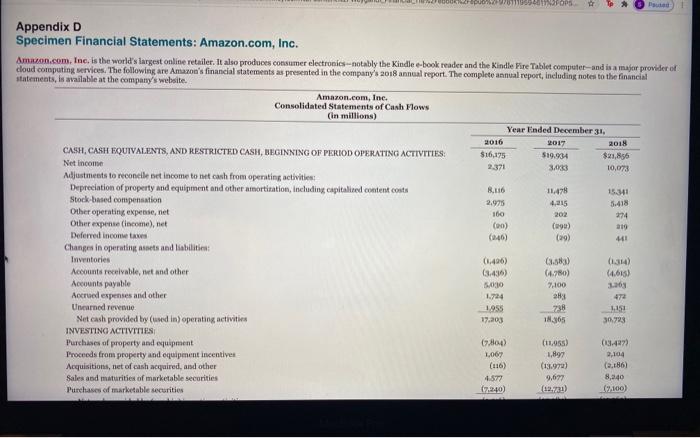

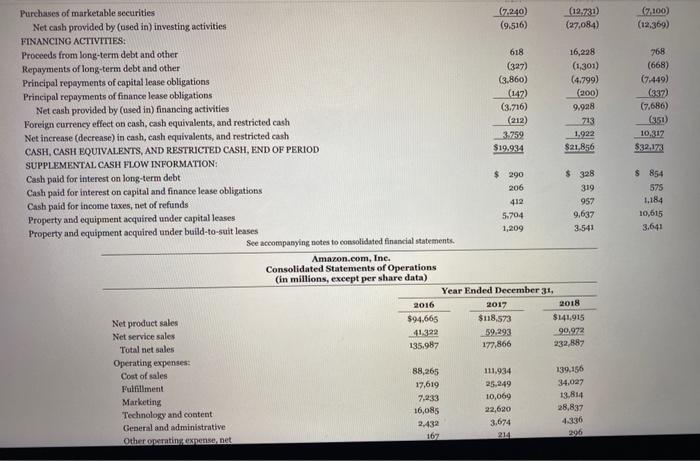

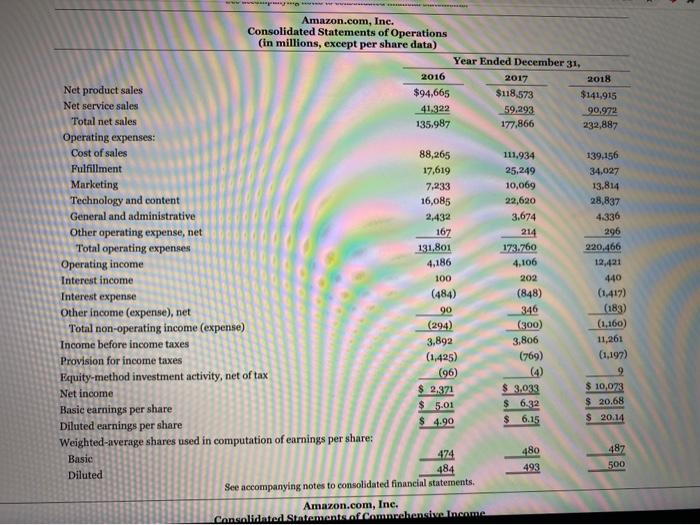

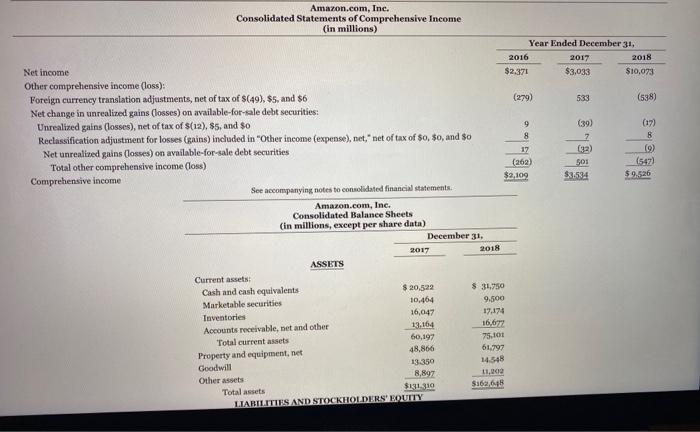

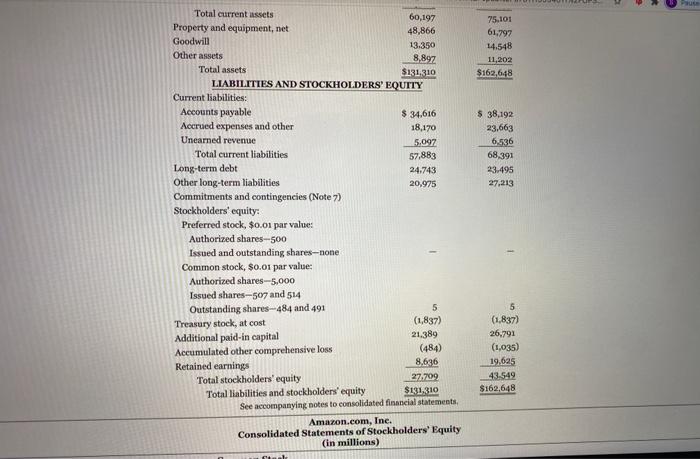

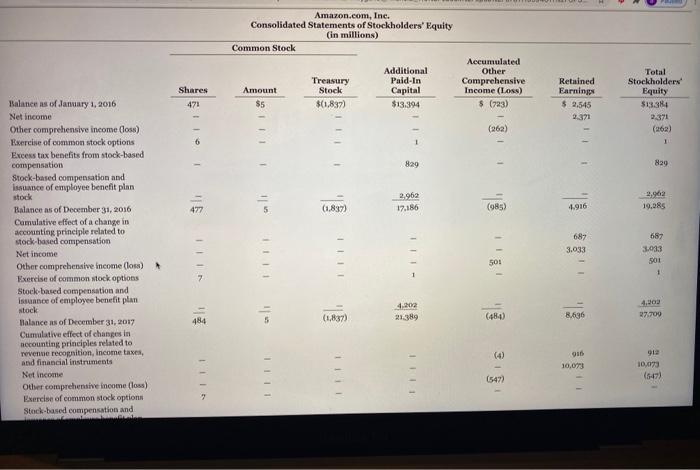

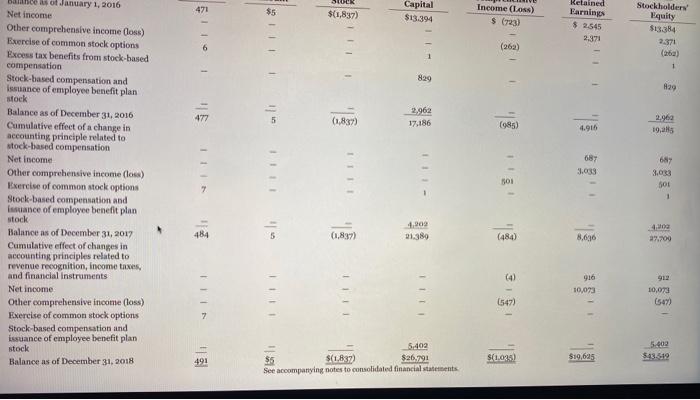

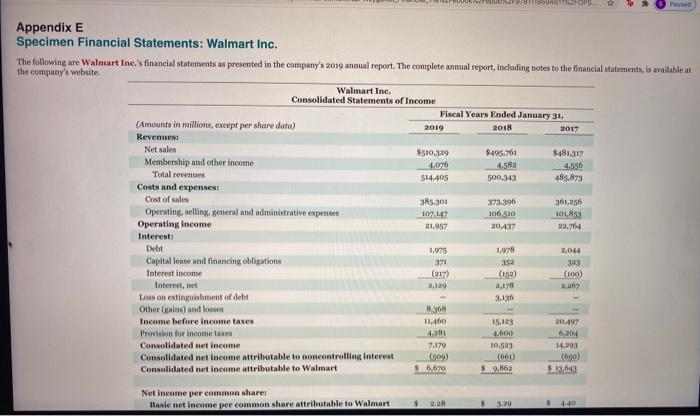

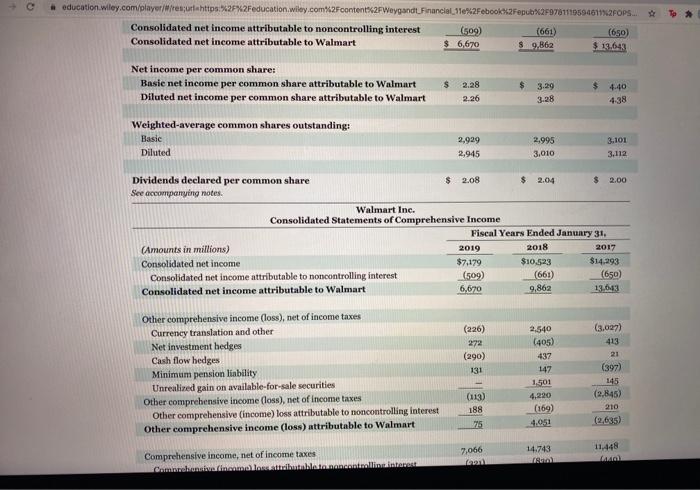

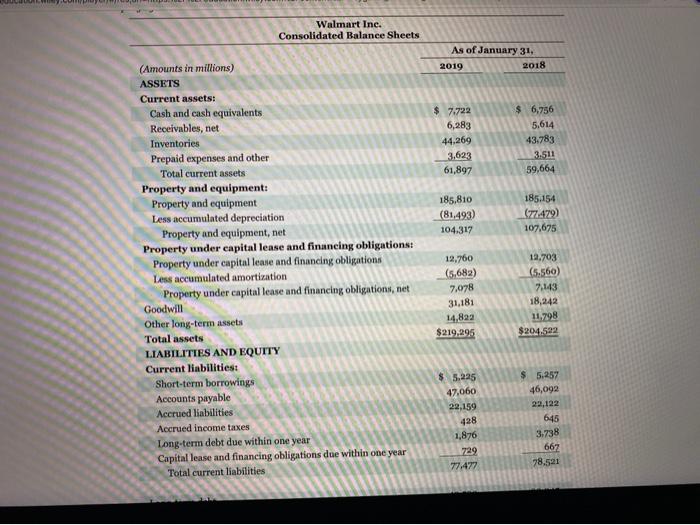

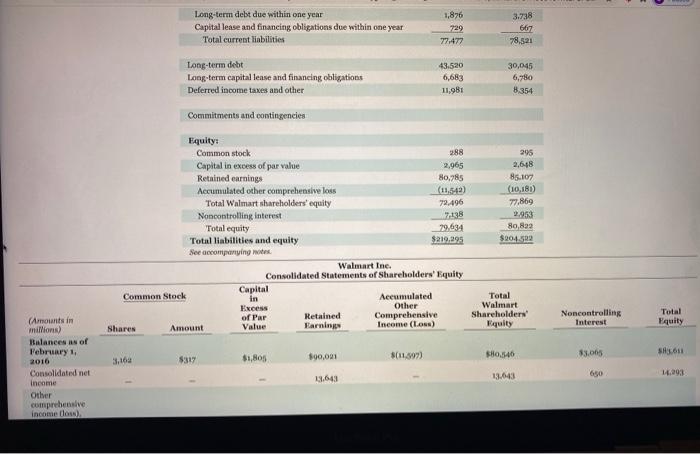

000 POPS Tp Appendix D Specimen Financial Statements: Amazon.com, Inc. Amazon.com, Inc. is the world's largest online retailer. It also produces consumer electronic-notably the Kindle e-book reader and the Kindle Fire Tablet computer and is a major provider of cloud computing services. The following are Amazon's financial statements as presented in the company's 2018 annual report. The complete annual report, including notes to the financial statements, is available at the company's website. Amazon.com, Inc. Consolidated Statements of Cash Flows (in millions) Year Ended December 31, 2016 2017 2018 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES $16,175 Net Income $19.934 2.371 Adjustments to reconcile net income to cash from operating activities 3.33 10,073 Depreciation of property and equipment and other amortization, including capitalized content costs 8.116 Stock-based compensation 11478 15.341 2,975 4,015 5.418 Other operating expense, net 100 274 Other expense (income), net (0) (9) 219 Deferred income taxes (246) (9) 41 Changes in operating assets and liabilities: Inventories (1406) 01.314) Accounts receivable, net and other (3.436) (478) (4.615) Accounts payable 54030 7.100 Accrued expenses and other 1.724 28 Unearned revenue 1.955 Net cash provided by used in) operating activities 18.365 30,728 INVESTING ACTIVITIES Purchases of property and equipment 19.804) (11) (13427 Proceeds from property and equipment incentives 1.067 1.897 Acquisitions, net of cash acquired, and other (116) (13.979) (186) Sales and maturities of marketable securities 4.877 8,240 Purchases of marketable securities (7240) 67.100) 202 2,104 (100) (12,369) 268 (668) (7.449) (337) (7,686) (200) 10,212 $32,178 Purchases of marketable securities (7240) (12.7731) Net cash provided by (used in) investing activities (9.516) (27,084) FINANCING ACTIVITIES: Proceeds from long-term debt and other 618 16,228 Repayments of long-term debt and other (327) (1,301) Principal repayments of capital lease obligations (3.860) (4.799) Principal repayments of finance lease obligations (147) Net cash provided by (used in) financing activities (3.716) 9.928 Foreign currency effect on cash, cash equivalents, and restricted cash (212) 713 Net increase (decrease) in cash, cash equivalents, and restricted cash 3.259 1.922 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD $19.934 $21,856 SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt $ 290 $ 328 Cash paid for interest on capital and finance lease obligations 206 319 Cash paid for income taxes, net of refunds 412 957 Property and equipment acquired under capital leases 5.704 9,637 Property and equipment acquired under build-to-suit leases 1,209 3.541 See accompanying notes to consolidated financial statements Amazon.com, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31, 2016 2017 2018 Net product sales $94.665 $118,573 $141.915 Net service sales 41 322 59,293 90.972 Total net sales 135.987 177,866 232,887 Operating expenses: : Cost of sales 88,265 111.934 139.156 Fulfillment 17.619 25.249 34,027 Marketing 7,233 10,069 19.814 Technology and content 16,085 22,620 28,837 General and administrative 2.432 3,674 Other operationens bet 167 2141 $ 854 575 1.184 10,615 3,641 4,106 Amazon.com, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31, 2016 2017 2018 Net product sales $94,665 $118.573 $141,915 Net service sales 41.322 59,293 90,972 Total net sales 135.987 177,866 232,887 Operating expenses: Cost of sales 88,265 111,934 139.156 Fulfillment 17.619 25,249 34.027 Marketing 7,233 10,069 13,814 Technology and content 16,085 22,620 28,837 General and administrative 2.432 3,674 4.336 Other operating expense, net 167 214 296 Total operating expenses 131,801 173.760 220.466 Operating income 4,186 12,421 Interest income 100 202 440 Interest expense (484) (848) (1417) Other income (expense), net 346 (183) Total non-operating income (expense) (294) (300) (1,160) Income before income taxes 3.892 3.806 11,261 Provision for income taxes (1.425) (769) (1.197) Equity-method investment activity, net of tax (96) (4) 9 Net income $ 2.371 $ 3,033 $ 10,073 Basic earnings per share $ 5.01 $ 6.32 $ 20.68 Diluted earnings per share $ 4.90 $ 6.15 $ 20.14 Weighted-average shares used in computation of earnings per share: 474 480 Basic 487 484 493 500 Diluted See accompanying notes to consolidated financial statements. Amazon.com, Inc. Consolidated Statements of Camorrahamsiwe neome 90 2016 9 8 Amazon.com, Inc. Consolidated Statements of Comprehensive Income (in millions) Year Ended December 31, 2017 2018 Net income $2.37 $3.033 $10,073 Other comprehensive income (loss): Foreign currency translation adjustments, net of tax of $(49). $5, and $6 (279) 533 (538) Net change in unrealized gains (losses) on available for sale debt securities: Unrealized gains (losses), net of tax of S(12), 85, and so (39) (17) Reclassification adjustment for losses (gains) included in "Other income (expense), net," net of tax of $0, $0, and $0 7 8 Net unrealized gains (losses) on available-for-sale debt securities 17 (32) (9) Total other comprehensive income (loss) (262 501 (547) $2,109 $3.534 Comprehensive income $9.526 See accompanying notes to consolidated financial statements Amazon.com, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31, 2017 2018 ASSETS Current assets Cash and cash equivalents $ 20,522 $31.750 Marketable securities 10,464 9.500 16,047 17.174 Inventories Accounts receivable, net and other 13.164 16,672 Total current assets 60,197 75,101 48,866 61.797 Property and equipment, net 13.350 14,548 Goodwill Other assets 8,897 S1626 $131 310 Total assets LIABILITIES AND STOCKHOLDERS UITY 75.101 61,797 14,548 11,202 $162,648 8,897 $ 38,192 23,663 6.536 68.391 23.495 27.213 Total current assets 60,197 Property and equipment, net 48,866 Goodwill 13.350 Other assets Total assets $131,310 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $ 34,616 Accrued expenses and other 18,170 Unearned revenue 5.097 Total current liabilities 57,883 Long-term debt 24.743 Other long-term liabilities 20.975 Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares-500 Issued and outstanding shares--none Common stock, $0.01 par value: Authorized shares-5,000 Issued shares-507 and 514 Outstanding shares-484 and 491 5 Treasury stock, at cost (1,837) Additional paid in capital 21.389 Accumulated other comprehensive loss (484) Retained earnings 8.636 Total stockholders' equity 27.709 Total liabilities and stockholders' equity $131,310 See accompanying notes to consolidated financial statements, Amazon.com, Inc. Consolidated Statements of Stockholders' Equity (in millions) 5 (1.837) 26,791 (1,035) 19,625 43.549 $162,648 Amazon.com, Inc. Consolidated Statements of Stockholders' Equity (in millions) Common Stock Amount Accumulated Other Comprehensive Income (Loss) $(723) Treasury Stock $(1,837) Shares 471 Additional Paid-In Capital $13,394 Retained Earnings $9.545 Total Stockholders Equity $13,384 2371 (262) (262) 6 1 829 829 1 li 2,942 19.085 2.962 17.186 427 (1.837) (985) 4.916 687 3.033 Balance as of January 1, 2016 Net income Other comprehensive income Gloss) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and Issuance of employee benefit plan stock Balance as of December 31, 2016 Cumulative effect of a change in accounting principle related to stock-based compensation Net income Other comprehensive income (los) Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2017 Cumulative effect of changes in accounting principles related to revende recognition, income taxes, and financial instruments Net Income Other comprehensive income (lows) Exercise of common stock options Stock-based compensation and 687 3.033 501 501 1 (1837) 21.89 484 (8) 8.636 27.700 916 10,073 912 10,073 1111 (547) Ketained 471 $5 $(1,837) Capital $13,394 Income (Loss) $ (723) Earnings $ 2.545 Stockholders Equity $13,384 2.371 2.371 6 (269) 1 1 829 29 477 (1837 2,963 17.186 (685) 4.916 19, 687 3.033 bance as of January 1, 2016 Net income Other comprehensive income Gloss) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and Issuance of employee benefit plan stock Balance as of December 31, 2016 Cumulative effect of a change in accounting principle related to stock-based compensation Net Income Other comprehensive income (los) Exercise of common stock options Stock-based compensation and Issuance of employee benefit plan stock Balance as of December 31, 2017 Cumulative effect of changes in accounting principles related to revenue recognition, Income taxes, and financial instruments Net income Other comprehensive income (loss) Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2018 501 687 3.033 501 1 484 4,902 21.380 (1.837) (484) 8,636 40 27.700 (4) 916 10,073 11 1111 11 10,073 (54) 647) 7 5.402 491 5.402 $5 $(1.837) $26.791 See accompanying notes to consolidated financial statements $(1.036) $19,625 Panel Appendix E Specimen Financial Statements: Walmart Inc. The following are Walmart Inc.'s financial statements as presented in the company's 2019 annual report. The complete annual report, including notes to the financial statements, is available at the company's website. Walmart Inc. Consolidated Statements of Income Fiscal Years Ended January 31, (Amounts in millions, except per share data) 2019 2018 2017 Revenues Net sales $510.329 $495.761 8481.317 Membership and other income 4,076 4.582 4.556 Total revenges 514.405 500 343 485879 Costs and expenses Cost of sales 385.301 373.396 361,256 Operating, selling general and administrative expenses 107147 106 510 1018 Operating income 21.957 20,437 99.764 Interest: Debt 1,975 2,044 Capital lense and financing obligations 371 352 323 Interest income (150) (100) Interest, et 2.36 Lots on extinguishment of debt 3.136 Other (als) and lose 8368 Income before income taxes 11,460 15,193 90.497 Provision for Income taxe 43 4.600 Consolidated net income 7.179 10.593 14,893 Consolidated net income attributable to noncontrolling Interest (500) (661) (050) Consolidated net income attributable to Walmart $6,670 $9.862 513613 1.978 6,204 Net Income per common sharet Basic net income per common share attributable to Walmart 2.08 $ 320 S 440 education.wiley.com/player/Wres;urlhttps:%2F%2Feducation wiley.com%2Fcontent%2FWaygandi. Financial11e%2Febook FepubX279781119594612FOP... Consolidated net income attributable to noncontrolling interest (509) (661) (650) Consolidated net income attributable to Walmart $ 6,670 $ 9,862 $ 13,643 Net income per common share: Basie net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart $ $ $ 2.28 2.26 4.40 3.29 3.28 438 Weighted-average common shares outstanding: Basic Diluted 2,929 2,945 2,995 3,010 3.101 3.112 Dividends declared per common share $ 2.08 $ 2.04 $ 2.00 See accompanying notes. Walmart Inc. Consolidated Statements of Comprehensive Income Fiscal Years Ended January 31, (Amounts in millions) 2019 2018 2017 Consolidated net income $7.179 $10.523 $14,293 Consolidated net income attributable to noncontrolling interest (509) (661) (650) Consolidated net income attributable to Walmart 6,670 9,862 13.013 (226) 272 (290) 131 Other comprehensive income (loss), net of income taxes Currency translation and other Net investment hedges Cash flow bedges Minimum pension liability Unrealized gain on available-for-sale securities Other comprehensive income (loss), net of income taxes Other comprehensive (income) loss attributable to noncontrolling interest Other comprehensive income (loss) attributable to Walmart 2.540 (405) 437 147 1.501 4,290 (169) (3.027) 413 21 (397) 145 (2.845) 210 (2635) (113) 188 7,066 14.743 11448 Comprehensive income, net of income taxes Communiste income tablet mencontrolli interest Walmart Inc. Consolidated Balance Sheets As of January 31, 2019 2018 7.722 6,283 44,269 3.623 61,897 $ 6,756 5,614 43.783 3.511 59,664 185.810 (81,493) 104.317 185.154 (77479) 107,675 (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets Property and equipment: Property and equipment Less accumulated depreciation Property and equipment, net Property under capital lease and financing obligations: Property under capital lease and financing obligations Less accumulated amortization Property under capital lease and financing obligations, net Goodwill Other long-term assets Total assets LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities 12,760 (5,682) 7,078 31,181 14,822 12.703 (5.560) 7.143 18,242 11.798 $204.522 $219,395 $ 5.225 47,060 22.159 428 1,876 7729 77.477 $ 5.257 46,092 22,122 645 3.738 667 78.521 Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities 1,876 729 77.477 3.738 667 78,521 Long-term debt Long-term capital lense and financing obligations Deferred income taxes and other 43.520 6,683 11,981 30,045 6,780 8354 Commitments and contingencies Equity: Common stock 288 295 Capital in excess of par value 2,965 2,648 Retained earnings 8075 85.107 Accumulated other comprehensive loss (11,542) (10,181) Total Walmart shareholders' equity 79.496 77,869 Noncontrolling interest 2.953 Total equity 29634 80,892 Total liabilities and equity $219.295 $204.59 See companying we Walmart Inc. Consolidated Statements of Shareholders' Equity Common Stock Capital in Aceumulated Total Other Walmart of Par Retained Comprehensive Shareholders Shares Amount Value Earnings Income (Loss) Equity Noncontrolling Interest Total Equity (Amounts in millions) Balances is of February $317 $1,805 SA 190,091 (11.897) S.546 13.065 19643 13.643 14,893 Consolidated net Income Other comprehensive Huy Common stock 288 295 Capital in excess of par value 2.965 2,648 Retained earnings 30,785 85.107 Accumulated other comprehensive loss (11.542) (10,181 Total Walmart shareholders' equity 72.496 77.869 Noncontrolling interest 7.138 2.953 Total equity 79,634 80,822 Total liabilities and equity $219.295 $204.522 See acompanying notes Walmart Ine. Consolidated Statements of Shareholders' Equity Common Stock Capital in Accumulated Total Excess Other Walmart of Par Retained Comprehensive Shareholders Shares Amount Value Earnings Income (Loss) Equity Noncontrolling Interest Total Equity $317 $1,805 $90,021 $(11.597) $80,546 $3.065 $83.611 13.643 13.643 650 14.293 (Amounts in millions) Balances as of February 1. 2016 Consolidated net Income Other comprehensive income (loss), net of income taxes Cash dividends declared ($2.00 per share) Purchase of Company stock Cash dividend declared to no controlling (9.635) (2,635) (210) (2.848) (6,216) (6,216) (6.216) (100) (12) (174) (8.276) (8.276) (8,090) (519) (519) (6,216) (6,216) (6,916) 6120) (12) (174) (8,090) (8.276) - (519) (249) 740 (4) (19) 47 7736 3.048 305 2.371 89.354 (14,232) 77.98 2,737 80,535 9,862 9.862 661 10.523 Cash dividends declared ($2.00 per share) Purchase of Company stock Cash dividend declared to noncontrolling interest Other Balances as of January 31, 2017 Consolidated net income Other comprehensive Income loss) net of income taxes Cash dividends declared ($2.04 per share) Pinchase of Company stock Cish divideod declared to noncontrolling interest Other Balances as or January 31 2018 Adoption of new Berounting standards on February 1, 2018 net of income 4.051 4.051 169 (6,124) (6,124) (6,134) (10) (219) (7.975) (8,204) (8.2014) (687) 11 (687) 559 496 (10) 486 Z 21.959 $295 52.648 585,107 $(10,181) $77,869 $9.953 PA standards on February 1, 2018, net of income 2,361 (1.436) 925 (1) 924 6,670 6,670 500 7.179 - - 75 75 1 (18) (113) 1 (6,102) (6.102) (6.102) (8) (245) (7.234) Consolidated net Income Other comprehensive income (loss). net of income taxes Cash dividends declared ($2.08 per share) Purchase of Company stock (80) Cash dividend declared to noncontrolling interest Noncontrolling interest of acquired entity Other 6 Balances as of January 31, 2019 2.878 See accompanying notes (487) (9.487) 1 1 1 4.345 8 4.345 34 562 (17) 546 $288 $2.965 $80.785 (11.542) $22.496 $7.198 579634 Walmart Ine. Consolidated Statements of Cash Flows Fiscal Year Ended January 31, 201N 2017 2019 $7.199 $10.523 $14,293 (Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses 10.329 10,080 10,678 3.516 Walmart Inc. Consolidated Statements of Cash Flows Fiscal Years Ended January 31, 2019 2018 2017 $ 7.179 $10,523 $14,293 10.529 10,080 10,678 3.516 4.850 (499) 761 (Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses (Gains) and losses for disposal of business operations Deferred income taxes Loss on extinguishment of debt Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities (304) 3.136 1,210 1.734 206 (368) (1.311) 1,831 183 (40) 27,753 (1,074) (140) 4,086 928 (557) 28,337 (402) 1,021 3.942 1,280 492 31,673 (10,619) (10.344) 519 876 (10,051) 378 1,046 456 Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale ocurities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (375) (14,656) (431) (24.036) 662 (1.901) (9.463) (31) (13.896) (9,079) Cash flows from financing activities: Net change in short-term borrowings (53) 4.148 (1.673) (10,05) (10.344) 519 876 378 1,046 Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (10,619) 456 662 (1.901) (2.463) (31) (13.896) (375) (14.656) (431) (24.036) (9,079) (53) 15,872 (3.784) (1.673) 137 (2,055) Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities (6,102) (7.410) (431) 4,148 7.476 (13.061) (3.059) (6,124) (8.296) (690) (8) (261) (19.875) (6,216) (8,298) (479) (90) (398) (19.072) (629) (2,537) Effect of exchange rates on cash, cash equivalents and restricted cash (438) 482 742 7,014 $.7256 (130) 7,144 $7,104 6.747) 8,89: $7.144 Net increase (decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period Supplemental disclosure of cash flow information: Income taxes paid Interest paid See accompanying notes 3.982 2.348 6.179 2,450 4.507 2,351 000 POPS Tp Appendix D Specimen Financial Statements: Amazon.com, Inc. Amazon.com, Inc. is the world's largest online retailer. It also produces consumer electronic-notably the Kindle e-book reader and the Kindle Fire Tablet computer and is a major provider of cloud computing services. The following are Amazon's financial statements as presented in the company's 2018 annual report. The complete annual report, including notes to the financial statements, is available at the company's website. Amazon.com, Inc. Consolidated Statements of Cash Flows (in millions) Year Ended December 31, 2016 2017 2018 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES $16,175 Net Income $19.934 2.371 Adjustments to reconcile net income to cash from operating activities 3.33 10,073 Depreciation of property and equipment and other amortization, including capitalized content costs 8.116 Stock-based compensation 11478 15.341 2,975 4,015 5.418 Other operating expense, net 100 274 Other expense (income), net (0) (9) 219 Deferred income taxes (246) (9) 41 Changes in operating assets and liabilities: Inventories (1406) 01.314) Accounts receivable, net and other (3.436) (478) (4.615) Accounts payable 54030 7.100 Accrued expenses and other 1.724 28 Unearned revenue 1.955 Net cash provided by used in) operating activities 18.365 30,728 INVESTING ACTIVITIES Purchases of property and equipment 19.804) (11) (13427 Proceeds from property and equipment incentives 1.067 1.897 Acquisitions, net of cash acquired, and other (116) (13.979) (186) Sales and maturities of marketable securities 4.877 8,240 Purchases of marketable securities (7240) 67.100) 202 2,104 (100) (12,369) 268 (668) (7.449) (337) (7,686) (200) 10,212 $32,178 Purchases of marketable securities (7240) (12.7731) Net cash provided by (used in) investing activities (9.516) (27,084) FINANCING ACTIVITIES: Proceeds from long-term debt and other 618 16,228 Repayments of long-term debt and other (327) (1,301) Principal repayments of capital lease obligations (3.860) (4.799) Principal repayments of finance lease obligations (147) Net cash provided by (used in) financing activities (3.716) 9.928 Foreign currency effect on cash, cash equivalents, and restricted cash (212) 713 Net increase (decrease) in cash, cash equivalents, and restricted cash 3.259 1.922 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD $19.934 $21,856 SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt $ 290 $ 328 Cash paid for interest on capital and finance lease obligations 206 319 Cash paid for income taxes, net of refunds 412 957 Property and equipment acquired under capital leases 5.704 9,637 Property and equipment acquired under build-to-suit leases 1,209 3.541 See accompanying notes to consolidated financial statements Amazon.com, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31, 2016 2017 2018 Net product sales $94.665 $118,573 $141.915 Net service sales 41 322 59,293 90.972 Total net sales 135.987 177,866 232,887 Operating expenses: : Cost of sales 88,265 111.934 139.156 Fulfillment 17.619 25.249 34,027 Marketing 7,233 10,069 19.814 Technology and content 16,085 22,620 28,837 General and administrative 2.432 3,674 Other operationens bet 167 2141 $ 854 575 1.184 10,615 3,641 4,106 Amazon.com, Inc. Consolidated Statements of Operations (in millions, except per share data) Year Ended December 31, 2016 2017 2018 Net product sales $94,665 $118.573 $141,915 Net service sales 41.322 59,293 90,972 Total net sales 135.987 177,866 232,887 Operating expenses: Cost of sales 88,265 111,934 139.156 Fulfillment 17.619 25,249 34.027 Marketing 7,233 10,069 13,814 Technology and content 16,085 22,620 28,837 General and administrative 2.432 3,674 4.336 Other operating expense, net 167 214 296 Total operating expenses 131,801 173.760 220.466 Operating income 4,186 12,421 Interest income 100 202 440 Interest expense (484) (848) (1417) Other income (expense), net 346 (183) Total non-operating income (expense) (294) (300) (1,160) Income before income taxes 3.892 3.806 11,261 Provision for income taxes (1.425) (769) (1.197) Equity-method investment activity, net of tax (96) (4) 9 Net income $ 2.371 $ 3,033 $ 10,073 Basic earnings per share $ 5.01 $ 6.32 $ 20.68 Diluted earnings per share $ 4.90 $ 6.15 $ 20.14 Weighted-average shares used in computation of earnings per share: 474 480 Basic 487 484 493 500 Diluted See accompanying notes to consolidated financial statements. Amazon.com, Inc. Consolidated Statements of Camorrahamsiwe neome 90 2016 9 8 Amazon.com, Inc. Consolidated Statements of Comprehensive Income (in millions) Year Ended December 31, 2017 2018 Net income $2.37 $3.033 $10,073 Other comprehensive income (loss): Foreign currency translation adjustments, net of tax of $(49). $5, and $6 (279) 533 (538) Net change in unrealized gains (losses) on available for sale debt securities: Unrealized gains (losses), net of tax of S(12), 85, and so (39) (17) Reclassification adjustment for losses (gains) included in "Other income (expense), net," net of tax of $0, $0, and $0 7 8 Net unrealized gains (losses) on available-for-sale debt securities 17 (32) (9) Total other comprehensive income (loss) (262 501 (547) $2,109 $3.534 Comprehensive income $9.526 See accompanying notes to consolidated financial statements Amazon.com, Inc. Consolidated Balance Sheets (in millions, except per share data) December 31, 2017 2018 ASSETS Current assets Cash and cash equivalents $ 20,522 $31.750 Marketable securities 10,464 9.500 16,047 17.174 Inventories Accounts receivable, net and other 13.164 16,672 Total current assets 60,197 75,101 48,866 61.797 Property and equipment, net 13.350 14,548 Goodwill Other assets 8,897 S1626 $131 310 Total assets LIABILITIES AND STOCKHOLDERS UITY 75.101 61,797 14,548 11,202 $162,648 8,897 $ 38,192 23,663 6.536 68.391 23.495 27.213 Total current assets 60,197 Property and equipment, net 48,866 Goodwill 13.350 Other assets Total assets $131,310 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $ 34,616 Accrued expenses and other 18,170 Unearned revenue 5.097 Total current liabilities 57,883 Long-term debt 24.743 Other long-term liabilities 20.975 Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares-500 Issued and outstanding shares--none Common stock, $0.01 par value: Authorized shares-5,000 Issued shares-507 and 514 Outstanding shares-484 and 491 5 Treasury stock, at cost (1,837) Additional paid in capital 21.389 Accumulated other comprehensive loss (484) Retained earnings 8.636 Total stockholders' equity 27.709 Total liabilities and stockholders' equity $131,310 See accompanying notes to consolidated financial statements, Amazon.com, Inc. Consolidated Statements of Stockholders' Equity (in millions) 5 (1.837) 26,791 (1,035) 19,625 43.549 $162,648 Amazon.com, Inc. Consolidated Statements of Stockholders' Equity (in millions) Common Stock Amount Accumulated Other Comprehensive Income (Loss) $(723) Treasury Stock $(1,837) Shares 471 Additional Paid-In Capital $13,394 Retained Earnings $9.545 Total Stockholders Equity $13,384 2371 (262) (262) 6 1 829 829 1 li 2,942 19.085 2.962 17.186 427 (1.837) (985) 4.916 687 3.033 Balance as of January 1, 2016 Net income Other comprehensive income Gloss) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and Issuance of employee benefit plan stock Balance as of December 31, 2016 Cumulative effect of a change in accounting principle related to stock-based compensation Net income Other comprehensive income (los) Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2017 Cumulative effect of changes in accounting principles related to revende recognition, income taxes, and financial instruments Net Income Other comprehensive income (lows) Exercise of common stock options Stock-based compensation and 687 3.033 501 501 1 (1837) 21.89 484 (8) 8.636 27.700 916 10,073 912 10,073 1111 (547) Ketained 471 $5 $(1,837) Capital $13,394 Income (Loss) $ (723) Earnings $ 2.545 Stockholders Equity $13,384 2.371 2.371 6 (269) 1 1 829 29 477 (1837 2,963 17.186 (685) 4.916 19, 687 3.033 bance as of January 1, 2016 Net income Other comprehensive income Gloss) Exercise of common stock options Excess tax benefits from stock-based compensation Stock-based compensation and Issuance of employee benefit plan stock Balance as of December 31, 2016 Cumulative effect of a change in accounting principle related to stock-based compensation Net Income Other comprehensive income (los) Exercise of common stock options Stock-based compensation and Issuance of employee benefit plan stock Balance as of December 31, 2017 Cumulative effect of changes in accounting principles related to revenue recognition, Income taxes, and financial instruments Net income Other comprehensive income (loss) Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Balance as of December 31, 2018 501 687 3.033 501 1 484 4,902 21.380 (1.837) (484) 8,636 40 27.700 (4) 916 10,073 11 1111 11 10,073 (54) 647) 7 5.402 491 5.402 $5 $(1.837) $26.791 See accompanying notes to consolidated financial statements $(1.036) $19,625 Panel Appendix E Specimen Financial Statements: Walmart Inc. The following are Walmart Inc.'s financial statements as presented in the company's 2019 annual report. The complete annual report, including notes to the financial statements, is available at the company's website. Walmart Inc. Consolidated Statements of Income Fiscal Years Ended January 31, (Amounts in millions, except per share data) 2019 2018 2017 Revenues Net sales $510.329 $495.761 8481.317 Membership and other income 4,076 4.582 4.556 Total revenges 514.405 500 343 485879 Costs and expenses Cost of sales 385.301 373.396 361,256 Operating, selling general and administrative expenses 107147 106 510 1018 Operating income 21.957 20,437 99.764 Interest: Debt 1,975 2,044 Capital lense and financing obligations 371 352 323 Interest income (150) (100) Interest, et 2.36 Lots on extinguishment of debt 3.136 Other (als) and lose 8368 Income before income taxes 11,460 15,193 90.497 Provision for Income taxe 43 4.600 Consolidated net income 7.179 10.593 14,893 Consolidated net income attributable to noncontrolling Interest (500) (661) (050) Consolidated net income attributable to Walmart $6,670 $9.862 513613 1.978 6,204 Net Income per common sharet Basic net income per common share attributable to Walmart 2.08 $ 320 S 440 education.wiley.com/player/Wres;urlhttps:%2F%2Feducation wiley.com%2Fcontent%2FWaygandi. Financial11e%2Febook FepubX279781119594612FOP... Consolidated net income attributable to noncontrolling interest (509) (661) (650) Consolidated net income attributable to Walmart $ 6,670 $ 9,862 $ 13,643 Net income per common share: Basie net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart $ $ $ 2.28 2.26 4.40 3.29 3.28 438 Weighted-average common shares outstanding: Basic Diluted 2,929 2,945 2,995 3,010 3.101 3.112 Dividends declared per common share $ 2.08 $ 2.04 $ 2.00 See accompanying notes. Walmart Inc. Consolidated Statements of Comprehensive Income Fiscal Years Ended January 31, (Amounts in millions) 2019 2018 2017 Consolidated net income $7.179 $10.523 $14,293 Consolidated net income attributable to noncontrolling interest (509) (661) (650) Consolidated net income attributable to Walmart 6,670 9,862 13.013 (226) 272 (290) 131 Other comprehensive income (loss), net of income taxes Currency translation and other Net investment hedges Cash flow bedges Minimum pension liability Unrealized gain on available-for-sale securities Other comprehensive income (loss), net of income taxes Other comprehensive (income) loss attributable to noncontrolling interest Other comprehensive income (loss) attributable to Walmart 2.540 (405) 437 147 1.501 4,290 (169) (3.027) 413 21 (397) 145 (2.845) 210 (2635) (113) 188 7,066 14.743 11448 Comprehensive income, net of income taxes Communiste income tablet mencontrolli interest Walmart Inc. Consolidated Balance Sheets As of January 31, 2019 2018 7.722 6,283 44,269 3.623 61,897 $ 6,756 5,614 43.783 3.511 59,664 185.810 (81,493) 104.317 185.154 (77479) 107,675 (Amounts in millions) ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets Property and equipment: Property and equipment Less accumulated depreciation Property and equipment, net Property under capital lease and financing obligations: Property under capital lease and financing obligations Less accumulated amortization Property under capital lease and financing obligations, net Goodwill Other long-term assets Total assets LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities 12,760 (5,682) 7,078 31,181 14,822 12.703 (5.560) 7.143 18,242 11.798 $204.522 $219,395 $ 5.225 47,060 22.159 428 1,876 7729 77.477 $ 5.257 46,092 22,122 645 3.738 667 78.521 Long-term debt due within one year Capital lease and financing obligations due within one year Total current liabilities 1,876 729 77.477 3.738 667 78,521 Long-term debt Long-term capital lense and financing obligations Deferred income taxes and other 43.520 6,683 11,981 30,045 6,780 8354 Commitments and contingencies Equity: Common stock 288 295 Capital in excess of par value 2,965 2,648 Retained earnings 8075 85.107 Accumulated other comprehensive loss (11,542) (10,181) Total Walmart shareholders' equity 79.496 77,869 Noncontrolling interest 2.953 Total equity 29634 80,892 Total liabilities and equity $219.295 $204.59 See companying we Walmart Inc. Consolidated Statements of Shareholders' Equity Common Stock Capital in Aceumulated Total Other Walmart of Par Retained Comprehensive Shareholders Shares Amount Value Earnings Income (Loss) Equity Noncontrolling Interest Total Equity (Amounts in millions) Balances is of February $317 $1,805 SA 190,091 (11.897) S.546 13.065 19643 13.643 14,893 Consolidated net Income Other comprehensive Huy Common stock 288 295 Capital in excess of par value 2.965 2,648 Retained earnings 30,785 85.107 Accumulated other comprehensive loss (11.542) (10,181 Total Walmart shareholders' equity 72.496 77.869 Noncontrolling interest 7.138 2.953 Total equity 79,634 80,822 Total liabilities and equity $219.295 $204.522 See acompanying notes Walmart Ine. Consolidated Statements of Shareholders' Equity Common Stock Capital in Accumulated Total Excess Other Walmart of Par Retained Comprehensive Shareholders Shares Amount Value Earnings Income (Loss) Equity Noncontrolling Interest Total Equity $317 $1,805 $90,021 $(11.597) $80,546 $3.065 $83.611 13.643 13.643 650 14.293 (Amounts in millions) Balances as of February 1. 2016 Consolidated net Income Other comprehensive income (loss), net of income taxes Cash dividends declared ($2.00 per share) Purchase of Company stock Cash dividend declared to no controlling (9.635) (2,635) (210) (2.848) (6,216) (6,216) (6.216) (100) (12) (174) (8.276) (8.276) (8,090) (519) (519) (6,216) (6,216) (6,916) 6120) (12) (174) (8,090) (8.276) - (519) (249) 740 (4) (19) 47 7736 3.048 305 2.371 89.354 (14,232) 77.98 2,737 80,535 9,862 9.862 661 10.523 Cash dividends declared ($2.00 per share) Purchase of Company stock Cash dividend declared to noncontrolling interest Other Balances as of January 31, 2017 Consolidated net income Other comprehensive Income loss) net of income taxes Cash dividends declared ($2.04 per share) Pinchase of Company stock Cish divideod declared to noncontrolling interest Other Balances as or January 31 2018 Adoption of new Berounting standards on February 1, 2018 net of income 4.051 4.051 169 (6,124) (6,124) (6,134) (10) (219) (7.975) (8,204) (8.2014) (687) 11 (687) 559 496 (10) 486 Z 21.959 $295 52.648 585,107 $(10,181) $77,869 $9.953 PA standards on February 1, 2018, net of income 2,361 (1.436) 925 (1) 924 6,670 6,670 500 7.179 - - 75 75 1 (18) (113) 1 (6,102) (6.102) (6.102) (8) (245) (7.234) Consolidated net Income Other comprehensive income (loss). net of income taxes Cash dividends declared ($2.08 per share) Purchase of Company stock (80) Cash dividend declared to noncontrolling interest Noncontrolling interest of acquired entity Other 6 Balances as of January 31, 2019 2.878 See accompanying notes (487) (9.487) 1 1 1 4.345 8 4.345 34 562 (17) 546 $288 $2.965 $80.785 (11.542) $22.496 $7.198 579634 Walmart Ine. Consolidated Statements of Cash Flows Fiscal Year Ended January 31, 201N 2017 2019 $7.199 $10.523 $14,293 (Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses 10.329 10,080 10,678 3.516 Walmart Inc. Consolidated Statements of Cash Flows Fiscal Years Ended January 31, 2019 2018 2017 $ 7.179 $10,523 $14,293 10.529 10,080 10,678 3.516 4.850 (499) 761 (Amounts in millions) Cash flows from operating activities: Consolidated net income Adjustments to reconcile consolidated net income to net cash provided by operating activities: Depreciation and amortization Unrealized (gains) and losses (Gains) and losses for disposal of business operations Deferred income taxes Loss on extinguishment of debt Other operating activities Changes in certain assets and liabilities, net of effects of acquisitions: Receivables, net Inventories Accounts payable Accrued liabilities Accrued income taxes Net cash provided by operating activities (304) 3.136 1,210 1.734 206 (368) (1.311) 1,831 183 (40) 27,753 (1,074) (140) 4,086 928 (557) 28,337 (402) 1,021 3.942 1,280 492 31,673 (10,619) (10.344) 519 876 (10,051) 378 1,046 456 Cash flows from investing activities: Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale ocurities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (375) (14,656) (431) (24.036) 662 (1.901) (9.463) (31) (13.896) (9,079) Cash flows from financing activities: Net change in short-term borrowings (53) 4.148 (1.673) (10,05) (10.344) 519 876 378 1,046 Payments for property and equipment Proceeds from the disposal of property and equipment Proceeds from the disposal of certain operations Purchase of available for sale securities Payments for business acquisitions, net of cash acquired Other investing activities Net cash used in investing activities (10,619) 456 662 (1.901) (2.463) (31) (13.896) (375) (14.656) (431) (24.036) (9,079) (53) 15,872 (3.784) (1.673) 137 (2,055) Cash flows from financing activities: Net change in short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to extinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities (6,102) (7.410) (431) 4,148 7.476 (13.061) (3.059) (6,124) (8.296) (690) (8) (261) (19.875) (6,216) (8,298) (479) (90) (398) (19.072) (629) (2,537) Effect of exchange rates on cash, cash equivalents and restricted cash (438) 482 742 7,014 $.7256 (130) 7,144 $7,104 6.747) 8,89: $7.144 Net increase (decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period Supplemental disclosure of cash flow information: Income taxes paid Interest paid See accompanying notes 3.982 2.348 6.179 2,450 4.507 2,351