Question

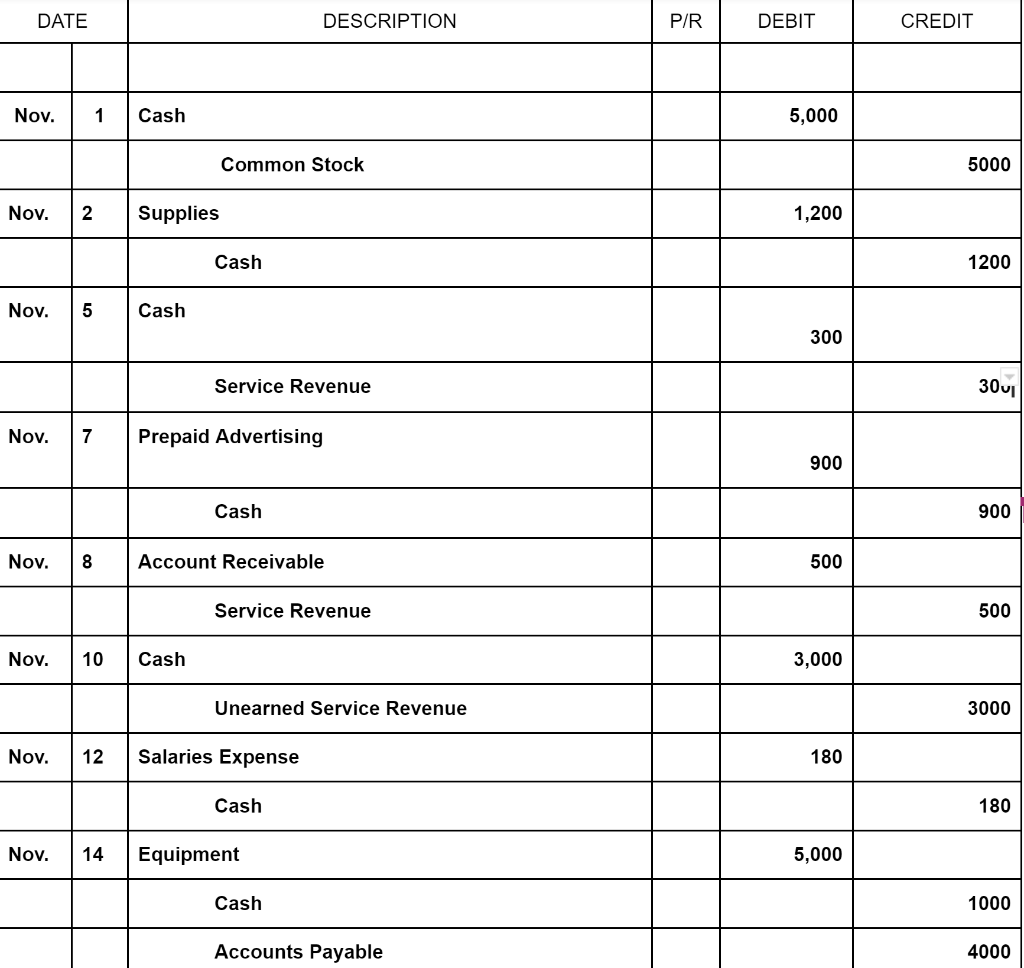

Transactions: Nov. 1 The principal partners contributed $5,000 to the business as seed money to start operations. Nov. 2 Purchased disposable makeup supplies costing $1,200.

Transactions:

Nov. 1 The principal partners contributed $5,000 to the business as seed money to start operations.

Nov. 2 Purchased disposable makeup supplies costing $1,200.

Nov. 5 Performed a counter gig at the local Macys for a modest $300 cash. Supplies were provided by the host.

Nov. 7 Purchased three months of advertising services to be displayed in the local newspaper and various websites, $900.

Nov. 8 Transformed a family into their fanciest selves for a reunion photo shoot. You charged $500 on account.

Nov. 10 A local theater company just asked you to do the entire casts makeup for their shows! The company paid you $3,000 in advance for 9 shows total.

Nov. 12 You hired a gopher whose job is to carry all your supplies and equipment to and from each job. He was paid $180 for the first week. Nov. 14 Magic Makeup purchases a mobile equipment station in order to professionally administer to customers. The equipment cost $5,000, of which you paid $1,000 and put the remainder of the balance on account.

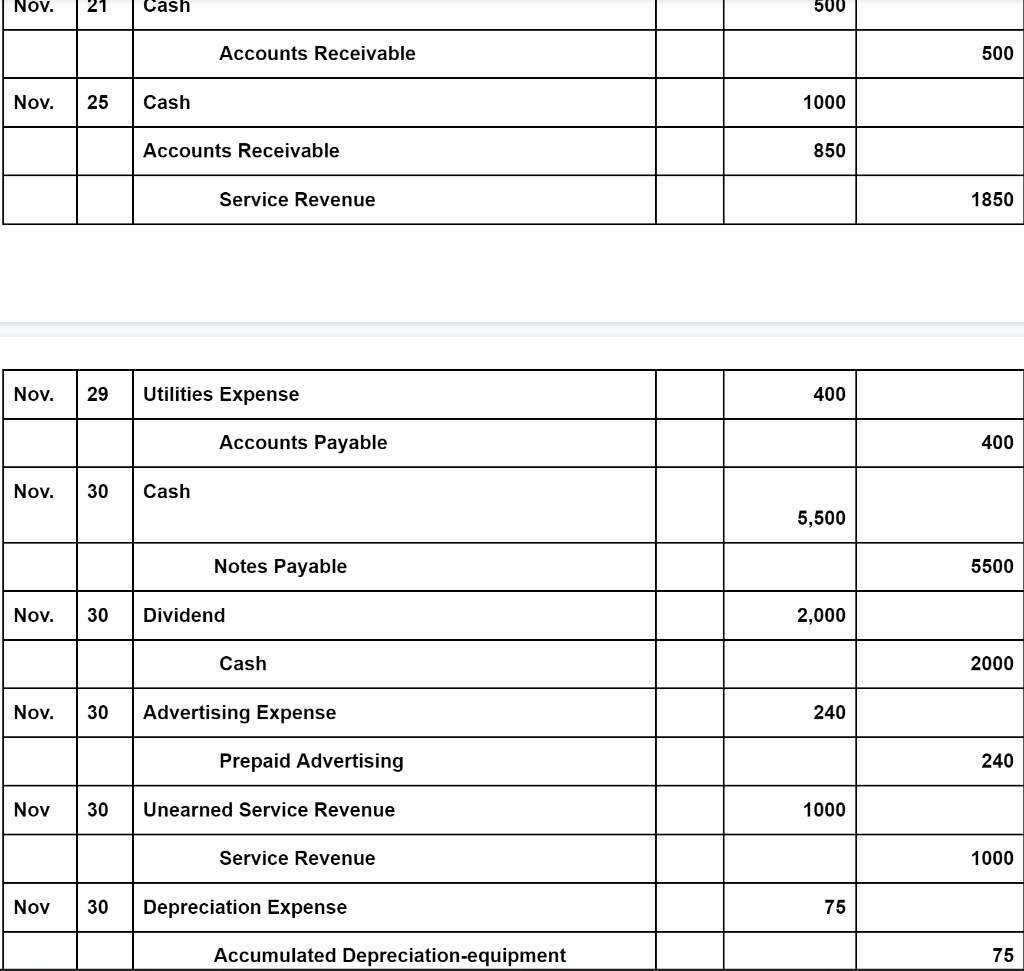

Nov. 21 The family paid the balance due from November 8th.

Nov. 25 Sephora has requested Makeup Magic to serve as makeup artists to work on several promotional shows they are holding this coming weekend. You completed the entire job for $1,850. Sephora paid $1,000, and you billed the difference.

Nov. 29 Received utility bill, $400, which you put on account.

Nov. 30 Took out a small business loan from the bank so that Makeup Magic can embark on a marketing blitz for the holiday season. The bank approved a loan for $5,500 at 9%, due exactly one year from today.

Nov. 30 The makeup magicians withdrew $2,000 in the form of dividends.

ADJUSTMENTS:

1. Expired advertising. 2. Makeup Magic did the makeup for 3 of the 9 shows for the theater company. 3. Depreciation of mobile equipment station, $75.

Instructions:

Journalize and post adjusting journal entries based on the adjustments data provided. Prepare an adjusted trial balance at November 30, 2017. Prepare a set of financial statements for Makeup Magic for the month of November. Journalize and post-closing entries for November. Prepare a post-closing trial balance at November 30, 2017

General Journal

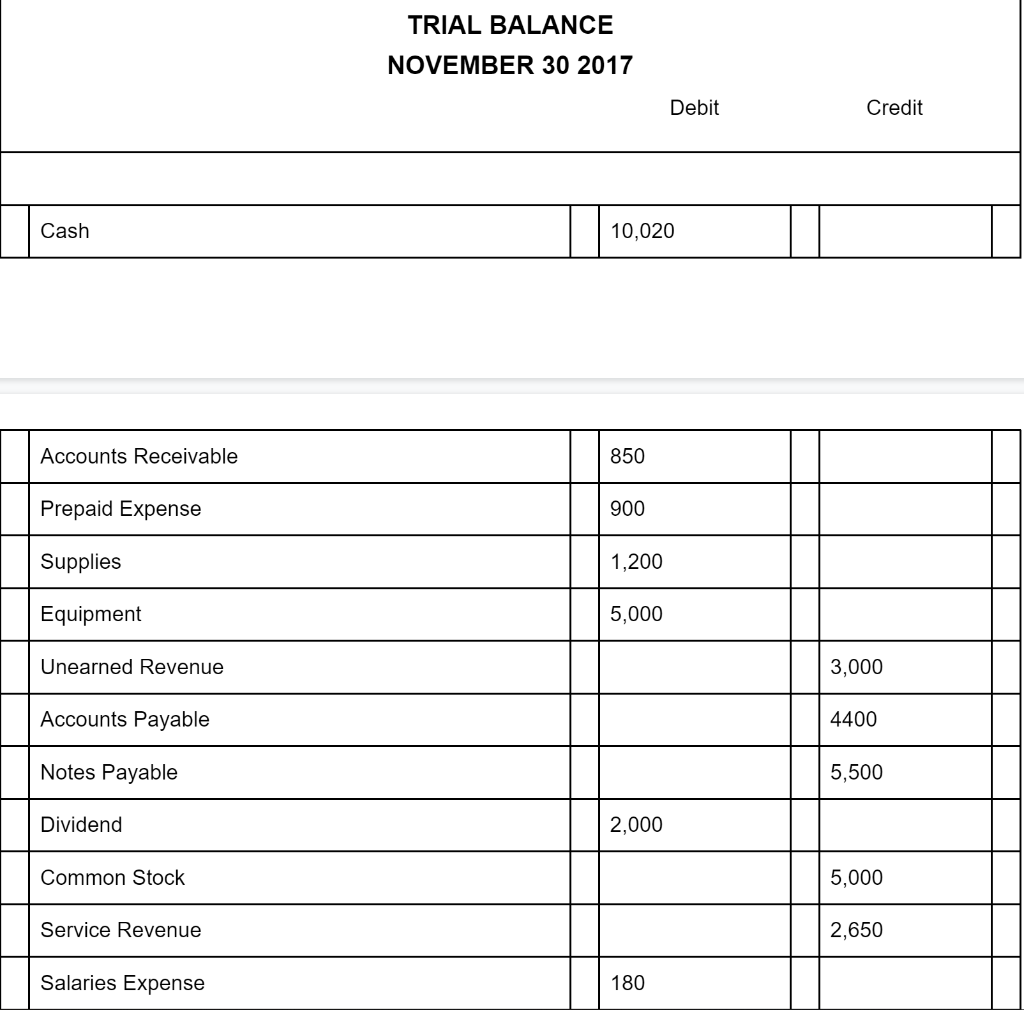

UNADJUSTED TRIAL BALANCE

\begin{tabular}{|l|l|l|r|r|r|} \hline Nov. & 29 & Utilities Expense & 400 & \\ \hline & & Accounts Payable & & & \\ \hline Nov. & 30 & Cash & 5,500 & \\ \hline & & Notes Payable & & 5500 \\ \hline Nov. & 30 & Dividend & 2,000 & \\ \hline & & Cash & & 2000 \\ \hline Nov. & 30 & Advertising Expense & & & \\ \hline & & Prepaid Advertising & & & \\ \hline Nov & 30 & Unearned Service Revenue & & & \\ \hline & & Service Revenue & & & \\ \hline Nov & 30 & Depreciation Expense & & & \\ \hline & & Accumulated Depreciation-equipment & & & \\ \hline \end{tabular} TRIAL BALANCE NOVEMBER 302017 Debit Credit \begin{tabular}{|l|l|l|l|l|} \hline Cash & & 10,020 & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & Accounts Receivable & 850 & & \\ \hline & Prepaid Expense & 900 & & \\ \hline & Supplies & 1,200 & \\ \hline & Equipment & 5,000 & \\ \hline & Unearned Revenue & & & 3,000 \\ \hline & Accounts Payable & & & 4400 \\ \hline & Notes Payable & & 2,000 & 5,500 \\ \hline & Dividend & & & \\ \hline & Common Stock & & 180 & 5,000 \\ \hline & Service Revenue & & 2,650 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Utilities Expense & 400 & \\ \hline Total & 20,550 & 20,550 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started