Question

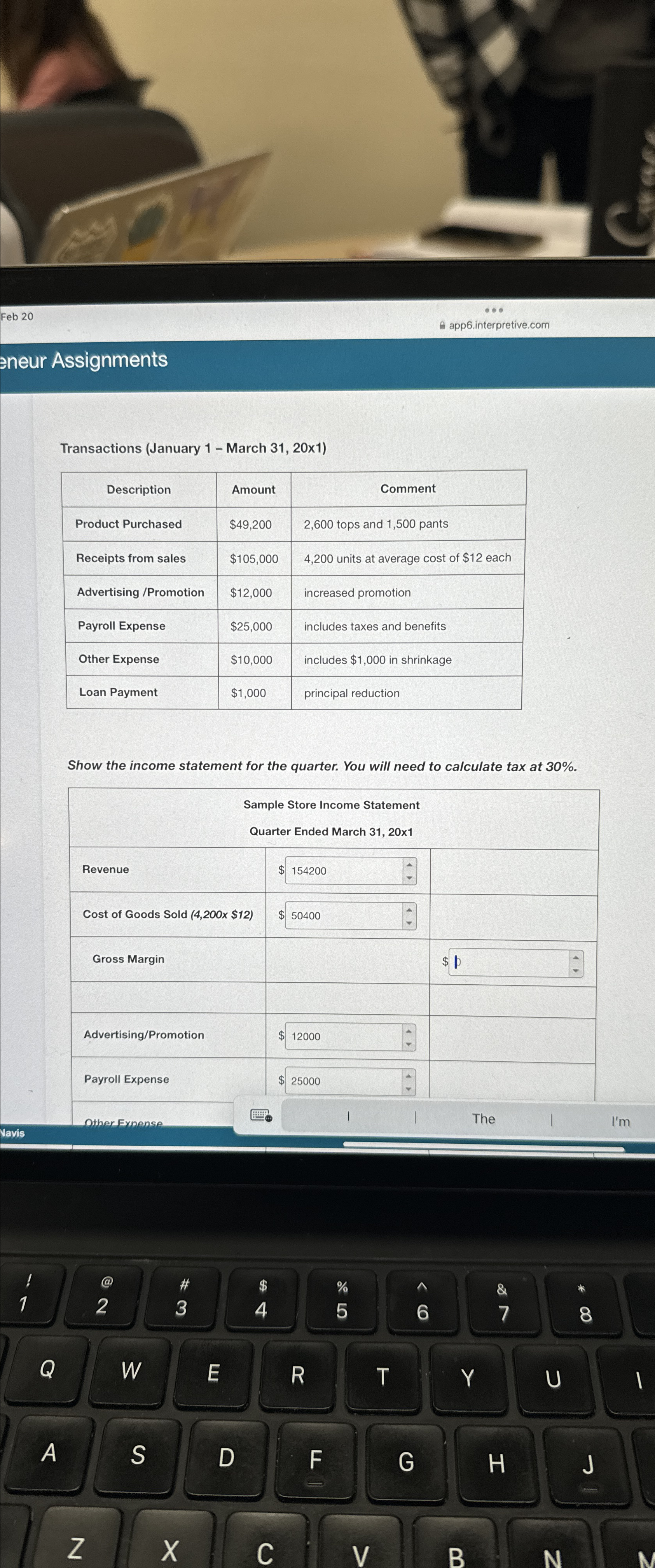

Transactions (January 1 - March 31, 20x1) table[[Description,Amount,Comment],[Product Purchased, $49,200 ,2,600 tops and 1,500 pants],[Receipts from sales, $105,000 ,4,200 units at average cost of $12

Transactions (January 1 - March 31, 20x1)\ \\\\table[[Description,Amount,Comment],[Product Purchased,

$49,200,2,600 tops and 1,500 pants],[Receipts from sales,

$105,000,4,200 units at average cost of

$12each],[Advertising /Promotion,

$12,000,increased promotion],[Payroll Expense,

$25,000,includes taxes and benefits],[Other Expense,

$10,000,includes

$1,000in shrinkage],[Loan Payment,

$1,000,principal reduction]]\ Show the income statement for the quarter. You will need to calculate tax at

30%.\ \\\\table[[Sample Store Income Statement],[Quarter Ended March 31, 20x1,],[Revenue,

$154200,],[Cost of Goods Sold (4,200x $12),

$50400,],[Gross Margin,,],[Advertising/Promotion,,],[Payroll Expense,,]]\ Vavis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started