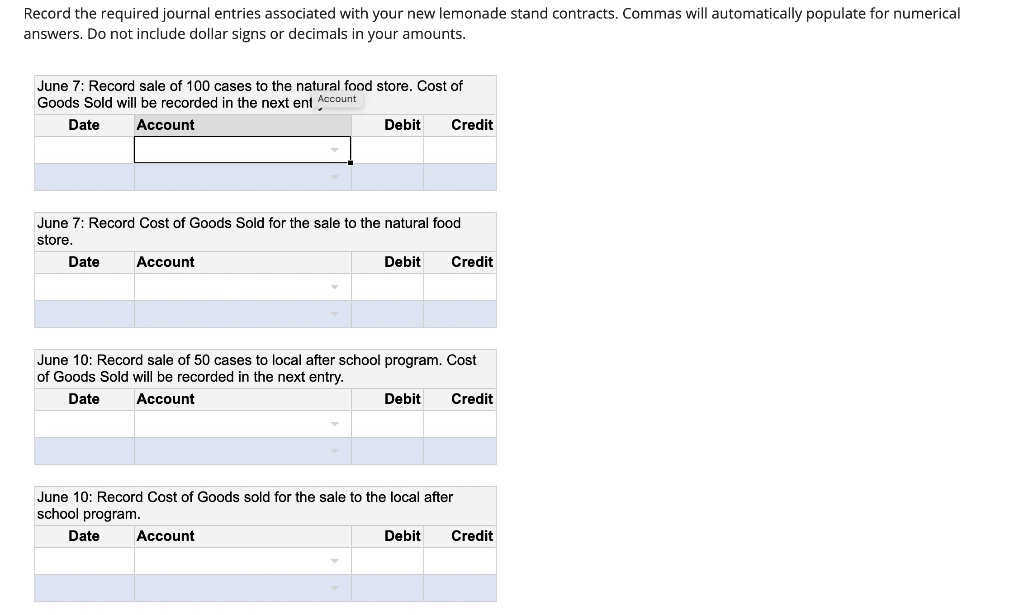

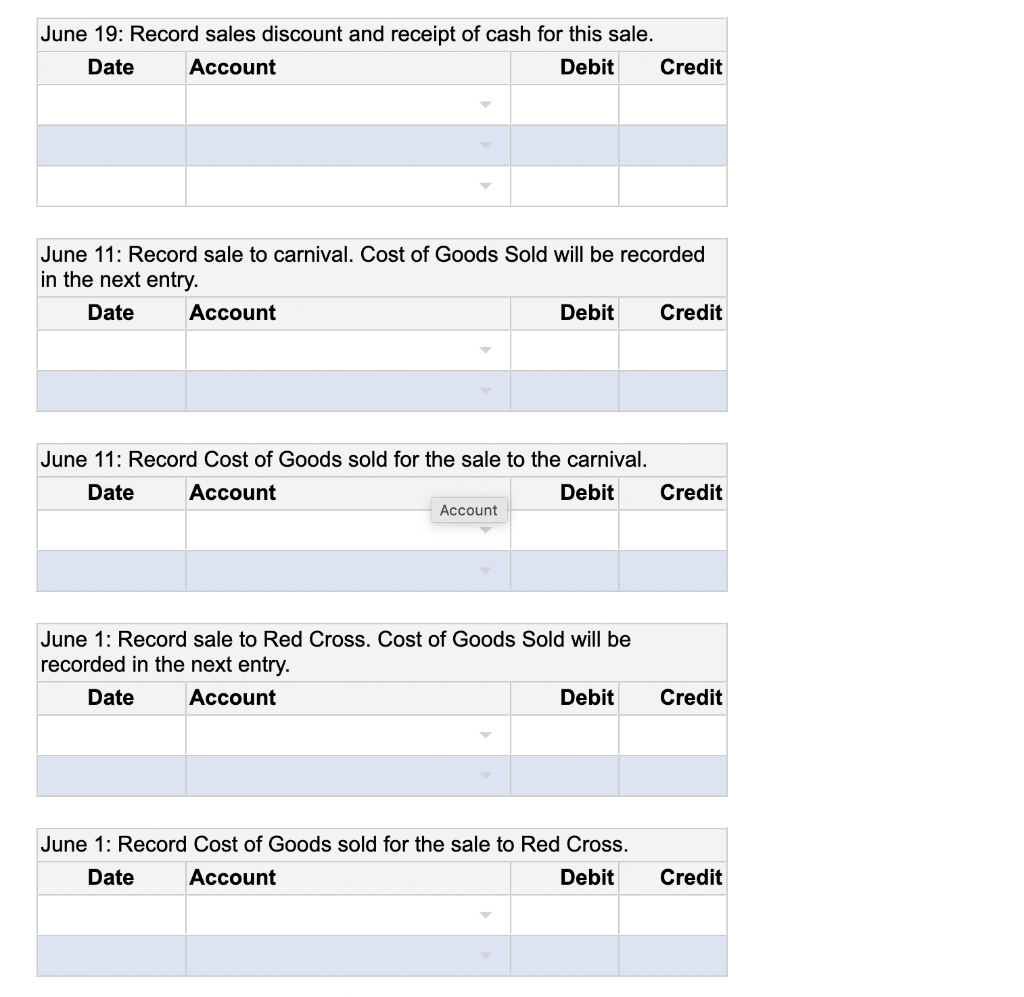

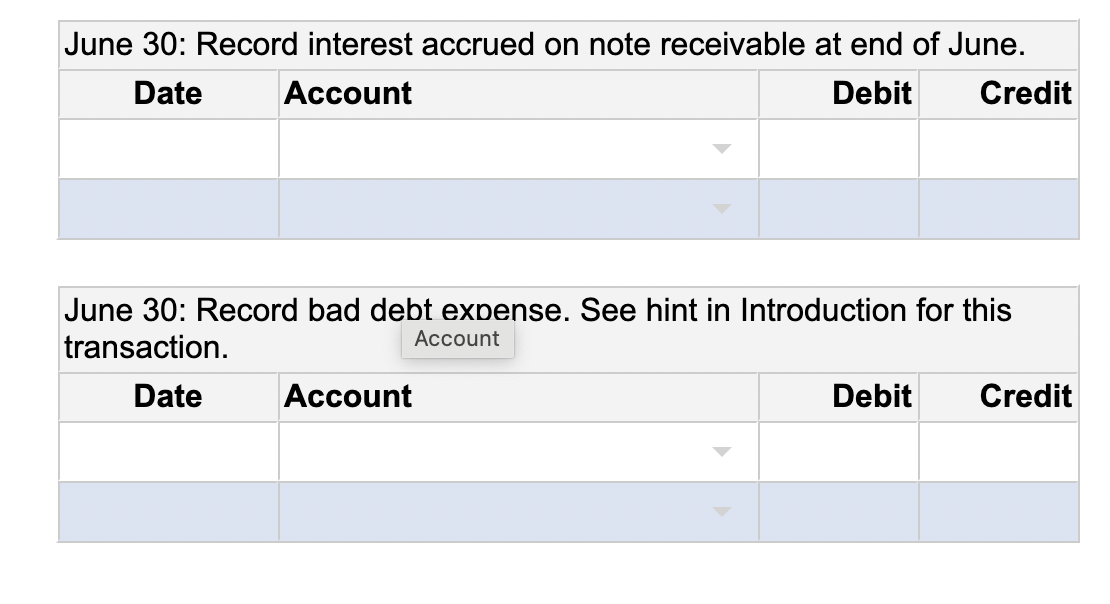

Transaction and Contracts Information Information about your new contracts and related transactions is provided below. 1. Your local natural foods store has decided to purchase 100 cases of your lemonade per month for $2,000, starting this June. You deliver the cases on the 7th of each month, but the store pays you within 30 days. Your cost to produce these cases is $800. Record the sale and the cost of goods sold in separate entries. 2. A local after-school program has decided to purchase 50 cases of your lemonade per month for $1,000, starting this june. You deliver the cases on the 10th of each month. The store is contractually obligated to pay you by the 30 th of each month, but you have offered them a 2% discount if they pay by the 20th. In June, the company paid you in full on the 19th. Your cost to produce these cases is $400. Record the sale and the cost of goods sold in separate entries. 3. On June 11th, a carnival purchased 20 cases of your lemonade for $180 with the promise to pay within 30 days. Your cost to produce these cases was $80. Record the entry on June 11th. Record the sale and the cost of goods sold in separate entries. 4. The local chapter of Red Cross purchased 400 cases of your lemonade for $5,000 on June 1st. Your cost to produce these cases is $2,000. They would like to set up the payment terms as a note receivable with the amount due on September 1 st and carrying an interest rate of 6%. You agree to these terms. Prepare the journal entry on June 1st and record interest income accrued as of June 30th. 5. On June 30th, you are ready to adjust the books for the month and review your receivables to assess the uncollectible amounts. Of your Accounts Receivable, you determine that 2% is uncollectible. Prepare the journal entry to record bad debt expense for the month of June. HINT: For this step, you will need to: (a) Post the above journal entries into T-Accounts (b) Calculate the ending balance of Accounts Receivable (c) Check the beginning balance of Allowance for Doubtful Accounts (d) Record the Bad Debt Expense journal entry (e) Post this entry into the T accounts. Record the required journal entries associated with your new lemonade stand contracts. Commas will automatically populate for numerical answers. Do not include dollar signs or decimals in your amounts. June 7: Record sale of 100 cases to the natural food store. Cost of June 7: Record Cost of Goods Sold for the sale to the natural food store. June 10: Record sale of 50 cases to local after school program. Cost of Goods Sold will be recorded in the next entry. June 10: Record Cost of Goods sold for the sale to the local after school program. June 19: Record sales discount and receipt of cash for this sale. June 11: Record sale to carnival. Cost of Goods Sold will be recorded in the next entry. June 11: Record Cost of Goods sold for the sale to the carnival. June 1: Record sale to Red Cross. Cost of Goods Sold will be recorded in the next entrv June 30: Record interest accrued on note receivable at end of June. June 30: Record bad debt exbense. See hint in Introduction for this transaction. Transaction and Contracts Information Information about your new contracts and related transactions is provided below. 1. Your local natural foods store has decided to purchase 100 cases of your lemonade per month for $2,000, starting this June. You deliver the cases on the 7th of each month, but the store pays you within 30 days. Your cost to produce these cases is $800. Record the sale and the cost of goods sold in separate entries. 2. A local after-school program has decided to purchase 50 cases of your lemonade per month for $1,000, starting this june. You deliver the cases on the 10th of each month. The store is contractually obligated to pay you by the 30 th of each month, but you have offered them a 2% discount if they pay by the 20th. In June, the company paid you in full on the 19th. Your cost to produce these cases is $400. Record the sale and the cost of goods sold in separate entries. 3. On June 11th, a carnival purchased 20 cases of your lemonade for $180 with the promise to pay within 30 days. Your cost to produce these cases was $80. Record the entry on June 11th. Record the sale and the cost of goods sold in separate entries. 4. The local chapter of Red Cross purchased 400 cases of your lemonade for $5,000 on June 1st. Your cost to produce these cases is $2,000. They would like to set up the payment terms as a note receivable with the amount due on September 1 st and carrying an interest rate of 6%. You agree to these terms. Prepare the journal entry on June 1st and record interest income accrued as of June 30th. 5. On June 30th, you are ready to adjust the books for the month and review your receivables to assess the uncollectible amounts. Of your Accounts Receivable, you determine that 2% is uncollectible. Prepare the journal entry to record bad debt expense for the month of June. HINT: For this step, you will need to: (a) Post the above journal entries into T-Accounts (b) Calculate the ending balance of Accounts Receivable (c) Check the beginning balance of Allowance for Doubtful Accounts (d) Record the Bad Debt Expense journal entry (e) Post this entry into the T accounts. Record the required journal entries associated with your new lemonade stand contracts. Commas will automatically populate for numerical answers. Do not include dollar signs or decimals in your amounts. June 7: Record sale of 100 cases to the natural food store. Cost of June 7: Record Cost of Goods Sold for the sale to the natural food store. June 10: Record sale of 50 cases to local after school program. Cost of Goods Sold will be recorded in the next entry. June 10: Record Cost of Goods sold for the sale to the local after school program. June 19: Record sales discount and receipt of cash for this sale. June 11: Record sale to carnival. Cost of Goods Sold will be recorded in the next entry. June 11: Record Cost of Goods sold for the sale to the carnival. June 1: Record sale to Red Cross. Cost of Goods Sold will be recorded in the next entrv June 30: Record interest accrued on note receivable at end of June. June 30: Record bad debt exbense. See hint in Introduction for this transaction