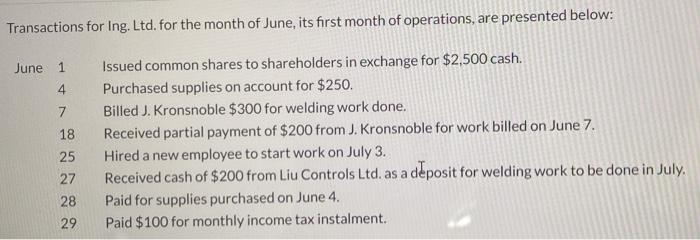

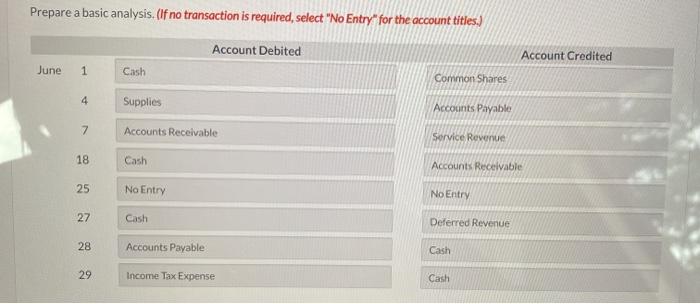

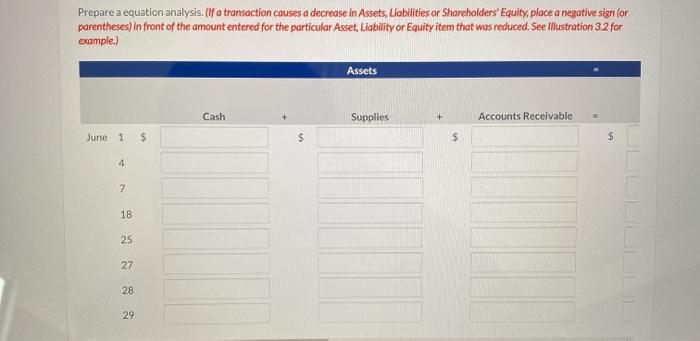

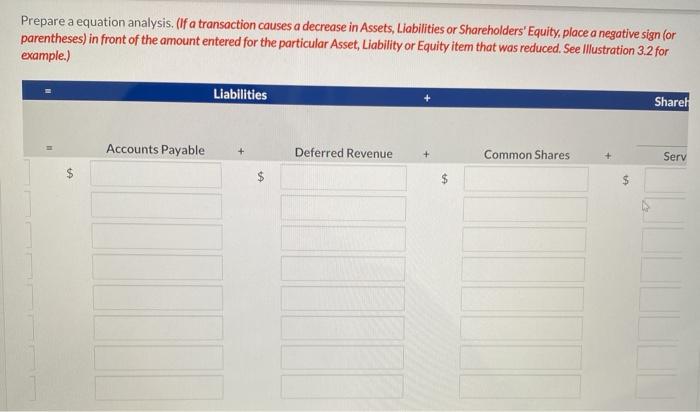

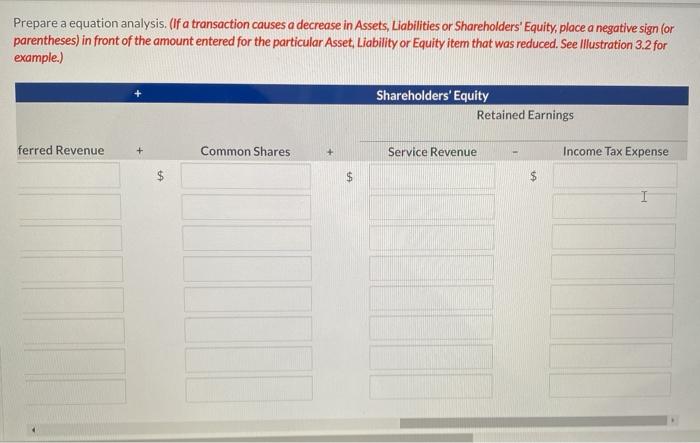

Transactions for Ing. Ltd. for the month of June, its first month of operations, are presented below: June 1 4 7 18 25 27 28 29 Issued common shares to shareholders in exchange for $2,500 cash. Purchased supplies on account for $250. Billed J. Kronsnoble $300 for welding work done. Received partial payment of $200 from J. Kronsnoble for work billed on June 7. Hired a new employee to start work on July 3. Received cash of $200 from Liu Controls Ltd. as a deposit for welding work to be done in July Paid for supplies purchased on June 4. Paid $100 for monthly income tax instalment. Prepare a basic analysis. (If no transaction is required, select "No Entry for the account titles.) Account Debited Account Credited June 1 Cash Common Shares 4 Supplies Accounts Payable 7 Accounts Receivable Service Revenue 18 Cash Accounts Receivable 25 No Entry No Entry 27 Cash Deferred Revenue 28 Accounts Payable Cash 29 Income Tax Expense Cash Prepare a equation analysis. (If a transaction causes a decrease in Assets, Liabilities or Shareholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset Liability or Equity item that was reduced. See Illustration 3.2 for example.) Assets Cash Supplies Accounts Receivable June 1 $ $ $ s 4 7 18 25 27 28 29 Prepare a equation analysis. (If a transaction causes a decrease in Assets, Liabilities or Shareholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See Illustration 3.2 for example.) Liabilities Sharel Accounts Payable Deferred Revenue + Common Shares Serv $ $ Prepare a equation analysis. (If a transaction causes a decrease in Assets, Liabilities or Shareholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See Illustration 3.2 for example.) Shareholders' Equity Retained Earnings ferred Revenue + Common Shares Service Revenue Income Tax Expense $ $