Answered step by step

Verified Expert Solution

Question

1 Approved Answer

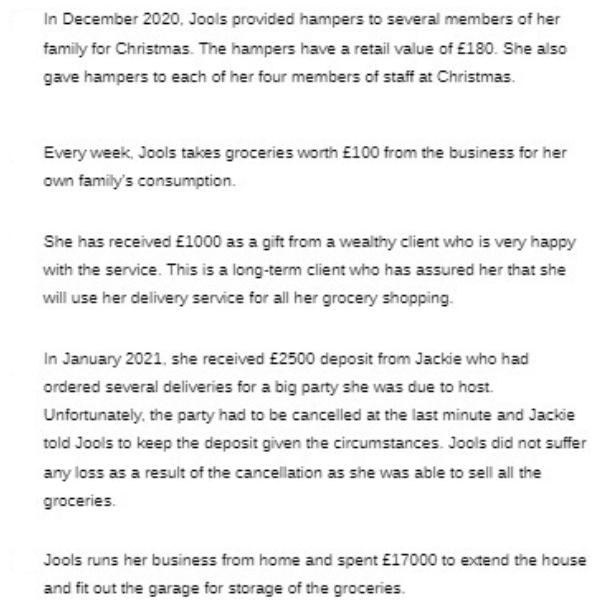

transactions: Please advise her on the tax implications of the following In December 2020, Jools provided hampers to several members of her family for

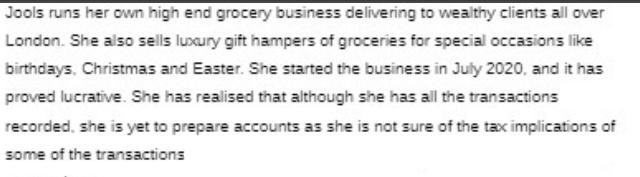

transactions: Please advise her on the tax implications of the following In December 2020, Jools provided hampers to several members of her family for Christmas. The hampers have a retail value of 180. She also gave hampers to each of her four members of staff at Christmas. Every week, Jools takes groceries worth 100 from the business for her own family's consumption. She has received 1000 as a gift from a wealthy client who is very happy with the service. This is a long-term client who has assured her that she will use her delivery service for all her grocery shopping. In January 2021, she received 2500 deposit from Jackie who had ordered several deliveries for a big party she was due to host. Unfortunately, the party had to be cancelled at the last minute and Jackie told Jools to keep the deposit given the circumstances. Jools did not suffer any loss as a result of the cancellation as she was able to sell all the groceries. Jools runs her business from home and spent 17000 to extend the house and fit out the garage for storage of the groceries. Jools runs her own high end grocery business delivering to wealthy clients all over London. She also sells luxury gift hampers of groceries for special occasions like birthdays, Christmas and Easter. She started the business in July 2020, and it has proved lucrative. She has realised that although she has all the transactions recorded, she is yet to prepare accounts as she is not sure of the tax implications of some of the transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To ensure accurate tax reporting and compliance Jools should consider consulting with a tax professi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started